Loop Capital Recommends Hold Rating on Qualcomm Amid Positive Outlook

On November 11, 2024, Loop Capital began its coverage of QUALCOMM (NasdaqGS:QCOM) with a Hold recommendation.

Analysts Predict a 31.06% Increase in Qualcomm’s Stock Price

As of October 21, 2024, analysts have set an average one-year price target for QUALCOMM at $214.15 per share. The price estimates range from a low of $161.60 to a high of $283.50, indicating a potential increase of 31.06% from the latest closing price of $163.39 per share.

QUALCOMM’s Revenue and EPS Forecasts

The expected annual revenue for QUALCOMM stands at $46,456 million, reflecting a growth rate of 19.23%. Additionally, the projected annual non-GAAP earnings per share (EPS) is estimated at 11.57.

Fund Sentiment Signals Increased Interest

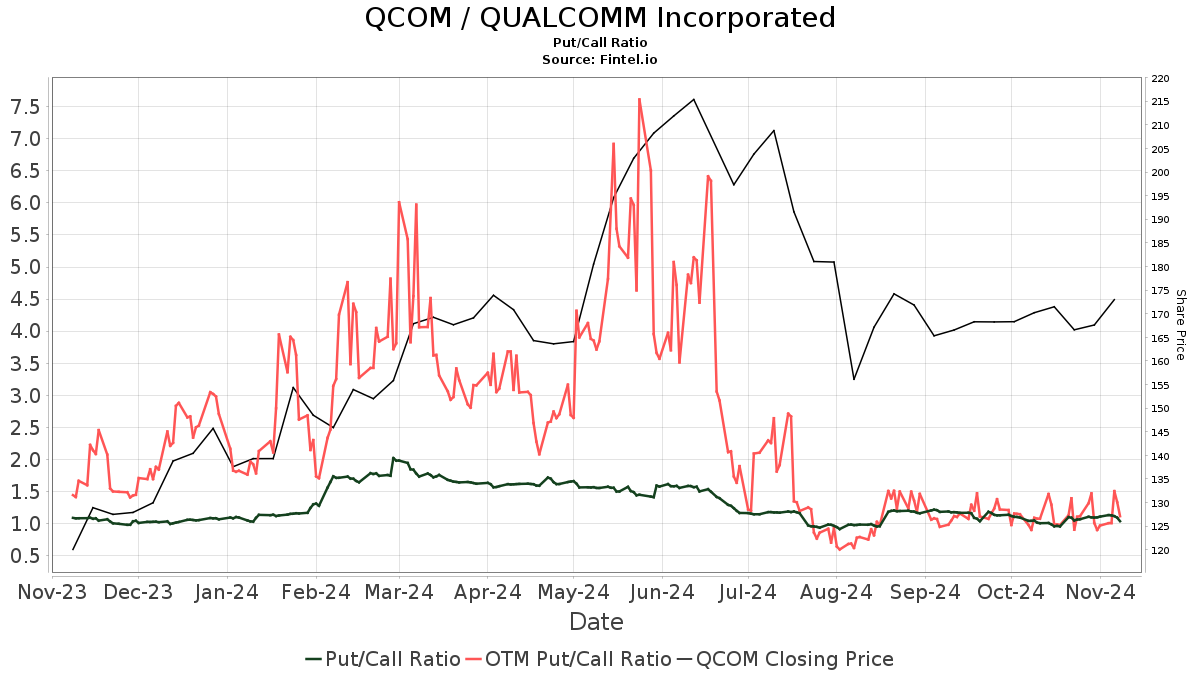

A total of 4,161 funds or institutions are currently reporting positions in QUALCOMM, an increase of 85 (or 2.09%) from the previous quarter. The average portfolio weight for these funds invested in QCOM is 0.65%, up by 2.23%. In the past three months, the total shares owned by institutions rose by 0.39%, reaching 950,664K shares. Interestingly, the put/call ratio for QCOM is 1.09, indicating a generally bearish sentiment.

Activity from Other Shareholders

Vanguard Total Stock Market Index Fund Investor Shares holds 35,262K shares, accounting for 3.17% ownership of QUALCOMM. This represents a slight increase from 35,071K shares previously reported, marking a growth of 0.54%. The fund has raised its portfolio allocation in QCOM by 15.03% over the last quarter.

Similarly, Vanguard 500 Index Fund Investor Shares holds 28,694K shares for a 2.58% ownership stake, up from 28,124K shares, a 1.99% increase, with a portfolio allocation hike of 13.63% in the last quarter.

Geode Capital Management possesses 27,128K shares, representing 2.44% ownership. From a previous holding of 25,139K shares, they saw a 7.33% increase but reduced their portfolio allocation by 55.49% over the same quarter.

Invesco QQQ Trust, Series 1 owns 21,494K shares (1.93% ownership), up from 20,919K shares, indicating a 2.68% increase and an 8.82% rise in their portfolio allocation. Norges Bank, which did not report any prior holdings, now owns 18,255K shares, marking a full 100% increase.

Understanding Qualcomm’s Role in Technology

Qualcomm Background Information

(This description is provided by the company.)

Qualcomm stands as a leader in wireless technology innovation and is significantly involved in the development and growth of 5G technology. The company has played a crucial role in the mobile revolution, enabling seamless communication across various devices and industries, such as automotive and the internet of things. Qualcomm operates through its licensing business, QTL, along with its subsidiaries, which focus on engineering, research and development, and semiconductor products.

Fintel is recognized as one of the most comprehensive investing research platforms for individual investors, traders, financial advisors, and small hedge funds.

This information encompasses global data, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, and more, to aid in investment decisions.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.