Global Unrest Impacts Markets: Insights on Blue-Chip Stocks

Recent Turmoil Around the Globe

I have updated my Stock Grader ratings for 102 major blue-chip stocks.

The current state of global affairs is concerning. It’s not limited to the ongoing conflicts in the Middle East or the tensions between Russia and Ukraine.

Just this past weekend, rebel forces took control of key cities in Syria, including Aleppo, Hama, Homs, and Damascus, following a surprise offensive. Rebel leader Hassan Abdul-Ghani now heads the country after a swift, 11-day assault that culminated in the storming of the Presidential Palace.

In a dramatic turn of events, Syrian President Bashar al-Assad and his family have fled and, reportedly, sought asylum in Russia. Once protected by both Iran and Russia for decades, Assad’s regime has collapsed after 50 years, highlighting a significant leadership vacuum in the Middle East. Observers will be keen to see how other nations respond to the new leadership in Syria.

Challenges in South Korea and Europe

Looking further east, South Korea faces its own political instability. President Yoon Suk Yeol announced Martial Law to combat “anti-state forces” and sympathizers of North Korea. However, just six hours later, following a vote in Parliament, he lifted the Martial Law.

This incident nearly led to President Yoon’s impeachment, which requires a two-thirds majority in Parliament. While Yoon’s People Power Party holds just over one-third of the seats, a significant portion of his party has turned against him.

Similar unrest in Europe adds to the global instability. Last week, the French government fell apart amid a budget battle. A no-confidence vote initiated by Marine Le Pen’s National Rally passed with 331 votes–far exceeding the 288 needed. This could lead to new elections in 60 days. President Macron’s party currently holds a minority in Parliament, while Le Pen’s party commands more seats, complicating efforts to stabilize leadership.

So far, Macron has refrained from calling for new elections, expressing intention to form a new administration that would appeal to Le Pen, an endeavor many believe is unfeasible given the current political climate.

The Economic Landscape in Germany

Germany also faces political shifts with elections approaching next February. Amid these developments, the country is experiencing an economic downturn. Recently, union workers at nine Volkswagen AG (VWAGY) plants have initiated two-hour strikes due to looming layoffs and potential plant closures. These strikes are likely to extend to four hours at select locations this week, highlighting the broader struggles within Germany’s automotive sector which is grappling with decreased global demand.

Collectively, these factors indicate that the Eurozone is currently in disarray, resembling a “headless” structure. With both France and Germany experiencing severe economic challenges, the possibility of a recession for the Eurozone looms large.

If this turmoil persists, it may not be surprising if the euro loses value against the U.S. dollar, paving the way for potential dollar-euro parity.

Comparative Stability in the U.S. Economy

In contrast, the United States emerges as a comparative refuge amidst this global chaos. The U.S. economy has a significant advantage, having grown at a 2.8% annual rate in the third quarter, with the Atlanta Fed projecting a 3.3% growth rate for the fourth quarter. Moreover, with the presidential election concluded without contest, the U.S. political landscape is stable.

Anticipating a “flight to quality,” many investors are likely to return to U.S. markets, contributing to a strong dollar.

The Latest Stock Grader Updates

This week began positively for U.S. markets. Both the S&P 500 and NASDAQ achieved their third consecutive week of gains, with increases of 1% and 3.3%, respectively, pushing both indexes to record highs.

This positive momentum is partly attributed to the November jobs report, which revealed the addition of 227,000 payroll jobs—slightly above the projected 220,000. However, the unemployment rate did tick up to 4.2% due to a decline in worker participation.

Given the Federal Reserve’s current emphasis on unemployment over inflation, there’s speculation that the Fed will lower key interest rates by 0.25% during its December 18 meeting.

In the coming days, two critical inflation measures will be released: the Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday. Stay tuned for an analysis of both reports in a forthcoming Market 360 update.

