This article is part of the LatAm Tech Weekly Series, written by Julia De Luca and powered by Nasdaq. Through Nasdaq’s global network, we partner with Latin American companies to support their entire business lifecycle to elevate their brand and access the global markets. Learn more about Latin American Listings here.

I’m excited to greet you for the first LatAm Tech Weekly of 2024. This week’s edition is quite special as I delve into an insightful analysis offering a glimpse into the venture market of the current year.

But, before we delve into that, let me provide a quick recap of my action-packed 2023. Don’t worry, we’ll return to our regular format next week. Stay tuned!

Share Weekly Tech Update – Julia

Follow me on LinkedIn , Instagram or Twitter for daily updates!

Opinions expressed here are solely my own and do not represent those of people, institutions, organizations that I may or may not be associated with in any capacity, unless explicitly stated.

Reflecting on the past year, here’s a snapshot of my journey and achievements:

-

Crafted 48 editions of the LatAm Tech Weekly newsletter

-

Highlighted 38 incredible ‘Startups to Watch’

-

Wrote a whopping 65,000 characters solely on Substack. To put that in perspective, that’s more content than a 200-page book!

-

Made waves in the media with 14 mentions across various news outlets.

-

Ventured into the world of audio and video, participating in 19 podcasts and videos.

-

Connected with the community through 28 live events as a panelist.

-

+16,000 followers on LinkedIn and +12,000 followers on Instagram.

It’s been a year of growth, learning, and connecting, and I’m excited to carry this momentum forward!

A Retrospective Glance

As I highlighted in our last edition, understanding the past is key to navigating the future of the VC industry. To that end, CB Insights recently published its State of Venture 2023 report, complete with Q4 data, and the findings are quite telling.

The report underscores a trend of ongoing market uncertainty and investor wariness, culminating in a significant dip in venture deal activity during the last quarter of 2023. The U.S., in particular, felt the brunt of this slowdown, with its quarterly deal count falling to a 10-year low at just 2,182 deals. However, amidst this slowing pace, there’s a noteworthy shift as investors are increasingly focusing on early-stage investments. In fact, about two-thirds of all deals were in the early stages. This implies that securing mid- and later-stage deals has become more challenging.

This pivot in investment strategy offers a glimpse into the evolving dynamics of the venture capital landscape as we step further into the year.

Evaluating the Future of Private Investment in Latin America

An Optimistic Outlook for Latin America

Latin America wrapped up the year, with funding for the region reaching a total of USD 3.3 billion, down from USD 7.5 billion in 2022. Notably, 83% of the rounds were dominated by early-stage companies. Q4 saw significant rounds for Brazilian companies QI Tech and Jusbrasil.

Pitchbook’s Insights on the Road Ahead

Pitchbook’s analysis indicates that private investment managers are eyeing a brighter future. However, challenges like poor fund distributions and high interest rates may impede recovery. The difficult exit environment has led to lower returns for both Private Equity and Venture Capital investors, resulting in limited cash availability for new investments by Limited Partners (LPs). Despite these obstacles, there is a cautiously optimistic view for 2024.

Pitchbook’s fundraising forecasts for the coming year underscore three main trends:

-

2024 is anticipated to be the year for a breakthrough with over 100 exit transactions involving continuation funds as buyers, given the tight conditions for exits.

-

Many Private Equity (PE) firms may extend their waiting period for investment vehicles during this low-exit phase, potentially leading to record-breaking holding periods for U.S. PE-backed companies.

-

Venture Capital (VC) firms are expected to witness a slight increase in total fundraising in the upcoming year, comparable to the figures from 2020.

An In-Depth Analysis

The 2024 U.S. VC Outlook by Pitchbook presents a balanced view of the venture capital market, focusing on key areas like fundraising, IPOs, and late-stage dealmaking. As 2023 draws to a close, positive indicators for a potential rebound in the IPO market have emerged. The U.S. economy has outperformed expectations, with a significant rise in GDP growth to 5.2% in the third quarter, alleviating recession fears. The Federal Reserve’s halt in interest rate hikes since July 2023 has revived interest in public stocks, as evidenced by the S&P 500’s 19% increase in 2023. If inflation continues to cool, further rate declines could occur in 2024, buoyed by the easing of supply chain disruptions from the pandemic. These improvements, particularly beneficial for companies in shipping and semiconductor production, could enhance operational efficiency and output. For startups, improved production capabilities might reduce uncertainties and elevate their appeal in the IPO market.

