The Story Behind La-Z-Boy’s Dividend

La-Z-Boy made a noteworthy announcement on February 20, 2024 – the declaration of a regular quarterly dividend of $0.20 per share ($0.80 annually). This figure matched the previous dividend of $0.20 per share. To be eligible for this dividend, investors must acquire shares before the ex-dividend date on March 4, 2024. Shareholders recorded as of March 5, 2024, are poised to receive the payment on March 15, 2024.

Historical Context and Financial Insights

Reflecting on the past five years and analyzing weekly data, the average dividend yield for La-Z-Boy has stood at 2.01%. Interestingly, the range has varied from a low of 1.26% to a high of 3.24%. There is a notable consistency in the figures, with the standard deviation of yields demonstrating a level of predictability (0.49, n=202). Notably, the current dividend yield stands at 0.32 standard deviations above this historical average.

The company’s dividend payout ratio of 0.29 reveals a strategic approach to dividend distribution. With a growth rate of 0.33% over three years, La-Z-Boy illustrates a commitment to incrementally enhancing its dividend over time.

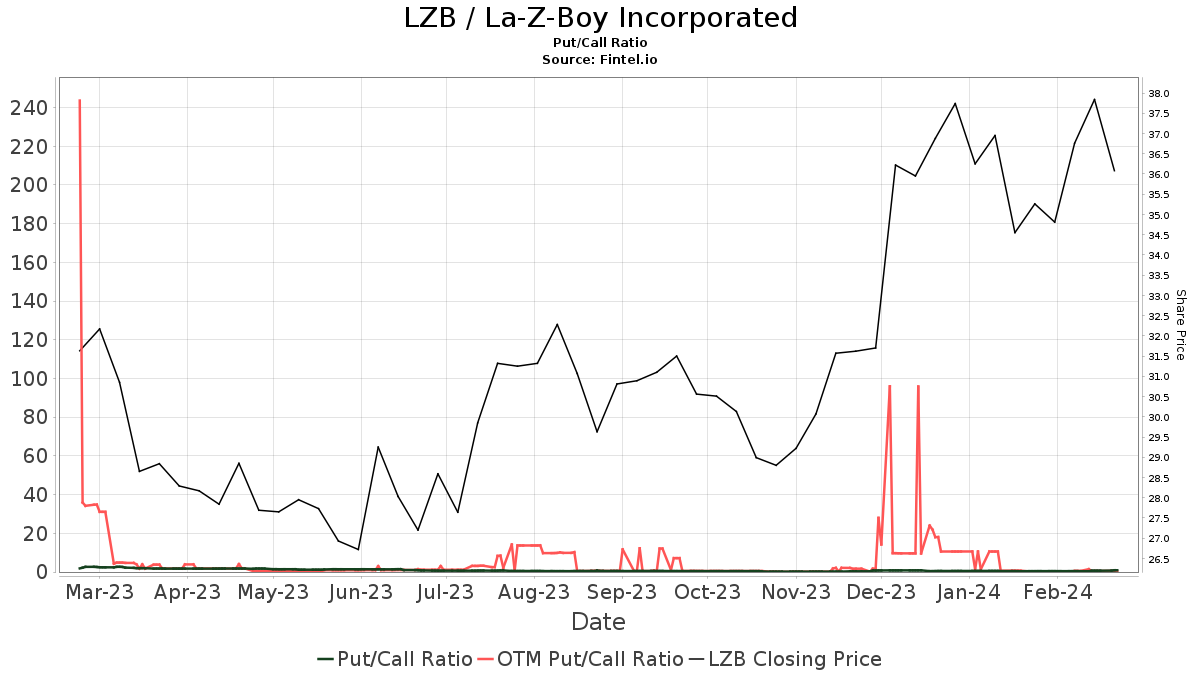

Understanding Investor Sentiment and Future Projections

An illuminating aspect of La-Z-Boy’s market landscape is the sentiment among funds and institutions. With 536 entities reporting positions in the company, the status quo has remained unchanged from the previous quarter. Average portfolio weight dedicated to LZB stands at 0.12%, showcasing a slight decrease of 0.89%. Institutions have upped their total shares owned by 0.96% in the last three months, now amounting to 51,685K shares.

Analyst price forecasts offer an optimistic outlook, projecting an 18.77% upside potential for La-Z-Boy. This estimate is based on an average one-year price target of $43.86 as of February 24, 2024. With a range from $43.43 to $45.15, the forecast hints at a promising trajectory.

Patterns in Shareholder Activities

Various notable shareholders have made adjustments to their holdings. Notably, iShares Core S&P Small-Cap ETF demonstrated a 1.51% decrease in ownership and a 1.86% increase in portfolio allocation toward LZB. Similarly, Silvercrest Asset Management Group and Lsv Asset Management adjusted their positions, indicating shifts in sentiment and strategy.

Moving forward, La-Z-Boy continues to solidify its position as a leading residential furniture producer, catering to every corner of the home. With distinct segments encompassing various renowned brands and a strategic distribution network, the company remains a prominent player in the market.

For a comprehensive investing research platform and deeper insights into the financial landscape, Fintel stands out as a valuable resource. Offering a range of fundamental data, ownership insights, and sentiment analysis, Fintel serves as an indispensable tool for investors navigating the markets.

Disclaimer: The views expressed in this article are those of the author and do not necessarily align with those of Nasdaq, Inc.