Meanwhile, I’ve ensured your portfolio is positioned for growth as we wrap up the year. After reviewing recent institutional buying trends and each company’s financial health, I have revised my Stock Grader recommendations for 102 blue-chip stocks. Here are the notable changes:

- Nine stocks upgraded from Buy (B-rating) to Strong Buy (A-rating).

- Twenty-eight stocks upgraded from Hold (C-rating) to Buy (B-rating).

- Fifteen stocks upgraded from Sell (D-rating) to Hold.

- Three stocks upgraded from Strong Sell (F-rating) to Sell.

- Sixteen stocks downgraded from Strong Buy to Buy.

- Twenty stocks downgraded from Buy to Hold.

- Six stocks downgraded from Hold to Sell.

- Five stocks downgraded from Sell to Strong Sell.

Below are ten stocks rated as Buys. For a more detailed list—and to access all 102 stocks’ Fundamental and Quantitative Grades—click here. You may find that some of these stocks are already in your portfolio and might warrant a closer look.

| AAL | American Airlines Group, Inc. | B |

| ALNY | Alnylam Pharmaceuticals, Inc. | B |

| AMZN | Amazon.com, Inc. | B |

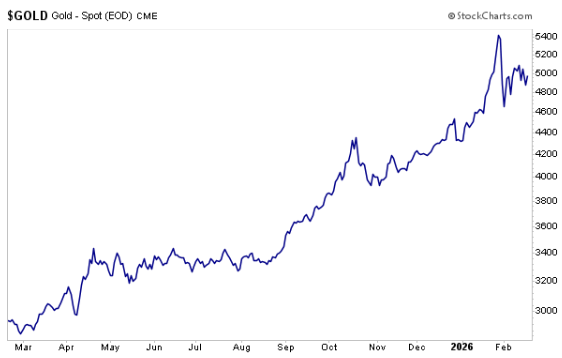

| AU | Anglogold Ashanti PLC | B |

| AUR | Aurora Innovation, Inc. Class A | B |

| AZO | AutoZone, Inc. | B |

| CHTR | Charter Communications, Inc. Class A | B |

| CRDO | Credo Technology Group Holding Ltd. | B |

| DKS | Dicks Sporting Goods, Inc. | B |

| DSGX | Descartes Systems Group Inc. | B |

Unlock the Secrets of Stock Analysis

In my last Market 360 update, I discussed the Stock Grader as a crucial tool that has significantly influenced my investment successes. This system helps identify the stocks that are currently performing well.

For example, I previously achieved over 700% gains with a discount retailer in China, Vipshop Holdings Ltd. (VIPS).

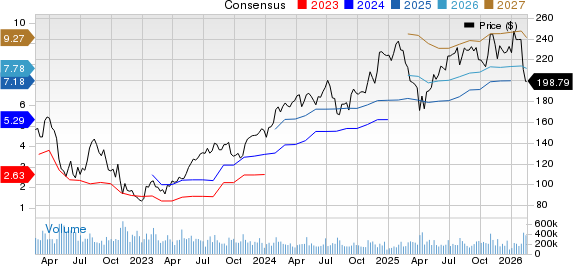

Currently, stocks in my Growth Investor service, such as NVIDIA Corporation (NVDA), have produced remarkable returns totaling 3,100%.

Finding the right stocks at the right moment is challenging for many. However, those who rely on a proven quantitative approach often achieve better results than relying on emotional decisions. This is the power of the Stock Grader and its effectiveness in identifying long-term investment opportunities.

Additionally, I want to highlight my colleague, Luke Lango’s innovative Auspex system.

This system combines various fundamental, sentiment, and technical metrics, helping investors identify stocks that can provide substantial gains in shorter time frames.

To learn more, click here to join Luke’s Auspex Anomaly webinar, which is scheduled for tomorrow, Dec. 11, at 1 p.m. Eastern.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Dick’s Sporting Goods, Inc. (DKS) and NVIDIA Corporation (NVDA)