Analyzing the Current Market Landscape

The objective of this write-up is to take a step back and assess the broader market conditions, seeking out potential investments that offer relative value compared to the S&P 500 (or NASDAQ 100). The current dominance of the “Mag 7” in driving market gains has led to a scenario where US indices are heavily concentrated and top-heavy. While this trend has certainly rewarded investors, it raises concerns about the sustainability of these gains. Looking back from January 2024, the lack of diversification might appear imprudent if the current euphoria wanes.

With this backdrop, I find myself contemplating a more balanced portfolio as we head into the new year. Given my overexposure to the US market, particularly large-cap US names, I am exploring avenues to maintain overall balance. In this review, I will delve into three areas that I am considering for investment in Q1 to achieve this equilibrium.

Europe: Unearthing Promise Amidst Economic Challenges

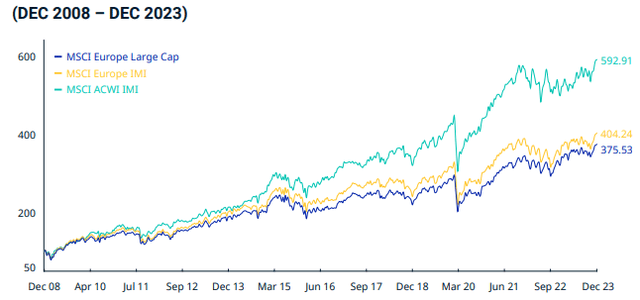

One area that stands out for potential value within developed markets is Europe. Initially, I held reservations about this region due to concerns surrounding inflation, sluggish growth, and geopolitical risks stemming from the Russia-Ukraine conflict. However, despite my reservations, European equities have defied these headwinds and delivered robust gains, especially in the short term:

The performance of European equities has been impressive over the long term, rebounding strongly from the lows witnessed during the pandemic. However, when compared to the S&P 500, their relative valuations have significantly widened.

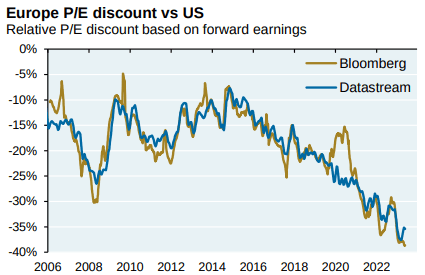

This brings me to a key rationale for considering European investments at the present juncture. Based on forward earnings estimates, European markets appear remarkably undervalued in comparison to the US for large-cap holdings:

While being “cheaper” does not guarantee immediate gains, it does serve to mitigate downside risk in my perspective. Furthermore, there are a couple of factors that underpin the attractiveness of this scenario.

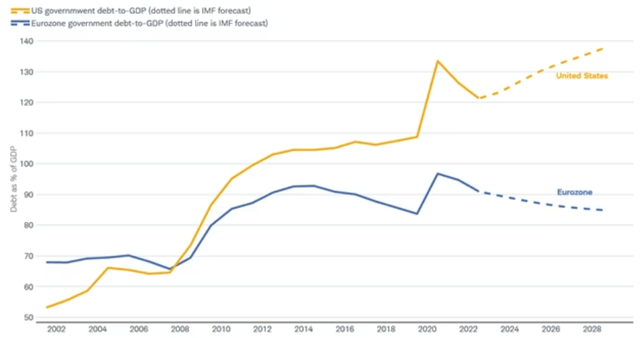

Firstly, the EU-zone is not expected to grapple with the same debt challenges that the US will face. The US continues to struggle with escalating borrowing and spending, leading to ballooning deficits. In contrast, Europe appears poised for a decline in its debt-to-GDP ratio moving forward:

This divergence suggests that the Eurozone may not encounter the same level of fiscal headwinds as the US, offering greater flexibility to its central bank and individual country governments. It also alleviates some of the uncertainty surrounding US budgetary discussions in the months and years ahead. While this divergence may not bode well for American citizens, it does underscore the case for diversifying into European markets.

Secondly, the containment of the Russia-Ukraine conflict within Ukraine adds to the appeal of investing in central and northern Europe. The resistance to the escalation of the conflict into wider geopolitical turmoil has kept corporate earnings in these regions relatively insulated from the associated risks. This has prompted me to reconsider European equities as a viable investment option after having sidelined them for a considerable period.

