The New Price Target

On January 16, 2024, the one-year price target for LOG Commercial Properties e Participações (BOVESPA:LOGG3) took a hit, decreasing by 10.63% to 26.74 / share. This revision reflects a sharp decline from the previous estimate of 29.92.

Analysts collectively crunch numbers to formulate this price target, providing a range extending from a modest 19.70 to a bullish 36.75 / share. The average target depicts a potential gain of 28.12% when compared against the latest closing price of 20.87 / share.

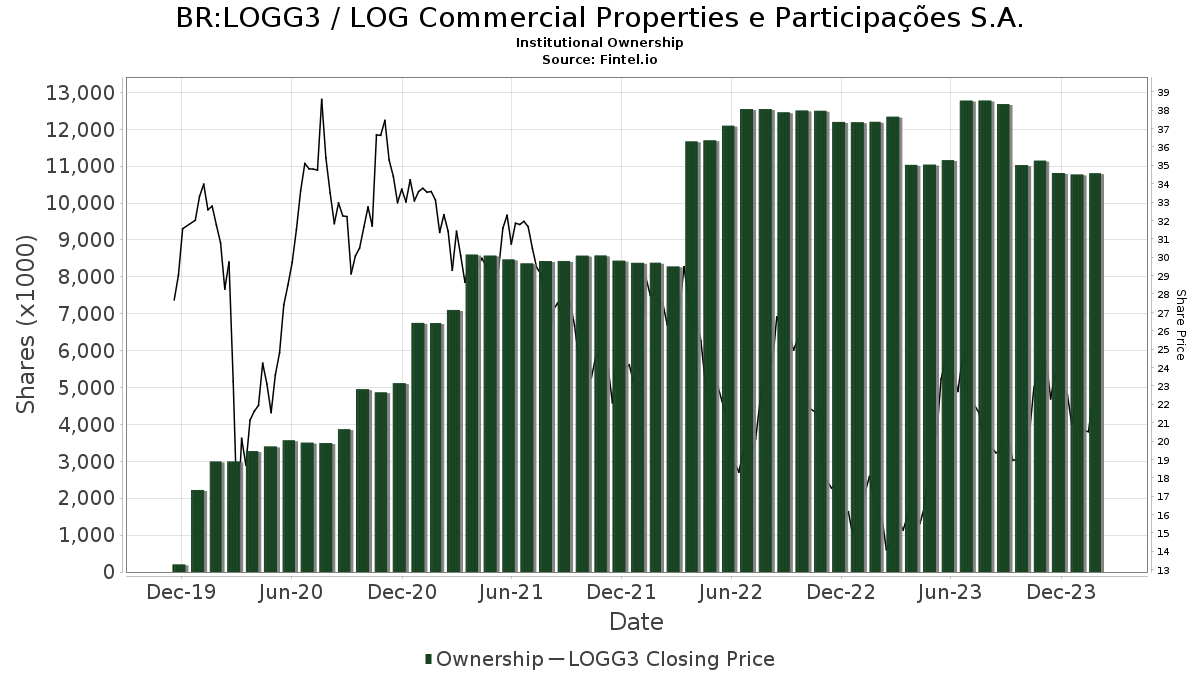

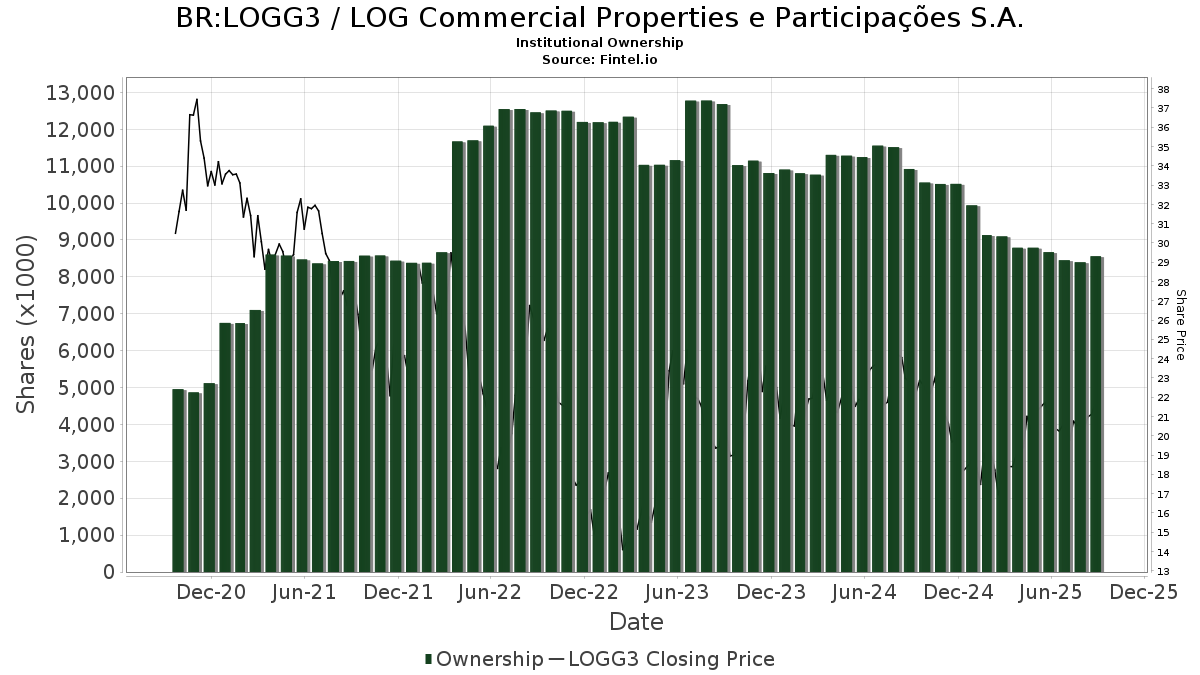

Diving into Fund Sentiment

Tracking the pulse of investor sentiment, 42 funds or institutions are holding positions in LOG Commercial Properties e Participações. This marks a 7.69% increase with 3 additional owners surfacing in the last quarter. Collectively, institutions have upped their ante, with the average portfolio weight dedicated to LOGG3 climbing by 8.61% to reach 0.18%. However, the total shares owned by these institutions saw a decline of 3.11% in the past three months, settling at 10,802K shares.

Insights from Other Shareholders

Shedding light on specific shareholders, FEMSX – Fidelity Series Emerging Markets Opportunities Fund holds 2,606K shares, translating to 2.60% ownership of the company. A stark shift from its prior ownership, the fund reported a substantial 35.34% decrease, indicating a significant adjustment in its portfolio allocation towards LOGG3.

