Lesaka Technologies Reports Earnings Surprise Amid Market Challenges

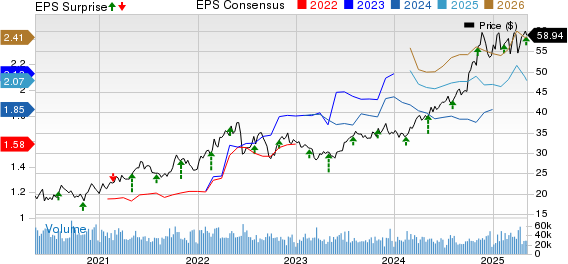

Lesaka Technologies (LSAK) announced quarterly earnings of $0.04 per share, exceeding the Zacks Consensus Estimate of $0.02. This marks an improvement from a loss of $0.06 per share reported in the same quarter last year. These results exclude non-recurring items.

This earnings report signifies a surprise of 100%. In the previous quarter, the company was predicted to generate earnings of $0.01 per share, aligning precisely with its actual results, which resulted in no surprise at that time.

Over the past four quarters, the company has surpassed the consensus EPS estimates only once.

Financial Performance Overview

Lesaka Technologies, operating within the Zacks Technology Services sector, reported revenues of $135.67 million for the quarter ending March 2025. This figure exceeded the Zacks Consensus Estimate by 4.36%, although it represents a decline from year-ago revenues of $138.19 million. The firm has topped consensus revenue estimates on three occasions in the past four quarters.

The immediate trajectory of the Stock following these numbers will largely hinge on management’s insights during the upcoming earnings call.

Year-to-date, Lesaka Technologies shares have decreased by approximately 21.7%. In contrast, the S&P 500 has reported a decline of 4.7%.

Future Outlook for Lesaka Technologies

Despite underperforming in the market this year, investors are left wondering what lies ahead for the Stock.

While definitive answers may be elusive, one valuable tool for investors is the company’s earnings outlook, which incorporates both current and revised consensus earnings expectations for the upcoming quarters.

Research indicates a solid correlation between short-term Stock movements and trends in earnings estimate revisions. Investors can monitor these revisions or utilize tools like the Zacks Rank, known for its efficacy in leveraging earnings estimate adjustments.

Following the recent earnings release, the trend in estimate revisions for Lesaka Technologies is mixed. Consequently, the current Zacks Rank is #3 (Hold), suggesting that the shares are expected to perform in line with the wider market in the near term.

The consensus EPS estimate is now $0.05 on revenues of $131 million for the next quarter, with a fiscal year estimate of $0.12 on $553.36 million in revenues.

Investors should also consider that industry trends can significantly affect Stock performance. The Zacks Industry Rank currently places Technology Services in the top 26% of over 250 industries. Historically, the top half of Zacks-ranked industries has outperformed the bottom half by over two to one.

Comparative Analysis: Veritone, Inc.

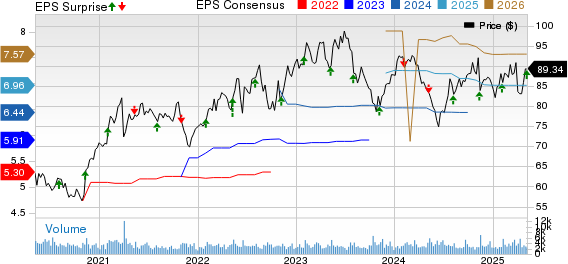

Another player in the same industry, Veritone, Inc. (VERI), is set to report its results for the quarter ending March 2025 on May 8. Analysts anticipate a quarterly loss of $0.18 per share, reflecting a year-over-year improvement of 10%. The consensus EPS estimate for Veritone has remained steady over the past month.

Projected revenues for Veritone stand at $25.2 million, which is a 20.4% decrease compared to the same quarter last year.

Investment Considerations for Lesaka Technologies, Inc.

When contemplating an investment in Lesaka Technologies, investors may wish to consider other strong stock opportunities in the market. The current landscape provides various options for strategic investments over the next month.

The Zacks Rank system, established in 1978, has shown strong performance, averaging gains of over 24% annually since 1988, easily outpacing the S&P 500.

In summary, while Lesaka Technologies shows potential with recent earnings, the upcoming earnings calls and industry conditions should guide investor decisions.

The views expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.