Loop Capital Installs ‘Buy’ Rating for AMD, Forecasting Significant Gains

Fintel reports that on January 14, 2025, Loop Capital began coverage of Advanced Micro Devices (NasdaqGS: AMD) with a Buy recommendation.

Analyst Price Predictions Show Strong Potential

As of December 23, 2024, the average one-year price target for Advanced Micro Devices stands at $185.86 per share. This prediction varies widely, with estimates ranging from a low of $146.45 to a high of $262.50. If true, the average price target reflects a 58.42% increase from its latest closing price of $117.32 per share.

Check out our leaderboard for companies with the largest price target upside.

Revenue Projections Indicate Strong Growth

The anticipated annual revenue for Advanced Micro Devices is $30,504 million, representing an increase of 25.56%. The expected non-GAAP earnings per share (EPS) is projected at 5.60.

Institutional Investment Trends

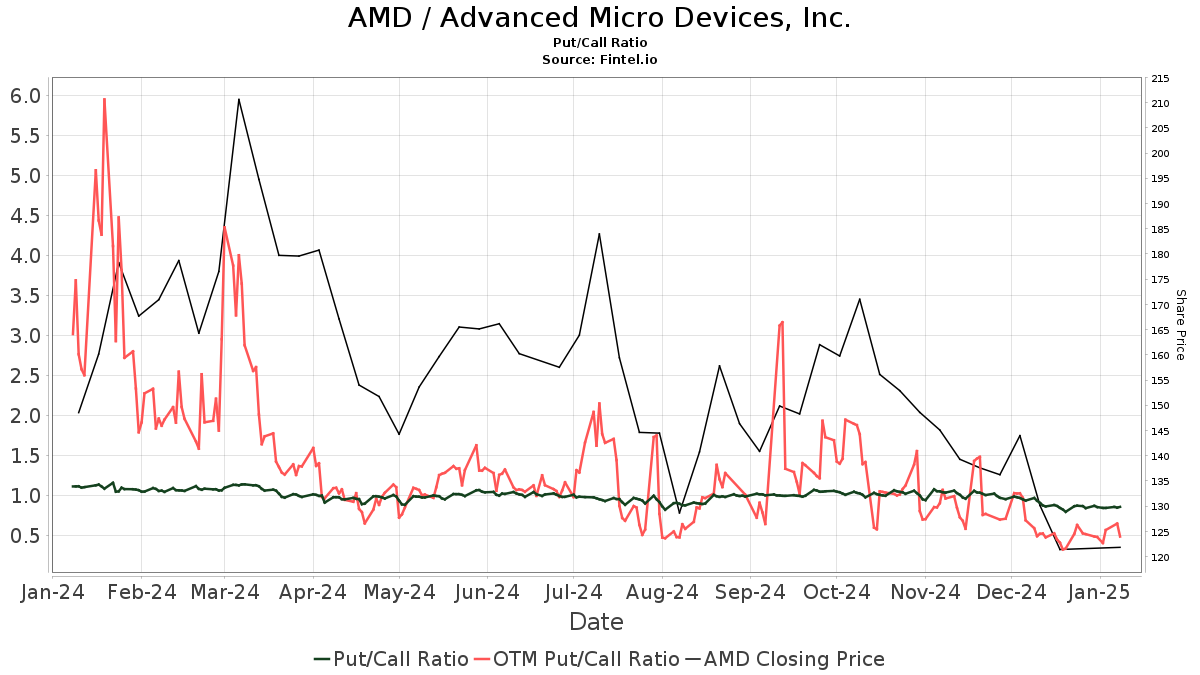

Currently, 3,834 funds or institutions hold positions in Advanced Micro Devices, with an increase of 33 investors, or 0.87%, in the last quarter. The average portfolio weight for all funds invested in AMD is now 0.59%, up 10.15%. Over the past three months, the total number of shares owned by institutions rose by 0.72%, totaling 1,224,613K shares.  The put/call ratio for AMD is 0.83, suggesting a bullish outlook among investors.

The put/call ratio for AMD is 0.83, suggesting a bullish outlook among investors.

Actions of Significant Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 51,307K shares, which represents 3.16% ownership of the company. In its previous filing, this firm reported ownership of 51,068K shares, reflecting a 0.47% increase. However, the firm’s portfolio allocation in AMD decreased by 4.55% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares has 42,388K shares, representing 2.61% ownership. This fund also saw an increase, from 41,484K shares, of 2.13%, yet decreased its portfolio allocation in AMD by 4.88% over the past quarter.

Price T Rowe Associates increased its stake in AMD significantly, now holding 35,308K shares, equating to 2.18% ownership, up from 20,117K shares – a remarkable 43.02% increase. The firm boosted its portfolio allocation in AMD by 70.81% during the last quarter.

Geode Capital Management holds 34,244K shares, representing 2.11% ownership, with a slight increase from 33,802K shares—a 1.29% rise. Nevertheless, this firm reduced its portfolio allocation in AMD by 5.53% in the last quarter.

Invesco QQQ Trust, Series 1 owns 31,432K shares, which accounts for 1.94% ownership. This reflects an increase from 31,130K shares, or 0.96%, but the firm reduced its portfolio allocation in AMD by 0.09% over the last quarter.

About Advanced Micro Devices

(This description is provided by the company.)

For over 50 years, AMD has been at the forefront of innovation in high-performance computing, graphics, and visualization technologies. These advancements serve as foundational elements for gaming and data centers. Daily, countless consumers, Fortune 500 companies, and advanced research facilities rely on AMD to enhance their work and leisure activities. Employees at AMD are dedicated to developing products that push the limits of technical possibilities.

Fintel is recognized as a comprehensive investing research platform catering to individual investors, traders, financial advisors, and smaller hedge funds.

We provide global data, including fundamentals, analyst reports, ownership data, and fund sentiment. Additionally, we offer insights into unusual options trades and more, utilizing sophisticated, backtested quantitative models to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.