In a contrasting stance, FEDDX – Fidelity Emerging Markets Discovery Fund acquired 2,519K shares, securing a 2.51% ownership. Demonstrating a contrasting behavior, the fund expanded its position by 25.20% in the last quarter, indicating a bullish sentiment towards LOGG3.

Meanwhile, IEMG – iShares Core MSCI Emerging Markets ETF maintains its existing stake of 750K shares, representing 0.75% ownership, indicating a stable stance on its part. Similarly, VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares holds its ground with 620K shares, marking a 0.62% ownership, staying put in the last quarter as well.

Additionally, VGTSX – Vanguard Total International Stock Index Fund Investor Shares owns 590K shares, representing 0.59% ownership, showing no change in its position in the last quarter.

Fintel serves as a robust investing research platform accessible to various players in the financial landscape, from individual investors to small hedge funds. Our extensive database spans the globe, encompassing fundamental data, analyst reports, ownership insights, and fund sentiment analysis, among other critical information. For investors seeking a competitive edge, our exclusive stock picks, driven by cutting-edge quantitative models, aim to enhance profit potential.

Click to uncover more insights at Fintel.

This narrative was originally published on Fintel.

The thoughts and perspectives shared here represent the author’s own viewpoints and do not necessarily mirror those of Nasdaq, Inc.