Leidos Holdings (LDOS) Exceeds Year-to-Date Market Performance

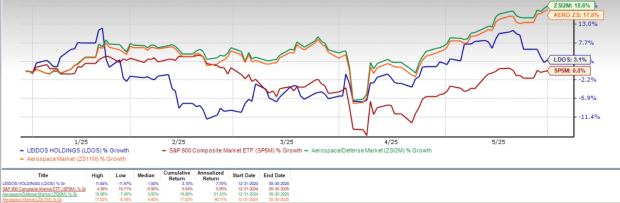

Leidos Holdings Inc. (LDOS) shares have risen 3.1% so far this year, surpassing the S&P 500’s return of 0.1%. Nonetheless, it has underperformed the Zacks Aerospace-Defense industry, which grew by 17.5%, and the broader Zacks Aerospace sector, up 18.6%.

Competitors like RTX Corp. (RTX) and Northrop Grumman Corp. (NOC) have had strong performances as well, with share prices increasing by 17.9% and 3.3% respectively this year.

While the stock’s rise may attract investors to add it, they should carefully assess the factors behind its surge, consider growth prospects, and evaluate potential risks.

Factors Behind LDOS Stock’s Surge

Leidos Holdings, a major player in aerospace and defense, has a diverse portfolio that spans cybersecurity and health data analytics. This diversity generates consistent order flows, reflected in a backlog of $46.30 billion as of Q1 2025, up from $43.55 billion in the previous quarter.

The increase in backlog suggests strong future revenue potential, likely boosting investor confidence and contributing to the recent rise in stock price.

Furthermore, Leidos’ solid financial position enhances its attractiveness. As of Q1 2025, the company held $0.84 billion in cash versus $0.12 billion in current debt, indicating strong solvency with a current ratio of 1.54.

Future Outlook for Leidos Holdings

The current economic and geopolitical landscape supports growth for Leidos, particularly with rising global tensions and increased U.S. defense spending. A White House report in May 2025 detailed President Trump’s proposal to increase the defense budget by 13% to $1.01 trillion for fiscal 2026, highlighting significant investment in the “Golden Dome” missile defense initiative.

Leidos believes it is well-positioned to contribute to the Golden Dome initiative due to its advanced air and missile defense capabilities, including its ongoing support for the defense of Guam.

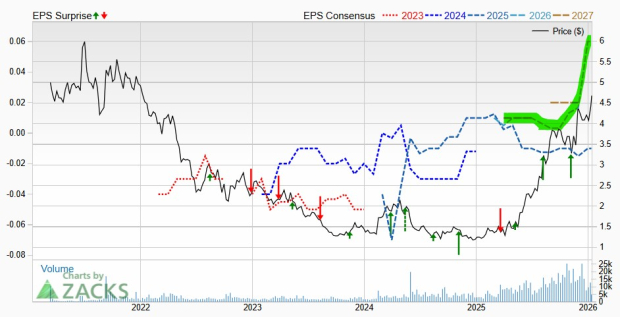

With a focus on innovative defense solutions, LDOS is poised for long-term growth. The Zacks Consensus Estimate anticipates a long-term earnings growth of 7.4% over the next three to five years.

Positive Earnings Estimates for LDOS

The Zacks Consensus Estimate indicates a sales increase of 2.7% for 2025 and 3.2% for 2026. Earnings projections have also seen upward revisions, with estimates for 2025 and 2026 EPS increasing by 1.8% and 1% respectively over the past 60 days, reflecting analysts’ growing confidence in the company.

Risks to Consider for LDOS Investment

Despite robust growth prospects, Leidos faces challenges that investors should weigh. The aerospace-defense sector is grappling with a significant labor shortage, with industry attrition at 13%, well above the national average. This shortage could result in delays and quality control issues, impacting Leidos’ ability to meet delivery timelines. Competitors RTX and NOC are similarly affected.

Additionally, increasing U.S. tariffs on major trading partners risk raising input costs and introducing supply chain uncertainties. If trade restrictions intensify, they could affect Leidos’ operational efficiency and profitability.

LDOS Stock Valuation

Currently, LDOS has a forward price-to-earnings (P/E) ratio of 13.49X, which is lower than the industry average of 26.42X, indicating potential value for investors compared to its expected earnings growth.

For comparison, RTX has a forward P/E of 21.71X and Northrop has 18.11X, also trading at a discount to industry averages.

Investor Considerations for LDOS

In conclusion, investors seeking to add LDOS to their portfolio may find the stock appealing due to its discounted valuation, strong growth prospects, and upward revisions in earnings estimates. The stock carries a VGM Score of A, signaling strong performance potential.

Additionally, Leidos has a Zacks Rank #2 (Buy), further supporting this outlook.