Leerink Partners Shines a Light on IQVIA

February 26, 2024 marked an auspicious occasion for IQVIA Holdings (NYSE:IQV) as Leerink Partners initiated coverage with an Outperform recommendation, painting a picture of promise for investors.

Seeing the Upside: Analysts’ Price Forecast

Currently, the one-year price target for IQVIA Holdings stands at 278.27. Analysts foresee a range from 237.35 to $315.00, indicating a potential increase of 12.54% from the latest closing price of 247.26.

Revenue Surge on the Horizon

In the forecast, IQVIA Holdings is projected to witness a substantial revenue spike of 13.69%, amounting to 17,036MM. Furthermore, the anticipated annual non-GAAP EPS is estimated at 12.60, further underlining the optimistic outlook for the company.

Tracking the Funds: A Shift in Sentiment

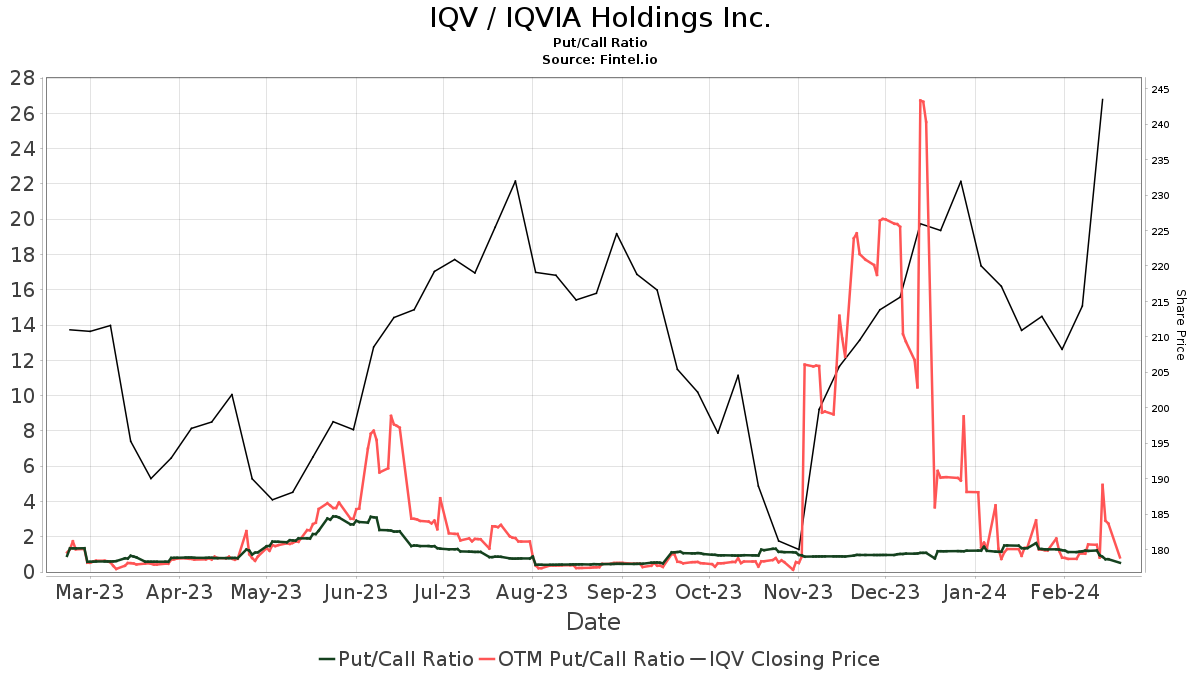

An analysis of 1762 funds reveals a notable transformation in sentiment towards IQVIA Holdings with a 2.09% increase in the number of owners. While the average portfolio weight dedicated to IQV is 0.35%, it reflects a decrease of 4.72%. Institutions have upped their stakes by 1.80%, owning 183,938K shares in total. The put/call ratio of IQV at 0.78 signals a bullish sentiment prevailing in the market.

Insights into Shareholder Behavior

Among prominent holders, Harris Associates L.P shows a progressive stance, boosting its ownership to 5.36% by holding 9,748K shares – a significant 18.93% increase. Conversely, Vanguard Total Stock Market Index Fund Investor Shares, while retaining 2.98% ownership with 5,419K shares, experienced a decrease of 6.88% in its holdings over the last quarter.

Additional holdings include significant shares by Alliancebernstein (2.60%), Vanguard 500 Index Fund Investor Shares (2.42%), and Geode Capital Management (2.22%), each illustrating shifts in portfolio allocation over the past quarter.

Exploring IQVIA Holdings

IQVIA emerges as a global leader offering advanced analytics, technology solutions, and clinical research services to the life sciences sector. With a robust presence spanning over 100 countries and a workforce of around 70,000, IQVIA’s Connected Intelligence™ facilitates accelerated innovation in medical treatments, ultimately enhancing patient healthcare outcomes.

Fintel’s Finest Insights

Fintel stands as a premier investing research platform catering to individual investors, financial advisors, and hedge funds alike. Providing a spectrum of data ranging from fundamentals to insider trading, Fintel equips investors with the necessary tools to make informed decisions and maximize profits.

For more information, visit Fintel.

Remember, the author’s views here are independent and not reflective of Nasdaq, Inc.