Live Nation: A Steady Climb Amid Mixed Earnings

Company Overview and Performance Highlights

With a market cap of $29 billion, Live Nation Entertainment, Inc. (LYV) is a leading force in the live entertainment sector. Headquartered in Beverly Hills, California, the company specializes in concert promotion, ticketing, and sponsorship. Its operations are categorized into three key segments: Concerts; Ticketing; and Sponsorship & Advertising, allowing it to manage venues and promote events across the globe.

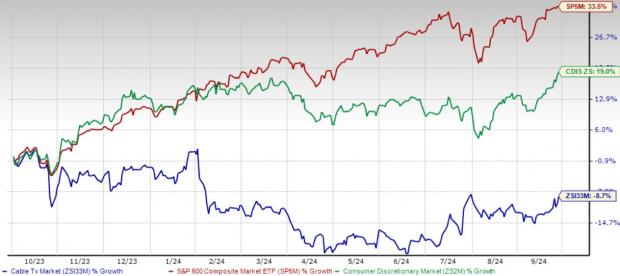

Strong Stock Performance Compared to Market

Over the past year, shares of the Ticketmaster parent have outperformed the broader market. LYV has risen 45.6% compared to a 36.3% gain for the S&P 500 Index ($SPX). Year-to-date in 2024, LYV has gained 33.9%, while the SPX has increased by 25.1%.

In a more focused comparison, LYV has also surpassed the Communication Services Select Sector SPDR ETF Fund’s (XLC) 42.2% return over the last 52 weeks and 32.5% on a year-to-date basis.

Recent Earnings Report and Investor Sentiment

On July 30, Live Nation reported Q2 revenue of $6 billion, which fell short of expectations. Despite this, shares increased by 1.7% the following day. A 21% rise in adjusted operating income and a record margin of 5.4% for Q2 significantly contributed to this growth. Management expressed an optimistic outlook, anticipating strong demand for live events, increased fan spending, and fewer cancellations. Plans to establish 14 new venues and strengthen sponsorships further restored investor confidence for continued growth into 2024 and 2025.

Future Earnings Predictions

Looking ahead, analysts predict that LYV’s earnings per share (EPS) will decline by 15.3% year-over-year, settling at $1.16 for the fiscal year ending in December. The company’s earnings surprises have been mixed, achieving above-consensus estimates in two of the last four quarters while falling short in the other two.

Analyst Ratings and Price Target Insights

The consensus rating among 19 analysts covering the stock is a “Strong Buy,” supported by 17 “Strong Buy” ratings, one “Moderate Buy,” and one “Hold.” This sentiment is slightly more positive than three months ago when the company garnered 16 “Strong Buy” ratings.

On Oct. 24, analyst David Karnovsky from JPMorgan raised LYV’s price target to $137 and kept an “Overweight” rating. This adjustment highlights the company’s new focus on venue development, potentially boosting high-margin revenue and cash flow growth, especially with favorable developments in the Department of Justice lawsuit.

Currently, LYV trades below the average price target of $127.50. The highest target on Wall Street at $140 suggests a potential upside of 11.9% from its current trading levels.

More Stock Market News from Barchart

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.