Consider These Growth Stocks Instead of Amazon Right Now

There’s no denying it: Amazon (NASDAQ: AMZN) has been one of the market’s most rewarding stocks of the modern era, gaining more than 270,000% since its initial public offering in 1997. The company continues to flourish, capitalizing not just on its dominance in the growing e-commerce sector, but also on its significant presence in cloud computing. Analysts project that both this year’s and next year’s revenues will increase by around 10%, with earnings expected to grow even faster.

Wondering where to invest $1,000 now? Our analyst team has identified the 10 best stocks to buy. Learn More »

However, seasoned investors know that nothing lasts forever. Stocks that are market favorites today can quickly become disappointments, especially as their size often becomes a liability. This could become a reality for Amazon.

In light of this, investors seeking the “next big thing” should consider two other growth stocks instead of Amazon. Let’s explore each one further.

1. Uber Technologies

For those monitoring Uber Technologies (NYSE: UBER), the fourth-quarter results were disappointing. Although the company beat revenue expectations, its operating income did not meet forecasts. Additionally, guidance for the current quarter has raised concerns, particularly about the potential impact of robotaxis on its business. This uncertainty contributed to a drop in Uber’s stock prices following the release of the report in early February.

Despite the initial decline, Uber’s share price rebounded and even surpassed its pre-report valuation. The reason for this resilience is that Uber is part of a larger shift in how people view automobile ownership.

As vehicle ownership declines, many individuals prefer ride-hailing services over personal cars. Car-sharing service Zipcar estimates that by 2030, around one-third of current car owners in the U.S. may decide to forgo ownership, primarily due to cost and convenience. Moreover, the Federal Highway Administration indicates that less than 40% of U.S. teenagers have a driver’s license today, compared to two-thirds of teens 30 years ago, reflecting similar trends.

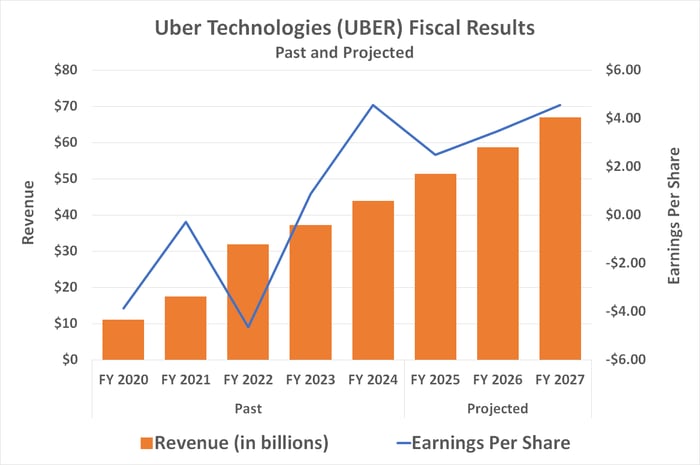

This generational shift may lead to continued growth in ride-hailing demand. Research from Straits Research anticipates an annualized growth rate of over 11% in the ride-hailing market through 2032. Analysts expect Uber’s sales growth will exceed this rate at least until 2027, reaffirming its leadership position in the U.S. aspect of the global ride-hailing market.

Data source: StockAnalysis.com. Chart by author.

Concerns about robotaxis are valid, but the technology is still developing. Years could pass before it poses a significant threat to Uber’s business model. In fact, Uber appears to be embracing this shift; recently, they announced an initiative in Austin, Texas, to offer rides with Alphabet‘s Waymo self-driving technology.

2. SoFi Technologies

The second compelling stock to consider is SoFi Technologies (NASDAQ: SOFI). Known as an online bank, SoFi offers a wide range of services that include checking accounts, investment options, loans, insurance, and credit cards—something that sets it apart from traditional banks.

While many banks have adopted online services, SoFi is fully focused on the digital experience. A survey by the American Bankers Association revealed that 55% of bank customers prefer mobile apps for banking transactions, compared to just 22% preferring online interfaces. Only 8% of respondents favored in-branch visits, and 4% preferred phone calls.

SoFi is adapting to this shift in consumer preferences and its customer growth reflects that trend.

Data source: SoFi Technologies Q4-2024 earnings call deck.

This industry migration is expected to persist, particularly among younger demographics. Gen Z and millennials show a strong preference for mobile banking apps, with 64% and 68%, respectively, indicating a desire for digital services.

The growth potential for SoFi is considerable; the company currently services about 10.1 million customers across nearly 14.8 million products. Given the United States’ population of 340 million, this suggests substantial market opportunities remain. Furthermore, SoFi can enhance growth prospects by deepening its relationships with existing customers and offering them more products.

In summary, both Uber Technologies and SoFi Technologies present promising growth trajectories that may be more attractive alternatives to investing in Amazon.

Global Online Banking Set to Grow Nearly 14% by 2030

The global online banking sector is projected to experience an average growth rate of nearly 14% through 2030. Notably, the North American market, where SoFi operates, is expected to remain the largest region throughout this period.

Should You Invest $1,000 in Uber Technologies Right Now?

Before deciding to purchase Uber Technologies stock, it’s essential to evaluate the situation:

The Motley Fool Stock Advisor analyst team recently identified their selection of the 10 best stocks that investors should consider now. Unfortunately, Uber Technologies did not make this list. The stocks included have strong potential for impressive returns in the coming years.

For context, consider how Nvidia was featured on this list back on April 15, 2005. If you had invested $1,000 at the time of their recommendation, your investment would be worth approximately $690,624 today!*

The Stock Advisor offers investors a straightforward approach to achieving success. The service includes portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since its inception in 2002, the Stock Advisor has outperformed the S&P 500 by more than four times.* Don’t miss out on the latest top 10 list available to members of Stock Advisor.

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. James Brumley has positions in Alphabet. The Motley Fool owns shares in and recommends Alphabet, Amazon, and Uber Technologies. The Motley Fool follows a disclosure policy.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.