Last-Minute Tax Filing: A Quick Guide to Avoid Penalties

The countdown to Tax Day is on, with April 15 approaching rapidly. If you’ve delayed filing until the last minute, you’re not alone. While it’s not the best strategy, it remains manageable. I speak from experience as a reformed procrastinator who once waited until the eleventh hour to file.

Tax season can feel chaotic, filled with frantic document searches and last-minute math. However, it is possible to navigate this stressful time effectively. You can still file your taxes accurately, even if you haven’t opened your software or your “filing system” is disorganized. If you’re wondering whether filing late could lead to arrest, take a breath. This guide outlines how to file quickly and accurately, tackling mandatory elements like income, optional deductions, and strategies to circumvent common pitfalls during crunch time.

Let’s dive in.

Step 1: Use Software for a Smoother Filing Process

The most effective move for last-minute filers is to use tax software. This tool streamlines the filing process, significantly reducing the likelihood of errors compared to manual entry. As the IRS endorses using software, it’s a proven method for expediting filing.

Consider these advantages of tax software:

- Prevention of Mistakes: It verifies your calculations, prompts for missing information, and highlights potential errors before submission.

- Guided Process: The software simplifies the filing process, eliminating guesswork about which forms to complete.

- Auto-Imports Data: Many programs can automatically import information from employers or financial institutions.

- Electronic Filing: E-filing is faster and provides immediate confirmation of receipt from the IRS.

- Extension Filing: Tax software often facilitates filing for an extension without additional paperwork.

Some programs even estimate your completion time, which can be reassuring when you’re racing against the clock. Start by selecting and opening your tax software before you search through piles of paper.

Step 2: Assess Your Situation with the TAXCON Scale

Next, determine how urgent your circumstances are. You may need to adjust your strategy based on how much information you have collected so far.

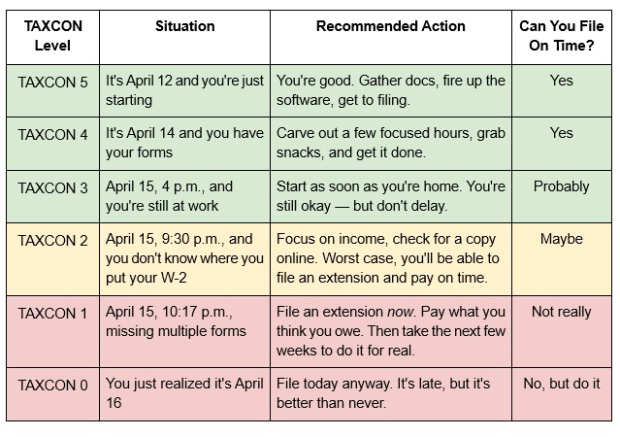

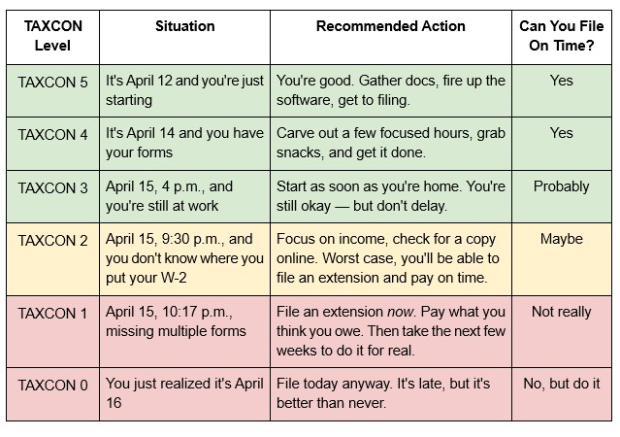

The TAXCON scale can assist: like DEFCON, it provides a measure for your tax situation.

Image Source: Zacks Investment Research

It’s essential to file something, even if you cannot pay the full amount due immediately. The IRS applies a failure-to-pay penalty of 0.5% per month on unpaid taxes. In contrast, the failure-to-file penalty is 5% per month, which could lead to escalating penalties quickly.

For example, if you owe $20,000 and do not file by April 15:

- If you file on time but can’t pay: the penalty is $100 monthly.

- If you miss the filing deadline: penalties escalate to $1,000 monthly, plus interest.

Overall, penalties can accumulate until reaching 25% of your total tax liability, with interest accruing at an annual rate of 7%. To mitigate this risk, file—even if only for an extension—and pay what you can. If deadline pressures mount, I suggest filing an extension as a precaution. This approach protects you from being penalized for missing the filing date, which bears a higher penalty than late payment.

