**Predictions for the U.S. Economy and Markets in 2026**

Analyst Louis Navellier forecasts that the S&P 500 could reach anywhere between 7,000 and 8,100 by 2026, amidst expectations of at least two more interest rate cuts in the year ahead. The Federal Reserve is likely to loosen monetary policy, especially with anticipated changes in leadership as Jerome Powell’s term ends in May 2026. Kevin Hassett, a possible successor, has indicated that he would support actions to stimulate growth.

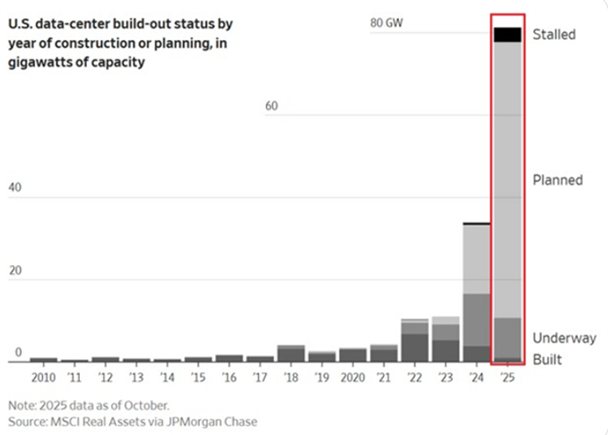

Navellier also predicts that U.S. GDP growth may accelerate to at least 5% in 2026, spurred by interest rate cuts, a booming data center industry, and increased domestic manufacturing. Nvidia Corp. is expected to play a significant role in the AI-driven economic shift, with projected revenue growth exceeding 65% year-over-year. Additionally, earnings momentum is gaining steam, with S&P 500 earnings forecasted to increase by 14.5% in the calendar year 2026.

However, Navellier warns of a “hidden crash,” where portfolios may appear diversified but are concentrated in a select group of mega-cap stocks, exposing investors to potential stagnation despite upward trends in headline indices. He emphasizes the need for careful stock selection in an increasingly selective market environment.