The Cboe Volatility Index (VIX) indicates a downward trend in market volatility, currently standing around 13, below the long-term median of 18. This reduction in volatility could potentially spur new IPO filings in 2024, creating a stable market environment favorable for both issuers and investors. VC-backed startups may find this steadier market conducive to their public debut. Lower volatility also diminishes the risks for investors in IPOs by minimizing concerns about sudden market fluctuations. However, stringent criteria favoring highly profitable startups for going public may limit the number of eligible VC-backed startups for IPOs. Nevertheless, a resurgence of selected IPOs for VC-backed companies is projected.

In 2023, capital distribution to investors from exits hit its lowest level since 2003 at just $54.8 billion from about 900 exits, a 30% decline from 2022. This decline is primarily attributed to a significant drop in tech IPOs and increased SEC regulations affecting alternative exits like acquisitions. Moreover, the distribution rate for VC funds aged five to 10 years has plummeted to a decade low. Future fundraising is expected to be around $64 billion, similar to 2020 but below the peak of 2022. The venture market grapples with challenges such as the subdued performance of tech unicorns and heightened selectivity by VC firms, resulting in a high capital demand-to-supply ratio, albeit in an investor-friendly environment. However, shifts in macroeconomic factors and Federal Reserve policies could reignite interest in riskier investments and create exit opportunities, potentially bolstering fundraising prospects in 2024.

In 2024, the percentage

US Venture Capital Sector: Challenges and Opportunities

The prevalence of insider-led deals in the US venture capital (VC) sector shows no signs of abating, particularly in the first half of the year. This trend is the direct result of ongoing capital constraints, sustained market volatility, waning investor confidence, and the continued closure of exit channels. Since mid-2022, US General Partners (GPs) have slashed their dealmaking pace, and numerous institutional Limited Partners (LPs) have encountered liquidity challenges due in part to the denominator effect affecting those with exposure to the public market. In this climate, company valuations have plummeted, and the requirements for startups to secure venture financing have escalated.

Over the past few years, U.S. venture capital (VC) fundraising skyrocketed, with record-high capital raised, buoyed by substantial funds such as Tiger Global’s $12.7 billion and Andreesen Horowitz’s $20.3 billion, spread across seven funds. The average fund size spiked from $108.3 million in 2019 to $166.3 million in 2022, propelled by a robust economic environment and investor hunger for high venture returns.

However, as we venture into 2024, the trend toward billion-dollar funds is losing steam, with only 10 such funds closing throughout 2023 year-to-date. This slowdown can be attributed to decreased liquidity in public markets and reduced investments from nontraditional investors, affecting the ability of mature startups to raise substantial rounds. Thus, in 2023 year-to-date, venture capital deployment in the U.S. nosedived to $135.2 billion with 239 mega-rounds, a striking contrast to the $325.6 billion and 840 mega-rounds in 2021.

As a result, the necessity for billion-dollar funds to participate at the top end of the VC market has diminished, mirroring the decline in large deal activities.

The Road Ahead for the US Venture Capital Sector

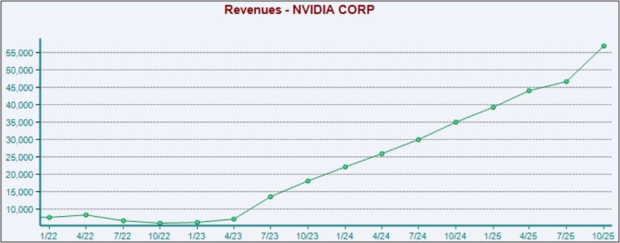

Looking ahead, it is apparent that the challenges and opportunities in the US venture capital sector amid the ongoing market volatility are intertwined. The predictions for AI in 2023 are indicative of a pivotal shift from attention to adoption. This transformation is underscored by reduced experimentation costs, business models shifting to “selling work,” and pricing transitioning to result-based. Furthermore, the rise of AI marketplaces and the convergence of open source and LLMs mark a notable industry shift.

Additionally, the sector is poised to witness a transformation in alliances and an exodus across the application layer as investors become more circumspect about funding endeavors. These forecasts offer a glimpse into the evolving landscape of the VC sector and the potential opportunities that lie ahead.

And now, as we assess these predictions, it becomes abundantly clear that 2023 was a year of heightened AI attention, setting the stage for 2024 to be the year of widespread AI adoption. These trends will reshape the future of the VC sector and influence the investment strategies and opportunities that emerge.

This article was originally published on Substack.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.