Utilize the TAXCON chart to maximize your time and minimize penalties: if you’re at TAXCON 5 to 2, continue with filing steps. However, if you’re TAXCON 1 or 0, go straight to Step 6 regarding filing an Extension.

Step 3: Prioritize Your Income Reporting

When under time constraints, reporting your income is the critical step you must complete. The IRS will forgive missed deductions but is strict about unreported income, which can lead to substantial penalties.

Gather your income documentation, including:

- W-2 for salaried employees

- 1099-NEC for freelance or contract work

- 1099-K for platform income (e.g., PayPal or Etsy)

- 1099-INT for interest income

- 1099-DIV for dividend income

- 1099-B for capital gains from investments

- 1099-R for retirement account distributions

- Schedule K-1 for income from partnerships or S corporations

If you’re not sure if you have all the necessary forms, check your IRS Wage and Income Transcript online at irs.gov/individuals/get-transcript for confirmation of income received.

For any forms you can’t locate, you may be able to download replacements online:

- W-2 or 1099: Check your payroll system or contact HR.

- Interest or dividends: Access your bank or investment account for tax documents.

If you’re unable to find certain income, don’t estimate. It is better to file for an extension than to guess, which could lead to penalties. After entering your income, you’ll have completed the most critical portion of your tax return.

Maximize Your Tax Savings Before the April Deadline

The most crucial step in avoiding penalties is to pay what you owe. If the tax deadline is looming, remember that you can always file an amended return after Tax Day to include any credits and deductions you qualify for.

If you still have time and energy, consider additional actions to lower your tax bill through deductions and credits.

Step 4: Want to Owe Less? Here’s How to Lower Your Tax Bill Fast

Once you’ve estimated your income and have an idea of your tax liability, it’s wise to explore ways to reduce what you owe before the deadline. Deductions and credits can play a significant role. While this step isn’t mandatory, it can be highly beneficial.

Deductions lower your taxable income, meaning you will be taxed on a smaller amount, while credits directly decrease your tax liability on a dollar-for-dollar basis.

To start, focus on above-the-line deductions. These deductions will reduce your tax income regardless of whether you choose the standard deduction or itemize. Some common above-the-line deductions include:

- Contributions to retirement accounts such as traditional IRAs and 401(k)s

- Health Savings Accounts (HSAs) and Archer Medical Savings Accounts (MSAs)

- Interest paid on student loans

- Tuition and certain educational expenses from qualified institutions

- Business expenses for sole proprietors

- Alimony payments from divorces finalized before 2019

- Pens for early withdrawal from CDs or savings bonds

- Qualified educator expenses for teachers in grades K-12 with at least 900 hours of classroom time

- Certain military moving expenses

Next, you need to choose between itemizing your deductions or taking the standard deduction. If you’re pressed for time, opting for the standard deduction is the simplest option. For your 2024 tax return, the standard deduction amounts are:

- $14,600 for single filers

- $29,200 for married couples filing jointly

- $21,900 for heads of household

For most taxpayers, the standard deduction offers the most tax relief. You should only consider itemizing if your total deductible expenses exceed the standard deduction; typical circumstances include:

- Significant mortgage interest payments

- Out-of-pocket medical expenses exceeding 7.5% of your income

- Large charitable contributions

- Major losses due to federally declared disasters

If you’re uncertain, let your tax software calculate both options. It will automatically select the method that minimizes your tax bill.

If you decide to claim deductions or credits, gather the necessary documentation, such as:

- Form 1098 for mortgage or student loan interest

- Receipts or documentation for charitable donations

- Form 1098-T for education credits from colleges or universities

- Employer Identification Numbers (EINs) or Social Security Numbers (SSNs) for expenses paid to individuals or businesses

If you’re missing documents like an EIN or Form 1098-T, contact the provider immediately. Many will have this information readily available during the tax season.

If you lack the paperwork needed by the deadline, you have two options to avoid penalties:

- File using the standard deduction now and amend your return later if you discover additional deductions or credits.

- Request an extension and file your complete return once you acquire all necessary documentation.

Step 5: Almost Out of Time? File an Extension to Avoid Penalties

As the deadline approaches and you still lack necessary information, consider filing an extension. It is a quick and straightforward process that grants you until October 15 to complete your return.

IMPORTANT: An extension allows more time to file your return but not more time to pay. When you file for an extension, you are still required to estimate and pay what you owe by the April 15 deadline. Should you be unable to pay the full amount, you can arrange a payment plan online with the IRS.

