Lamb Weston Reports Disappointing Quarterly Earnings

Q2 Earnings Fall Short of Expectations

Lamb Weston (LW) reported quarterly earnings of $0.66 per share, which fell short of the Zacks Consensus Estimate of $1.02 per share. This figure marks a decline from last year’s earnings of $1.45 per share, adjusted for non-recurring items.

This report reveals an earnings surprise of -35.29%. Last quarter, the company met expectations with earnings of $0.73 per share.

Revenue Declines Amidst Industry Challenges

For the quarter ending in November 2024, Lamb Weston generated revenues of $1.6 billion, missing the Zacks Consensus Estimate by 4.30%. This is a decrease compared to the $1.73 billion reported a year earlier. Over the past four quarters, the company has failed to meet consensus EPS estimates.

The company’s future stock performance will largely depend on insights shared during the upcoming earnings call.

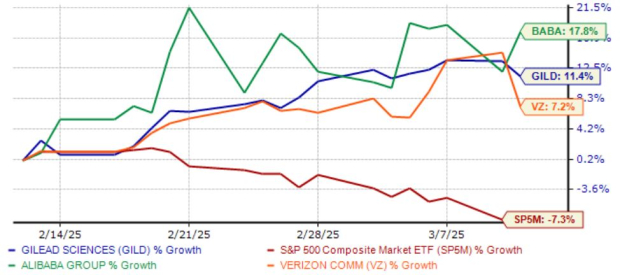

Since the start of the year, Lamb Weston shares have dropped approximately 27.6%, while the S&P 500 has increased by 23.1%.

Looking Ahead: Investor Concerns

Given Lamb Weston’s underperformance this year, many investors are left wondering about the stock’s future direction.

Addressing this concern often involves evaluating the company’s earnings outlook. This includes current consensus earnings expectations for the upcoming quarters, along with any recent revisions.

Research indicates a significant link between stock movements and changes in earnings estimate revisions. Investors can monitor these revisions themselves or leverage a rating tool like the Zacks Rank, which is known for its effectiveness in tracking earnings estimates.

Before this earnings release, the estimate revisions for Lamb Weston were unfavorable. The current status reflects a Zacks Rank of #4 (Sell) for the stock, suggesting it may underperform the market in the near term. Prospective investors might want to explore the list of Zacks #1 Rank (Strong Buy) stocks for more promising options.

In the coming days, it will be crucial to observe any changes to earnings estimates for the upcoming quarters and current fiscal year. The current consensus for the upcoming quarter stands at $1.30 on $1.61 billion in revenues, while the estimate for the fiscal year is $4.24 on $6.65 billion in revenues.

It’s also vital to consider how the overall industry outlook may affect stock performance. Currently, the Zacks Industry Rank for Food – Miscellaneous places it in the bottom 48% of over 250 Zacks industries. Historical data shows that industries in the top 50% tend to outperform those in the bottom half by more than a factor of 2 to 1.

Comparing Lamb Weston with Industry Peers

In the broader context of the Consumer Staples sector, another company, Helen of Troy (HELE), has not yet reported its results for the quarter ending November 2024. Helen of Troy anticipates quarterly earnings of $2.61 per share, reflecting a year-over-year decrease of 6.5%. The consensus EPS estimate for this quarter has remained stable over the last month.

Expected revenues for Helen of Troy are projected at $530.38 million, down 3.5% compared to the same quarter last year.

Is it Time to Invest in Lamb Weston (LW)?

Before making an investment decision regarding Lamb Weston (LW), consider exploring the best stocks to buy over the next month. Zacks Investment Research offers insightful analysis and updated reports.

Since 1978, Zacks Investment Research has aimed to equip investors with research tools and independent insights. Their rating system, the Zacks Rank, has historically outperformed the S&P 500, achieving an average gain of +24.08% annually.

For those interested in the latest investment recommendations, you can download a free report on 5 Stocks Set to Double.

Lamb Weston (LW): Free Stock Analysis Report

Helen of Troy Limited (HELE): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.