I view large-cap European equities as a diversified group that offers multiple avenues for investment. For more passive and conservative investors, two recommended large-cap funds are the iShares Europe ETF (IEV) and the SPDR Euro Stoxx 50 ETF (FEZ).

Municipal Bonds: Capitalizing on Stability and Attractive Yields

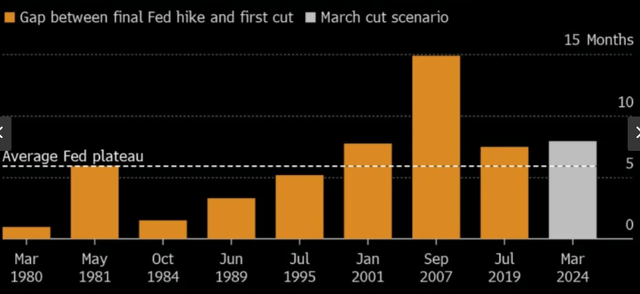

Another area demonstrating potential value is within the fixed-income segment of the market. This asset class has witnessed a rally since Q4 on the back of a pause in Fed tightening and the anticipation of rate cuts in 2024. There is merit to this outlook, as historical patterns indicate that the Fed typically initiates rate cuts within 3 to 7 months after its last rate hike. By March 2024, the Fed’s tightening cycle will have surpassed the historical average duration, potentially setting the stage for a cut by mid-year in my assessment:

This has driven increased demand for bonds, with investors positioning themselves ahead of anticipated rate cuts. The resultant rise in bond prices has further supported the attractiveness of municipal bonds in current market conditions.

Investment Opportunities to Seize in 2024

Amidst the unpredictable dance of market fluctuations, investors are always on the lookout for the next big opportunity. To gain an edge, many are positioning themselves to profit from potentially rising bond prices in the coming year. This strategic pursuit is not unlike attempting to navigate a bustling marketplace to secure a bargain that could yield substantial returns in the future.

Municipal Bond Market: A Looming Opportunity for Savvy Investors

The municipal bond market is currently creating a buzz among investors, with its allure heightened by the anticipation of overall falling rates. Astute individuals, especially those in higher tax brackets, are eyeing this terrain as a promising route to secure higher tax-adjusted yields. The attractiveness of these tax-exempt securities is undeniably appealing, but it’s vital for investors to consider their personal financial circumstance before delving into this domain.

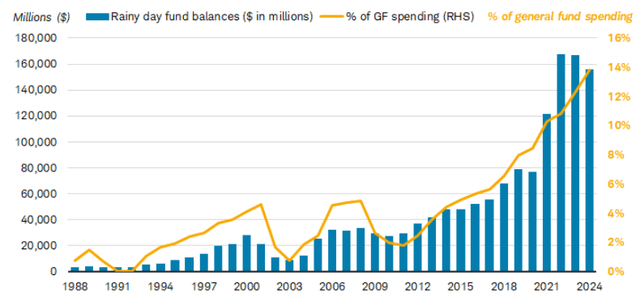

Delving deeper, the robust state finances underpinning the General Obligation (GO) municipal bonds add an extra layer of confidence for potential investors. Following frugal spending and bolstered tax collections, coupled with federal stimulus, states now boast substantial “rainy day” reserves. Though there may be pessimistic mutterings in the press regarding imminent budgetary concerns, the broader picture reveals that most states are standing firm on solid financial ground as they enter the year 2024.

This clarity underscores that local and state governments are far from the brink of major defaults, with ample reserves at their disposal to meet their obligations. Moreover, the robust fiscal position permits these entities to access the municipal market for new issuances at reasonable yields, thereby fortifying the quality of these assets.

Venturing further down the credit quality ladder, the high yield muni sector presents obvious relative value for investors seeking a higher income stream. While it does carry more risk, the promising historical performance of this area offers an enticing proposition. When juxtaposed with high yield corporates, the risk-adjusted yield for junk-rated munis emerges favorably – and when factoring in the potential tax savings, the appeal becomes increasingly irresistible.

With numerous ETFs and CEFs to navigate this domain, a cautious approach is advisable, particularly concerning leveraged CEFs given the inverted nature of the yield curve. Notwithstanding this, the VanEck High Yield Muni ETF (HYD) stands out to me as an appealing vehicle to augment my portfolio’s yield.

