Landstar System Updates Earnings Outlook Amid Volume and Claims Challenges

Landstar System, Inc. (LSTR) has revised its first-quarter 2025 earnings guidance, citing challenges with truckload volumes, truck revenue per load, and increased insurance and claims expenses. Also impacting expectations is a recent supply chain fraud case that may influence LSTR’s profitability.

Let’s explore the details further.

Performance Overview

Landstar experienced a robust February, where truckload activity exceeded expectations. This trend compensated for lower load volumes seen at the end of fiscal January, primarily due to harsh winter weather and California wildfires. In March, truck volume levels returned to typical seasonal patterns, though revenue per load remained below average for this period.

Volume and Revenue Analysis

In the first eight weeks of the first quarter of 2025, LSTR reported a 4% year-over-year decrease in truck loads. This decline was driven by a 6% fall in van equipment loads and a 5% drop in unsided/platform equipment loads, partially balanced by a 26% rise in other truck transportation loading categories.

Revenue per load for the first eight weeks of 2025 nearly matched that of the same timeframe in 2024, with a notable 4% hike in revenue from unsided/platform equipment. However, this was largely offset by a 2% dip in van equipment revenue. The variable contribution margin for this period aligns with LSTR’s prior guidance of 14.0% to 14.3%.

Frank Lonegro, Landstar’s president and CEO, commented, “I’m pleased that in a highly fluid freight transportation environment and ever-changing policy backdrop, we expect our revenue for the 2025 first quarter to finish at or near the mid-point of our 2025 First Quarter Prior Guidance.”

Insurance and Claims Impact

Conversely, LSTR anticipates significantly higher insurance and claims costs in the first quarter of 2025 due to increased cargo theft and truck accident claims. While revenue expectations now hover around the midpoint of the previously communicated range of $1.075-$1.175 billion, heightened insurance costs have prompted LSTR to revise its earnings per share guidance down to a range of 90-95 cents, from the earlier estimate of $1.05-$1.25 per share.

Moreover, during the last fiscal week of the quarter, LSTR identified a supply chain fraud case currently under investigation, which does not pertain to LSTR’s core North American truckload services. Initial estimates suggest this fraud may negatively impact first-quarter earnings per share by 35 to 50 cents, primarily due to an impairment recorded on accounts receivable from the December 28, 2024 balance sheet, excluding potential insurance recoveries.

Share Repurchase Activity

In the first quarter of 2025, LSTR bought back nearly 386,000 shares for approximately $60 million, exclusive of any applicable excise taxes. The company retains authorization to repurchase up to an additional 2,161,663 shares under its ongoing share buyback program.

Given these developments, market participants await LSTR’s first-quarter earnings results, which are set to be released on April 29, 2025, after the market closes.

LSTR’s Zacks Rank & Price Performance

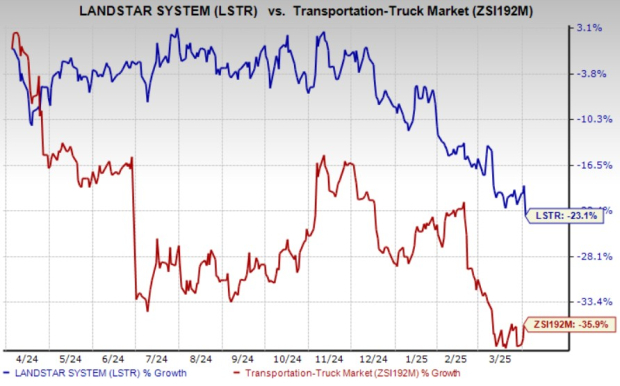

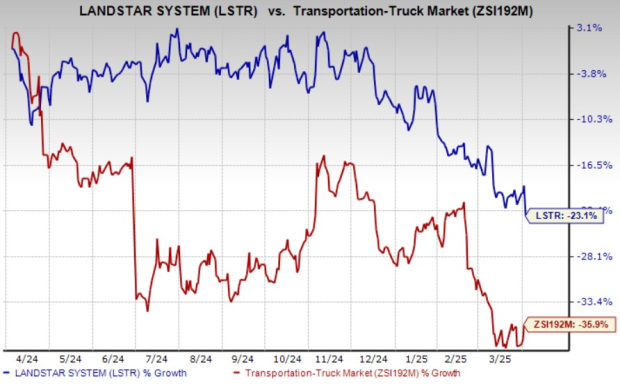

Currently, Landstar holds a Zacks Rank of #4 (Sell). Over the past year, LSTR shares have plummeted 23.1%, compared to a decline of 35.9% in the transportation-truck industry.

One-Year LSTR Stock Price Comparison

Image Source: Zacks Investment Research

Stocks to Consider

Investors focusing on the Zacks Transportation sector might also consider SkyWest SKYW and Frontier Group ULCC.

SkyWest

SkyWest currently holds a Zacks Rank of #1 (Strong Buy). Its expected earnings growth rate is 16% for the current year. The company has consistently exceeded earnings estimates, demonstrating a solid surprise record with an average beat of 16.7% over the last four quarters. Over the past six months, SKYW shares have increased by 9.1%.

Frontier Group

Frontier Group also boasts a Zacks Rank of #1. The company is projected to have an extraordinary earnings growth rate exceeding 300% this year.

With a commendable earnings surprise track record, Frontier Group has surpassed consensus estimates in three of the last four quarters, with an average surprise of 1.1%. ULCC shares have surged 43% in the past six months.

Zacks’ Research Chief Selects “Stock Most Likely to Double”

Our experts have identified five stocks with the highest potential for gains of +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian has spotlighted one stock poised for significant appreciation.

This leading pick represents a highly innovative financial entity, boasting a rapidly expanding customer base exceeding 50 million and a diverse range of cutting-edge solutions. It stands out as a strong candidate for major gains. While not all selections are guaranteed winners, this stock could outperform previous Zacks’ picks, such as Nano-X Imaging, which rose 129.6% in a little over nine months.

Free: See Our Top Stock And 4 Runners Up

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Frontier Group Holdings, Inc. (ULCC) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.