“`html

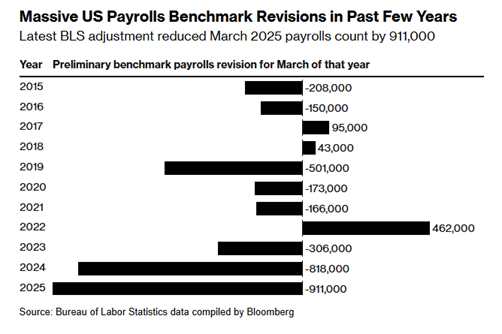

The Federal Reserve is expected to cut key interest rates by 0.25% at its Federal Open Market Committee (FOMC) meeting this week, driven by moderating inflation and a deteriorating job market. The Bureau of Labor Statistics (BLS) recently revised its payroll job estimates, revealing an overstatement of 911,000 jobs from March 2024 to March 2025, the largest revision in 26 years, indicating that monthly job growth is potentially half of previous estimates.

Inflation data also supports this anticipated rate cut; the Producer Price Index (PPI) showed a 2.6% increase annually, below the 3.3% expectations, while the Consumer Price Index (CPI) rose to 2.9%. There is a 96% chance of the rate cut, with financial markets reacting positively—evident by the recent 0.8% gain in the Dow and a 2.9% rise in the NASDAQ over the past two weeks.

“`