New Price Target Illuminates Growth

The glow-up for Kyudenko (TSE:1959) continues as analysts increase the one-year price target to 5,773.20 / share. This upward adjustment of 11.86% from the previous estimate showcases investor optimism in the company’s potential. It marks a significant progression from the January 16, 2024 estimation of 5,161.20. This surge indicates a promising trajectory that investors are keen to capitalize on.

Steadfast Dividend Performance

Surviving the tumultuous tides of the market, Kyudenko maintains a dividend yield of 2.02%. With a dividend payout ratio of 0.28, the company demonstrates a prudent balance in distributing earnings to shareholders. This indicator shines a light on Kyudenko’s sound financial health and prudent management decisions. The 3-Year dividend growth rate of 0.15% further underscores the company’s commitment to enhancing shareholder value over time.

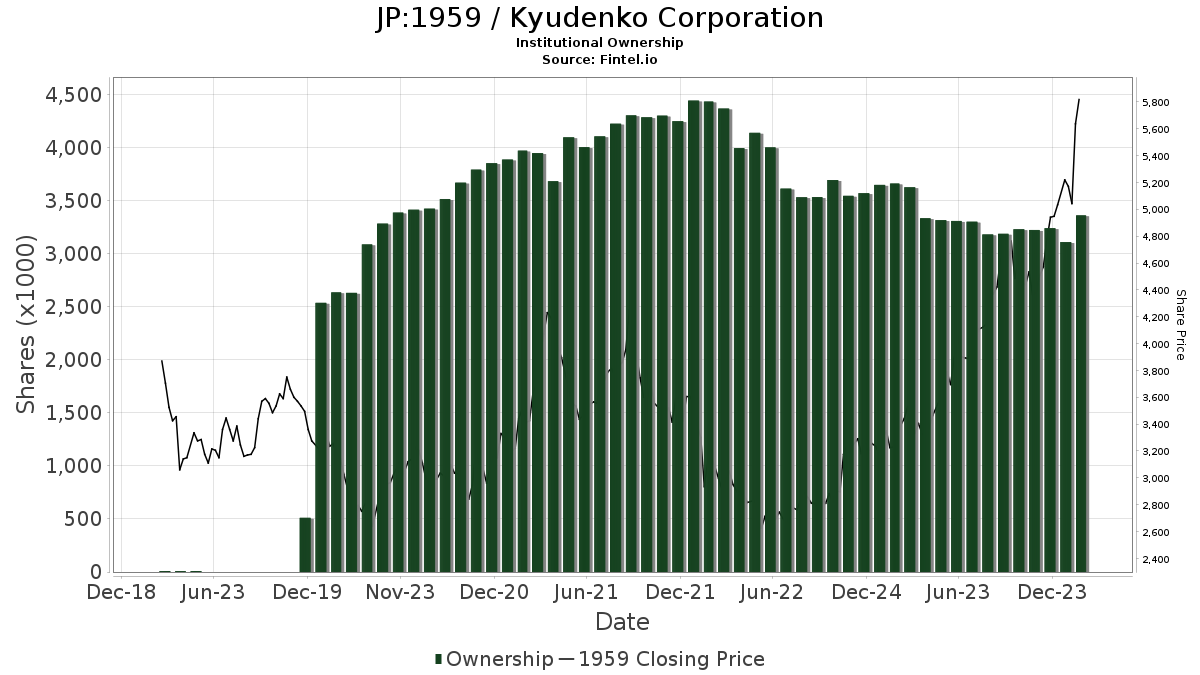

The Pulse of Fund Sentiment

Amidst the bustling world of investments, 80 funds or institutions are currently invested in Kyudenko. This represents an increase of 6 owners or 8.11% in the last quarter alone. The average portfolio weight dedicated to Kyudenko stands at 0.16%, projecting growing confidence in the company’s potential. Institutions have shown a collective increase in total shares owned by 4.18% over the past three months, reaching 3,364K shares.

Loyal Shareholders on the Move

Steering through the market currents, various shareholders are making strategic moves with Kyudenko. Vanguard Total International Stock Index Fund Investor Shares, holding 539K shares, has maintained a steady 0.76% ownership of the company. Meanwhile, Vanguard Developed Markets Index Fund Admiral Shares and Avantis International Small Cap Value ETF have actively increased their portfolio allocation in Kyudenko, illustrating growing confidence in the company’s future prospects. As the market landscape evolves, these shareholders stand as steadfast supporters, navigating the waves of change.

Unleashing the Power of Data for Investors

Fintel stands as a beacon in the realm of investment research, offering a comprehensive platform for investors, from individuals to financial advisors. With a range of tools covering fundamentals, analyst reports, ownership data, and fund sentiment, Fintel equips investors with the insights needed to navigate the intricate world of finance. As investors seek to illuminate their path to success, Fintel provides the guiding light, empowering them with advanced quantitative models and exclusive stock picks, enriching their journey towards profitable outcomes.

Embark on your investment odyssey with Fintel and unlock the potential for financial growth.