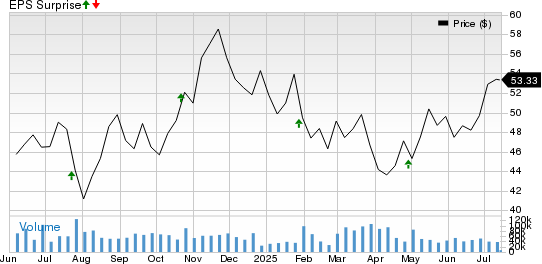

As of the second quarter of 2025, Ford and General Motors (GM) are preparing to report their earnings, with GM set to release results on July 25 and Ford on July 30. The Zacks Consensus Estimate predicts GM will report earnings of $2.44 per share and revenues of $45.34 billion, while Ford is expected to report earnings of 30 cents per share and sales of $41.5 billion. Historically, GM has surpassed EPS estimates in the last four quarters with an average surprise of 10.16%, whereas Ford has only beaten estimates in two of the last four quarters.

In terms of vehicle sales, Ford sold 612,095 vehicles in Q2 2025, marking a 14.2% increase year-over-year, driven primarily by strong demand for trucks and hybrids. GM sold 746,588 units, a 7.3% increase from the previous year, with electric vehicle (EV) sales skyrocketing 111% to 46,280 units. However, both companies face potential financial impacts from U.S. President Trump’s tariffs, with Ford estimating a $2.5 billion toll while GM anticipates a $4-$5 billion impact.

Ford’s dividend yield stands at over 5%, significantly higher than GM’s 1.13% and the industry’s average of 0.3%. While both companies are making strides in electrification, Ford’s better stock performance and shareholder return strategy give it a favorable position ahead of their earnings reports.