The average yield of closed-end funds (CEFs) currently stands at 9.1%, making them an attractive investment option for those seeking financial independence. CEFs trade at discounts to their net asset value (NAV), providing opportunities for investors to purchase assets at lower prices. This trend has led to a heightened interest in high-quality CEFs, particularly those with strong track records.

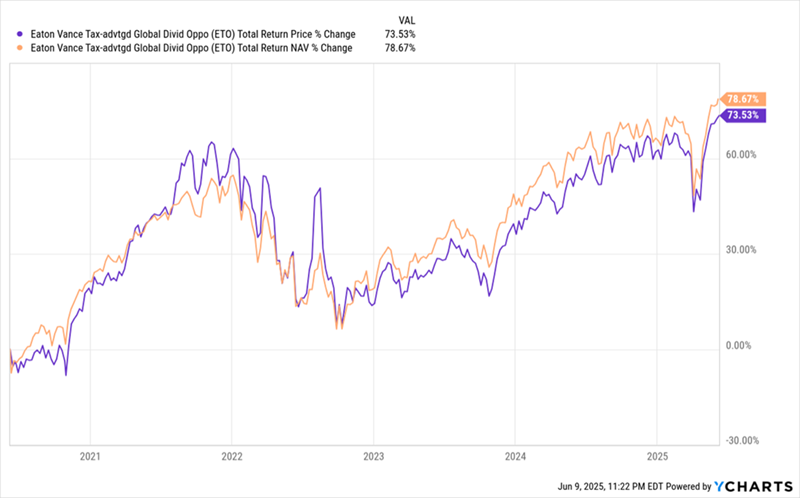

One example is the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (ETO), which has a 7.9% dividend and is trading at an 8.7% discount. Another noteworthy fund is the Eaton Vance Tax-Managed Buy-Write Income Fund (ETB), which yields 9.1% and holds major S&P 500 stocks, currently trading at a 7.8% discount. Additionally, the John Hancock Financial Opportunities Fund (BTO) offers a 7.5% yield and has an 18.4% annualized return, currently priced at a 5.5% premium.

Investors are focusing on these CEFs as the market continues to shift, with some funds seeing their discounts decrease, while others have room to grow. Overall, investors are encouraged to look into these opportunities for substantial income and potential price appreciation.