Energy Sector: A Realm of Value and Resilience

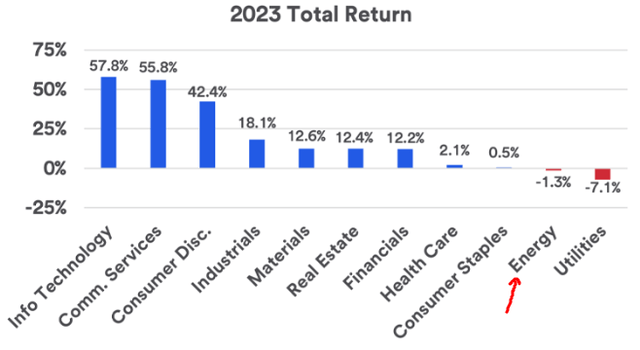

In the realm of energy, particularly oil and gas, a compelling narrative is unfurling as we step into 2024. After a strong showing in 2022, the sector faced some stumbling blocks in 2023, resulting in a lackluster performance. Impressively, this fortitude remained consistent even as the market saw dwindling returns within selective sectors, with Energy and Utilities being the only two in negative territory.

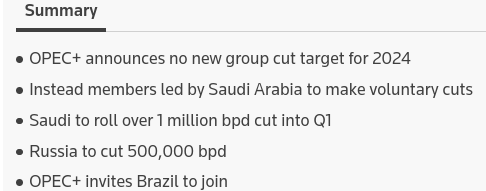

Gazing into the horizon, abundant reasons emerge, painting the Energy sector as a compelling opportunity. Notably, while US oil production has surged, OPEC+ has countered this trend by implementing production cuts. This strategic stance could serve as a prolonged tailwind for oil prices, particularly as the market currently seems to be underestimating the true valuation of crude. The efforts of OPEC+ in the latter part of the preceding year reveal their concerted action in this direction.

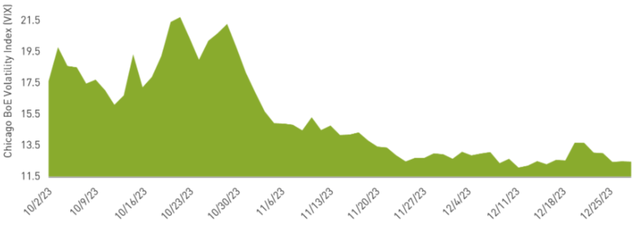

This collective resolve could potentially propel crude prices forward, bearing favorable implications for the Energy sector at large. Furthermore, amidst an unnervingly serene marketplace, concerns of an overly complacent market surface as a pertinent issue. Prolonged tranquility often precedes upheaval, making commodities such as crude oil, gold, and other metals potential hedges against unwarranted volatility. The nagging question of whether the market is too serene for its own good prompts contemplation.

In the context of a subdued market backdrop, the present juncture may be opportune to commence or bolster positions. With market calmness prevailing and oil prices relatively subdued, the depth of the market’s confidence in OPEC+ actions hangs in the balance. Recognition of oil’s inherent volatility, and by extension that of the Energy sector, underscores the heightened significance of timing in this cyclical arena. From where I stand, the timing appears ripe for action.

Passive ETFs present a compelling mode of entry into this niche. Personally, I have vested my confidence in the Vanguard Energy ETF (VDE) and the Invesco S&P 500 Equal Weight Energy ETF (RSPG) to cater to my portfolio’s nuanced needs.

Concluding Remarks: The Road Ahead

As the investment landscape unfolds amidst the ebbs and flows, it remains imperative for prudent investors to discern the entrancing offerings from the hollow facades. The exuberance of the new year has undoubtedly infused vigor into the equity market, with the “Mag 7” continuing to dominate proceedings. As an ardent net-long equity investor, the ride thus far has been gratifying, and yet, the need to judiciously deploy fresh capital persists.

In this lens, three compelling domains beckon for investors – the municipal bond market, High Yield munis in particular, and the intriguing world of the Energy sector. In these realms, the promise of relative value and substantial upside beckons, setting the stage for prudent capital deployment. As the year unfolds, the essence of this strategic pursuit is to thread the needle between prudence and ambition, and to extract value from the nuanced opportunities that abound in the market. I extend my heartfelt hopes that my insights prove valuable to fellow investors, and hereby wish everyone a fruitful and prosperous start to 2024.