Limbach Holdings, Inc. (LMB) reported its first quarter 2025 earnings on May 5, 2025, exceeding the Zacks Consensus Estimate by $0.82, or 273.3%, with earnings of $1.12 compared to the estimate of $0.30. This marks the tenth consecutive earnings surprise for the company. Revenue increased by 11.9% to $133.1 million, up from $119 million a year ago, driven largely by a 21.7% growth in their higher margin Owner Direct Relationships (ODR) business, contributing 67.9% of total revenue.

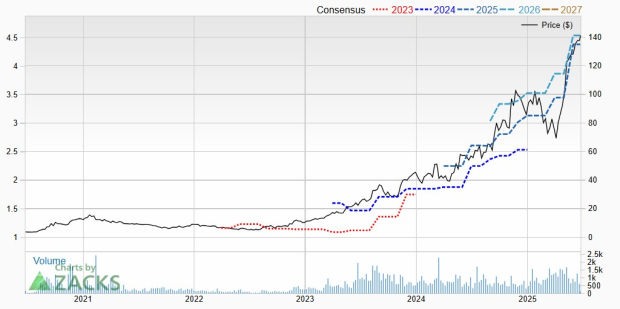

As of March 31, 2025, Limbach’s cash and cash equivalents stood at $38.1 million, with current assets of $204.5 million and current liabilities of $131.7 million, yielding a current ratio of 1.55x. Analysts have raised their earnings estimates for 2025 to $4.39 from $3.45, reflecting a projected growth of 21.9% from last year’s earnings of $3.60.

The company’s shares have recently rallied, benefiting from the strong growth in the mission-critical building systems solutions sector, alongside a forecasted earnings growth of 12% over the next 3 to 5 years.