Embracing Volatility in a Seemingly Unstoppable Bull Market

The VIX Index, closing at 14.33, showcases a market environment where volatility is at bay, leading to a decline in option prices. In such times, the Long Straddle Screener comes into play, offering a nuanced approach for traders looking to capitalize on significant market movements and potential upticks in implied volatility.

The Long Straddle Demystified

A long straddle involves the simultaneous purchase of a call and a put option with identical conditions: the same underlying stock, expiration date, and strike price. However, this strategy requires traders to fork out two premiums upfront, representing the maximum potential loss.

Exploring Profit Potential and Risk Factors

Theoretically, the profit margin in a long straddle is infinite, contingent upon substantial market shifts. Yet, without such movements, the trade may suffer daily losses due to time decay. Success hinges on the underlying stock surpassing the upper break-even point or plummeting below the lower break-even point.

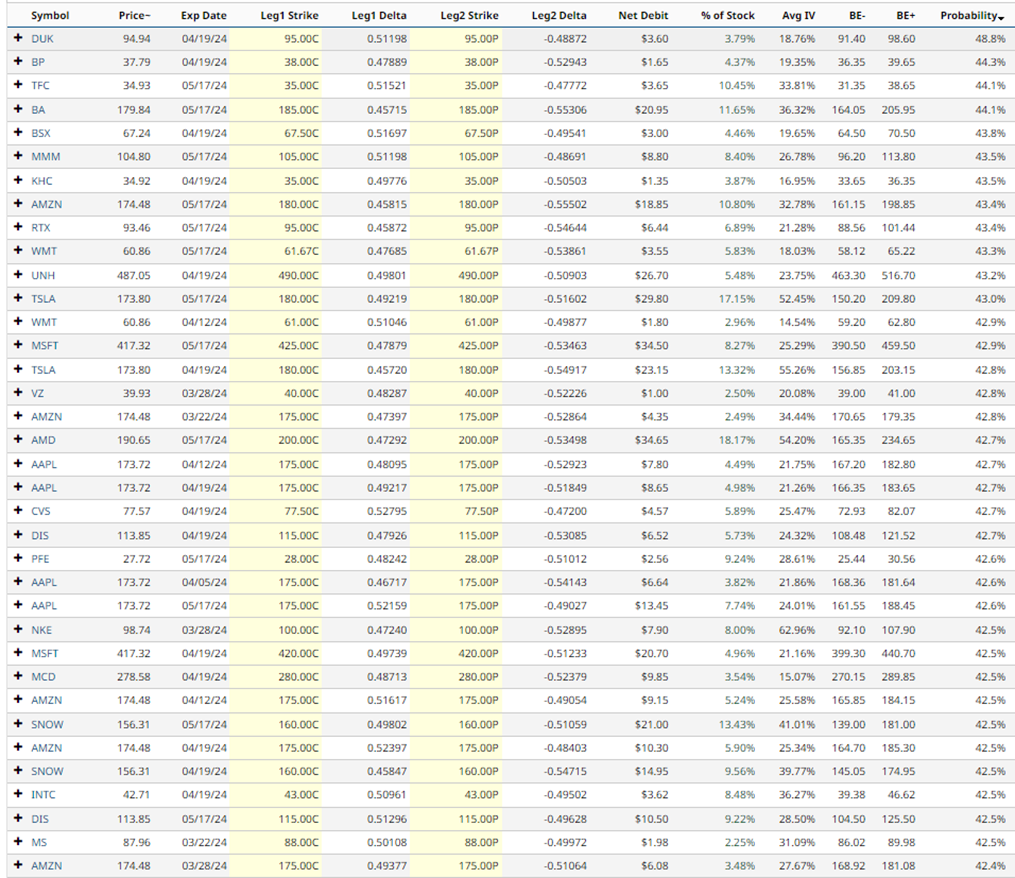

Assessing the Long Straddle Screener Results

The screener has unearthed intriguing long straddle opportunities on marquee stocks like DUK, BA, MMM, AMZN, RTX, WMT, UNH, and TSLA. Let’s delve into a couple of these prospects.

DUK Long Straddle Analysis

Examining a long straddle on DUK with an April 19th expiry reveals a $95-strike call and put purchase. This trade incurring a $360 premium equals the maximum loss, with unlimited profit potential. The venture boasts a 48.8% estimated success probability, while the Barchart Technical Opinion signals a bullish stance with an Average short-term outlook.

BA Long Straddle Evaluation

Turning to a long straddle opportunity on BA with a May 17th expiry, involving a $185-strike call and put purchase, highlights a $2,095 premium outlay as the maximum loss. Amid a 44.1% estimated success probability, the Barchart rating reflects an 88% Sell, signaling a Strengthening short-term outlook.

WMT Long Straddle Examination

Exploring a long straddle option on WMT expiring on May 17th portrays a $61.67-strike call and put pairing, carrying a $355 premium expense as the maximum loss. With a 43.3% estimated success probability, the Barchart rating leans toward a 100% Buy, indicating a Strengthening short-term outlook.

Navigating Risks with Long Straddles

It is critical to exercise caution with long straddles, given the potential for swift losses in stagnant markets or declining implied volatility. Mitigating risk involves prudent position sizing to prevent disproportionate portfolio losses, along with a recommended 20-30% stop loss rule.

Parting Words

Long straddle strategies offer a tantalizing glimpse into market dynamics, but they come with inherent risks. As with any investments, diligence, and expert advice are paramount. Remember, the market is a fickle friend, embracing risk and reward in equal measure.