Loop Capital Issues Buy Rating for Boise Cascade, Predicts Price Surge

Fintel reports that on November 1, 2024, Loop Capital started coverage of Boise Cascade (NYSE:BCC) recommending it as a Buy.

Analyst Price Forecast Indicates 9.14% Potential Increase

As of October 22, 2024, the average one-year price target for Boise Cascade stands at $146.47 per share. Predictions vary, with estimates ranging from a low of $128.27 to a high of $169.05. This average target suggests a rise of 9.14% from the most recent closing price of $134.21 per share.

For an overview of stocks with significant price target upsides, refer to our leaderboard.

Positive Revenue Growth Projected for Boise Cascade

The anticipated annual revenue for Boise Cascade is $7.663 billion, reflecting a 10.71% growth. Additionally, analysts project a non-GAAP EPS of 9.95.

Institutional Sentiment Remains Generally Strong

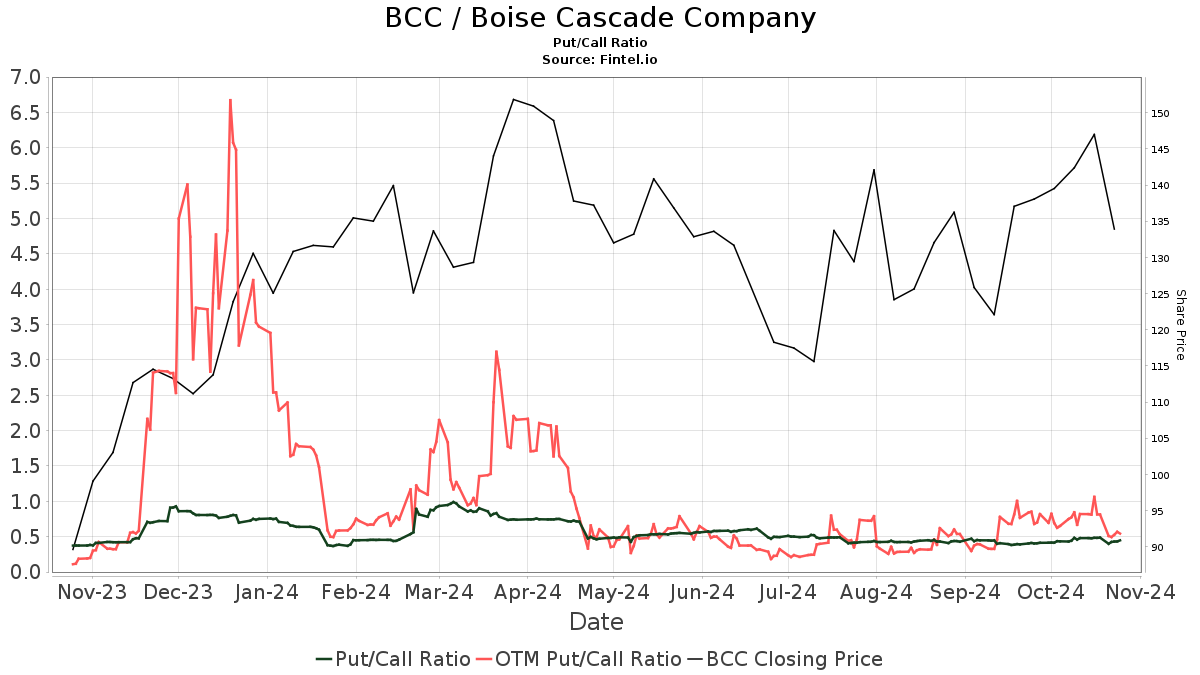

A total of 825 funds and institutions are currently reporting positions in Boise Cascade, which is a decline of six investors, or 0.72%, from the previous quarter. The average portfolio allocation of these funds dedicated to BCC slightly rose to 0.22%, an increase of 12.93%. Over the last three months, total institutional shares increased by 2.91% to 45.294 million shares.  The current put/call ratio for BCC is 0.47, which suggests sentiment is leaning bullish.

The current put/call ratio for BCC is 0.47, which suggests sentiment is leaning bullish.

Shifting Holdings Among Major Shareholders

Wellington Management Group LLP owns 2.72 million shares, equating to 6.99% of the company. This is an increase of 37.22% from their previous holding of 1.708 million shares. However, they decreased their portfolio allocation in BCC by 82.42% last quarter.

The iShares Core S&P Small-Cap ETF holds 2.553 million shares, representing 6.56% ownership. This marked a reduction of 4.85% from the 2.677 million shares held previously and a 23.00% decrease in portfolio allocation for the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares own 1.248 million shares, reflecting 3.21% of the company. This is a slight increase of 0.22% from the previously reported 1.245 million shares but shows a 24.24% decrease in allocation.

Pacer Advisors holds 1.239 million shares, 3.18% ownership. This is a drop of 4.34% from 1.293 million shares held earlier, resulting in a 26.56% decrease in allocation.

Finally, the Pacer US Small Cap Cash Cows 100 ETF holds 1.229 million shares, equating to 3.16% ownership, down from 1.368 million shares, which is an 11.32% decrease in holdings, reflecting an 8.91% decline in allocation.

Understanding Boise Cascade’s Position

(Description provided by Boise Cascade)

Boise Cascade Company specializes in high-quality wood products and maintains a national distribution network for building materials. The firm is well-equipped to deliver value to shareholders by balancing sustainability in social, environmental, and economic aspects. Their product offerings include engineered wood products, plywood, lumber, and particleboard, along with a diverse range of building materials.

Fintel serves as one of the most extensive investing research platforms for individual investors, traders, financial advisors, and small hedge funds.

The data spans globally and includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Unique stock picks are derived from advanced, backtested quantitative models designed to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.