Brace yourselves investors, for Lifenet Insurance (TSE:7157) has boldly upped its average one-year price target to a staggering 1,394.00 per share. This represents a robust surge of 10.81% from the previous estimate of 1,258.00, dated back to January 16, 2024.

This price target amalgamates the forecasts from numerous analysts. The most recent targets range from a conservative low of 1,010.00 to an ambitious high of 1,680.00 per share. The average price target signifies a notable 1.16% hike from the latest closing price of 1,378.00 per share.

Unlocking the Fund Sentiment

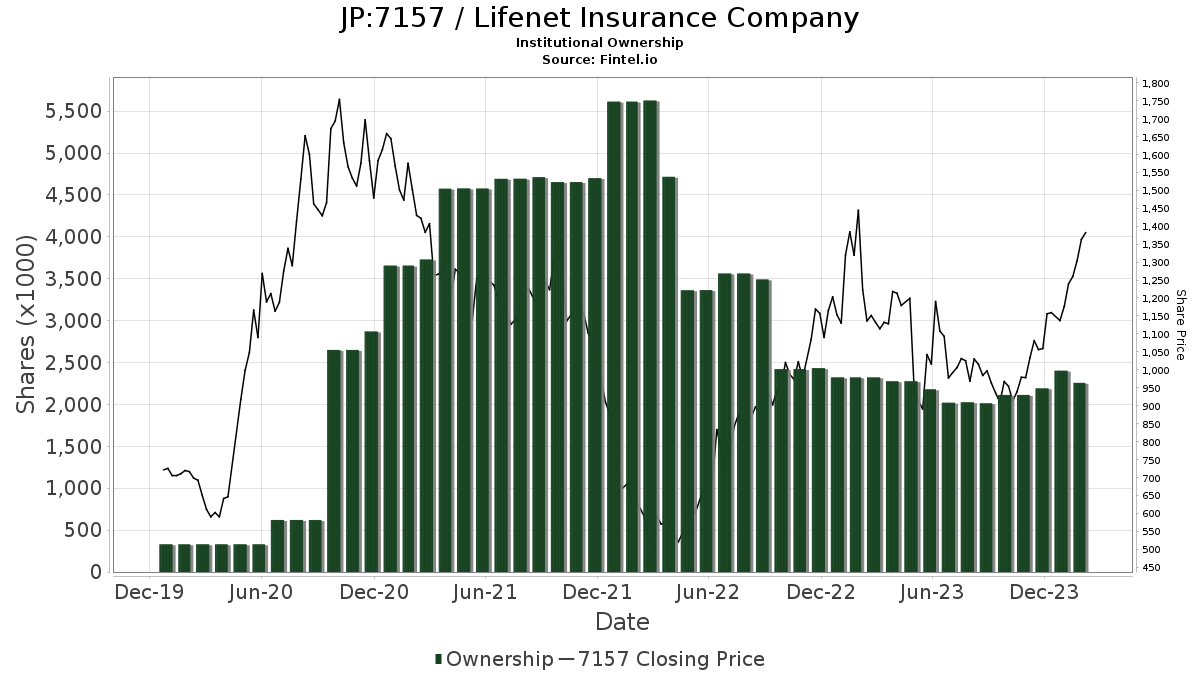

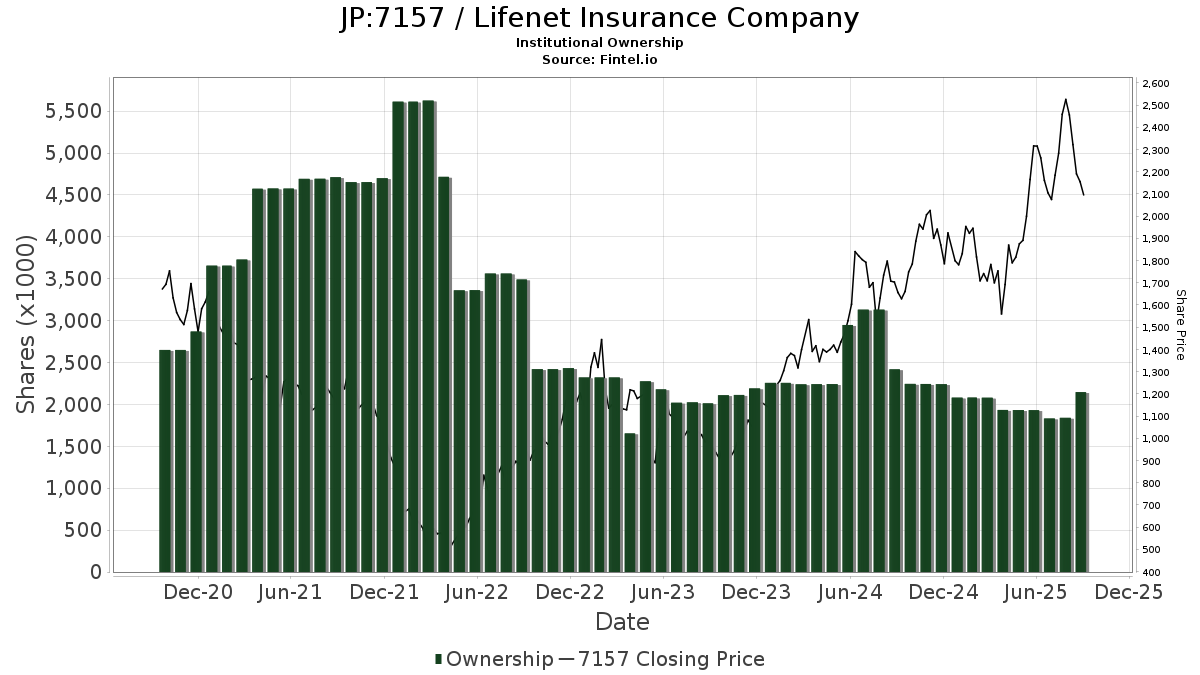

Sit tight, for there are 25 funds or institutions now showcasing their stake in Lifenet Insurance. A notable surge of 11 owners or 78.57% in the last quarter alone. The average portfolio weight of all funds dedicated to 7157 now stands at 0.06%, reflecting a decrease of 51.84%. The total number of shares owned by these institutions has surged by a solid 6.70% in the last three months, now resting at 2,257K shares.

Tracking the Shareholder Realm

FJPNX – Fidelity Japan Fund proudly holds 454K shares, signifying 0.57% ownership of the illustrious company. No alterations have been made in this impressive feat in the last quarter.

FPBFX – Fidelity Pacific Basin Fund grasps 370K shares, emblematic of 0.46% ownership within the company. No ripples in its hold during the last quarter.

FJSCX – Fidelity Japan Smaller Companies Fund secures possession of 358K shares, declaring 0.45% ownership of the coveted company. This unyielding stance has remained unaltered in the past quarter.

IEFA – iShares Core MSCI EAFE ETF boasts 298K shares, representing 0.37% ownership within the company. Steadfast in their position, they have maintained this stronghold in the last quarter.

SCZ – iShares MSCI EAFE Small-Cap ETF has a firm grip on 230K shares, claiming 0.29% ownership in the company. Compare this to the prior filing, where the firm reported ownership of 241K shares, showcasing a decrease of 4.82%. The firm significantly downgraded its portfolio allocation in 7157 by 0.50% over the previous quarter.

Fintel is a treasure trove of investing information, catering to individual investors, traders, financial advisors, and modest hedge funds.

Our data spans the globe, encompassing fundamentals, analyst reports, ownership data, and fund sentiment. We delve into options sentiment, insider trading, options flow, unusual options trades, and much more. Moreover, our exclusive stock picks are guided by refined, backtested quantitative models for optimized profits.

Click to Learn More

This piece was initially featured on Fintel.

The opinions and insights articulated herein are sole perspectives of the author and may not necessarily echo those of Nasdaq, Inc.