The winds of change are blowing favorably for LIC Housing Finance (NSEI:LICHSGFIN), signaling a remarkable uptick in its price target. As of the latest adjustment, the price target has soared to 656.84 per share, a significant climb of 21.68% from the previous benchmark set on January 16, 2024.

An ensemble of analyst projections forms the bedrock for this renewed target. Forecasts now range from a modest 377.74 to a stellar 840.00 per share. This revamped target represents a 2.42% lift from the recent closing price of 641.35 per share.

LIC Housing Finance Sturdy with 1.33% Dividend Yield

Basking in financial strength, the company proudly flaunts a dividend yield of 1.33% at its latest valuation. This dividend yield, complemented by a favorable dividend payout ratio of 0.10, reflects a balanced mechanism where prudent dividend distribution intertwines with strategic reinvestment for future growth.

A peek into the past reveals a 3-Year dividend growth rate of 0.06%, affirming LIC Housing Finance’s commitment to nurturing its dividend distribution over time.

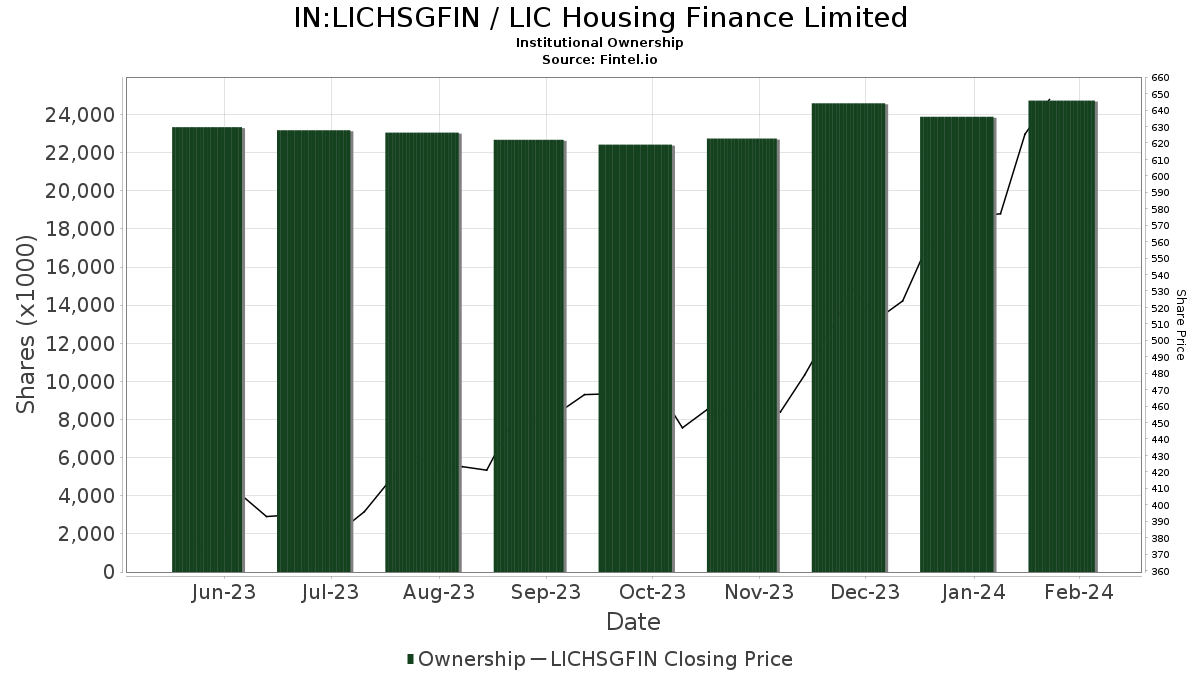

Gauging Fund Sentiment

The tide is turning in LIC Housing Finance’s favor with 61 funds or institutions now vested in its progress, signifying a notable surge of 32.61% in the last quarter. The mean portfolio allocation across all funds dedicated to LICHSGFIN now stands at 0.16%, marking a considerable uptick of 23.55%. Noteworthy, institutions have collectively bolstered their stake by 11.19% over the past three months, amounting to 25,638K shares.

Insight into Shareholder Actions

VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares stands strong with 4,236K shares, representing a solid 0.77% stake in the company. Impressively, the firm has recently pumped up its portfolio allocation in LICHSGFIN by 18.92% over the last quarter, showcasing growing confidence in the entity’s prowess.

The robust support extends to VGTSX – Vanguard Total International Stock Index Fund Investor Shares and IEMG – iShares Core MSCI Emerging Markets ETF, with both institutions emboldening their faith through increased portfolio allocation despite slight decreases in share holdings. These strategic moves underscore a prevailing sense of optimism surrounding LIC Housing Finance’s trajectory.

Fintel stands as an unrivaled beacon, illuminating the path for individual investors, traders, financial advisors, and small hedge funds alike. With a vast array of resources covering fundamentals, analyst reports, ownership data, and fund sentiment, Fintel paves the way for informed decision-making in the financial realm.

Join the league of informed investors and discover exclusive stock picks fueled by advanced quantitative models that promise enhanced profitability.

This insightful update originally emerged on Fintel, rewriting the narrative of optimism and triumph for LIC Housing Finance.

The thoughts and opinions conveyed here signify the author’s perspective and do not necessarily echo the sentiments of Nasdaq, Inc.