Lincoln Electric Holdings, Inc. (LECO) reported fourth-quarter 2023 adjusted earnings of $2.45 per share, surpassing the Zacks Consensus Estimate of $2.19. This impressive performance represented a 26.3% year-over-year rise and was fueled by strong demand, efficient cost management, and operational improvements. Investors responded with an 8% surge in the company’s shares on Feb 15, following the better-than-expected results.

Including one-time items, the bottom line amounted to $2.70 per share, compared with $1.87 in the year-ago quarter.

Total revenues reached a record $1.06 billion, marking a 13.7% year-over-year increase and surpassing the Zacks Consensus Estimate of $1.03 billion. This growth was driven by a 2.6% rise in organic sales and a 9.8% benefit from acquisitions. Additionally, foreign currency exchange had a positive impact of 1.3%.

Costs and Margins

The cost of goods sold rose 10.4% year over year to $688 million. Gross profit increased by 20.5% to $371 million, resulting in a gross margin of 35.1%, signifying a 200-basis point expansion compared to the year-ago quarter.

Selling, general and administrative expenses increased 15.1% year over year to $189 million. Furthermore, adjusted operating profit surged by 24% year over year to reach $182 million for the quarter. Hence, LECO achieved a record adjusted operating margin of 17.2%, up from 15.8% in the year-ago quarter.

Segment Performances

In the Americas Welding segment, total sales increased by 14.4% to $690 million compared to $603 million in the year-earlier quarter. The segment’s adjusted operating income amounted to $129.5 million, marking a significant rise from the $114 million reported in the year-ago quarter. Meanwhile, the International Welding segment’s revenues grew by 22% year over year to $304 million, with the segment reporting an adjusted operating profit of $43 million, a substantial increase from the $23 million in the year-ago quarter. The Harris Products Group posted fourth-quarter total sales of around $114 million, reflecting a slight year-over-year decrease of 2%, with adjusted operating profit at $15 million compared to $12 million in the year-ago quarter.

Cash Flow & Balance Sheet

Lincoln Electric closed 2023 with approximately $394 million in cash and cash equivalents, up from $197 million at the end of 2022. The company generated a record $668 million in cash flow from operations in 2023, representing a remarkable 74% year-over-year increase. Moreover, LECO returned $347 million to shareholders through dividends and share repurchases during the quarter. Additionally, the company’s debt to invested capital was 45.8% at the end of 2023, down from 53.8% at the end of 2022.

2023 Results

For the full year 2023, the company reported adjusted earnings of $9.41 per share, marking a 13.8% increase from the $8.27 reported in 2022. This outperformed the Zacks Consensus Estimate of $9.16 per share, setting a new record for the company’s performance. When including one-time items, earnings were $9.37 per share for the year, compared to $8.04 in 2022. Total revenues also reached a record high of $4.19 billion, reflecting an 11% year-over-year increase and surpassing the Zacks Consensus Estimate of $4.16 billion. The company achieved 4% organic sales growth, with acquisitions contributing 7.4% to sales improvement, while foreign exchange added 0.1%.

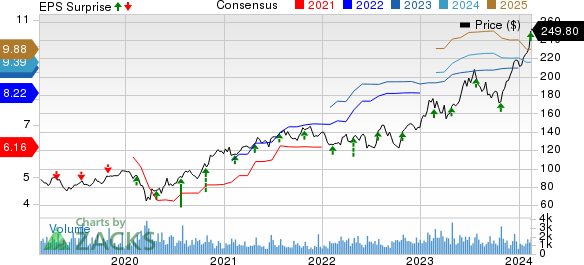

Price Performance

Lincoln Electric’s shares have surged by 43.3% in the past year, outperforming the industry’s 16.1% growth.