If taxes are owed and the payment is not made by April 15, the IRS will start accruing interest and may impose a penalty on the unpaid balance, regardless of whether you file an extension.

To properly file for an extension:

1. Submit Form 4868 to request your extension.

Most tax software will handle this with minimal effort. Alternatively, you can use the IRS Free File Fillable Forms tool at irs.gov/freefile. This request must be submitted by April 15 at 11:59 p.m. local time.

2. Estimate and pay what you owe.

By entering your income into your tax software, you should have a good estimate of your tax obligation. The IRS Tax Withholding Estimator can help provide a rough figure.

No time to estimate? You can still qualify for the “safe harbor” rule by ensuring your payment meets one of the following criteria:

- Pay at least 90% of your tax obligation for this year, or…

- Pay 100% of your total tax liability from last year (110% if your AGI was over $150,000).

If you’re pressed for time, simply look at last year’s taxes to confirm that you’ve paid either 100% or 110% based on your adjusted gross income (AGI). Meeting either threshold protects you from underpayment penalties even if you file your full return subsequently. Should you discover additional credits and deductions later, any overpayment will be refunded.

Key Point: If you can’t pay the entire amount today, file for the extension and make at least a partial payment. The failure-to-file penalty is significantly harsher than the failure-to-pay penalty.

Once your extension is submitted and your payment is processed, you have addressed the most pressing concerns and granted yourself some additional time.

Step 6: Essential Final Checks to Avoid IRS Issues

Before submitting your return or requesting an extension, ensure that you check these important details:

Neglecting these small but vital details can lead to delays, penalties, or even rejected returns.

If filing electronically: You have until 11:59 p.m. local time on April 15 to submit your return or extension electronically. As long as your submission is completed before midnight, you’re in the clear.

If mailing your return or extension: It must be postmarked by April 15. Use a staffed post office and consider requesting a receipt or opting for certified mail for confirmation.

Can’t find your IP PIN (if applicable)? If the IRS has previously issued you an Identity Protection PIN (IP PIN), its inclusion is mandatory upon filing. Omitting it will result in your return being rejected. You can retrieve this information at…

Critical Tax Filing Checklist: Ensure Accuracy Before Submission

Essential Steps Before You File Your Taxes

The IRS recommends that all taxpayers double-check their information before filing taxes. This review is essential, even if time is short. Allocate at least five minutes to confirm these six critical details:

- Verify Your Bank Account Information: Ensure that your banking details are accurate and up-to-date. Refunds are directed to the account you provide, so avoid mistakenly sending money to a closed account or someone else’s bank.

- Check Social Security Numbers: Confirm that all Social Security numbers are correct. This should include your own, your spouse’s, and those of any dependents.

- Ensure Your Return is Signed: If filing jointly, both spouses must sign the return, even when submitting electronically.

- Confirm Your Address is Accurate: The IRS still sends important communications via traditional mail, so ensure your address is correct.

- Review Your Income Sources: Do not overlook any reported income, including minor items like an $18.94 interest form from your bank, as the IRS accounts for it all.

- Check Extensions and Payments: If you filed for an extension, make sure to document any payments made, even partial payments, to minimize penalties and demonstrate good faith.

This final review, though brief, can prevent significant hassles down the line, saving you from hours or even weeks of corrections.

After Filing: Next Steps to Take

Once you have completed your tax filing or submitted for an extension, your job is done. You can take satisfaction in having filed your taxes, despite any chaos involved.

Was the process uncomfortable? Possibly.

Was it stressful? Likely.

However, the key takeaway is that you have successfully completed your filing. Remember to save either a digital or printed copy of your tax return or extension confirmation for your records. If you opted for an extension, mark your calendar: October 15, 2025, is your new deadline.

Take a moment to close your laptop, organize your paperwork, and decompress. A healthy reward, like a snack or a favorite show, is deserved after the effort you put in. Remember, you accomplished what you set out to do, which is the most important part.

If you’re feeling overwhelmed or behind schedule, rest assured you’re not alone. Many people, including countless others, have filed their taxes at the last minute for various reasons.

Focus on your completion rather than the timing—it’s what truly matters.

Subscribe for Free Financial Insights

Consider joining Zacks’ Money Sense newsletter, a reliable source of personal finance tips and resources. Each week, you’ll gain valuable ideas and actionable strategies to help you save more, invest wisely, and work towards a more secure financial future.

No matter if you’re a beginner or have already accumulated significant savings, the expertise shared by our professionals can guide you towards achieving your financial goals. Sign up for free today.

Get Money Sense absolutely free >>

This article initially appeared on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.