# Wall Street Reassesses Nvidia Amidst AI Challenges and Price Target Cuts

For over two years, artificial intelligence (AI) has captivated investors, demonstrating immense potential to reshape industries. This transformative technology can reason, act, and even learn without human input, suggesting vast opportunities ahead.

According to PwC’s Sizing the Prize, AI is projected to contribute $15.7 trillion to the global economy by 2030, driven by productivity enhancements and consumption effects. Among the early beneficiaries is semiconductor giant Nvidia (NASDAQ: NVDA).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

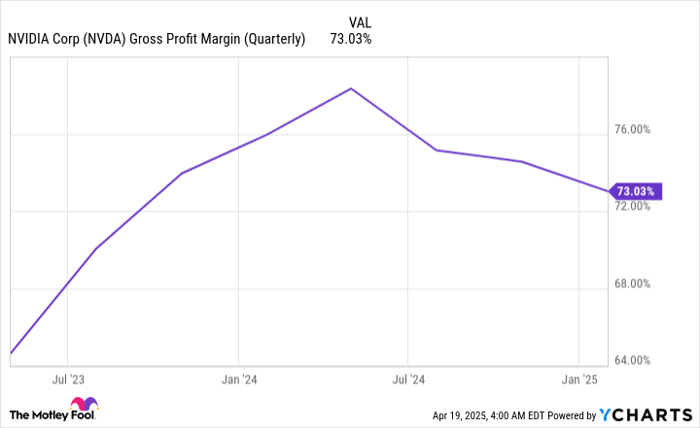

Recently, Nvidia’s Hopper (H100) graphics processing units (GPUs) and Blackwell GPU architecture have gained a significant share of the AI GPU market in high-performance data centers. Due to high demand and limited supply, Nvidia established strong pricing power, with a generally accepted accounting principles (GAAP) gross margin of 78.4% during its fiscal first quarter of 2025, which ended April 28, 2024.

However, just last week, pessimism among Wall Street analysts regarding Nvidia has increased, signaling possible challenges ahead.

Image source: Getty Images.

Analysts Adjust Nvidia’s Price Targets

Price targets set by Wall Street analysts serve as key indicators of their outlook for specific companies. Last week, eight analysts revised their price targets for Nvidia downwards:

- Gil Luria of D.A. Davidson reduced the target from $125 to $120.

- Vivek Arya of Bank of America Securities moved from $200 to $160.

- Harsh Kumar of Piper Sandler decreased his target from $175 to $150.

- Srini Pajjuri of Raymond James cut the target from $170 to $150.

- Timothy Arcuri of UBS lowered from $185 to $180.

- Kevin Cassidy of Rosenblatt revised down from $220 to $200.

- Chris Caso of Wolfe Research adjusted from $180 to $150.

- Jim Kelleher of Argus Research reduced the target from $175 to $150.

These revisions largely followed Nvidia’s April 15 regulatory filing, which disclosed a potential export hit of up to $5.5 billion related to its H20 chips heading to China. Nvidia indicated that it would require a special license to export this chip to the world’s second-largest economy.

Understanding this revelation requires context: for three years preceding Donald Trump’s presidency, the Biden administration had imposed restrictions on exporting AI-related chips and equipment to China. Notably, the A800 and H800 chips, created specifically for the Chinese market, were added to the restriction list under the Biden administration.

While some investors might view the price target cuts as a buying opportunity for Nvidia stock, there is a genuine possibility that we are witnessing the onset of broader adjustments in analysts’ projections for the company.

Nvidia’s Gross Margin Indicators

The decline in Nvidia’s GAAP gross margin signals the likelihood of more price target reductions. Nvidia had commanded prices exceeding $40,000 for its Hopper chip a year ago, resulting in a GAAP gross margin of 78.4%. However, this margin has since decreased:

- Q1 2025: 78.4%

- Q2 2025: 75.1%

- Q3 2025: 74.6%

- Q4 2025: 73%

- Q1 2026 (est.): 70.6% (+/- 50 basis points)

This decline signifies both heightened competition in AI data centers and a reduction in the scarcity of AI GPUs.

Interestingly, Nvidia’s most significant competition is emerging from within its customer base. Many companies among the “Magnificent Seven,” which are some of Nvidia’s top revenue sources, are developing their own AI GPUs and solutions. Though these internally designed chips may not be marketed externally and are likely to be less powerful than Nvidia’s offerings, they are considerably cheaper and have no production delays.

With time, Nvidia may start losing market share to these internally developed chips, diminishing AI GPU scarcity and eroding the pricing power that has driven its stock’s impressive performance.

Image source: Getty Images.

Nvidia’s Product Cycle Faces Challenges

Additionally, Nvidia’s product replacement cycle presents another concern that may lead to lower price targets from analysts. Innovation usually reigns supreme in the tech sector, and Nvidia’s Hopper and Blackwell chips are champions in AI compute speed. This innovation has propelled Nvidia’s annual sales from $27 billion in fiscal 2023 to over $130 billion in fiscal 2025.

Nonetheless, Nvidia’s fast-paced innovation strategy may deter not only current customers but also potential buyers. Following the Hopper’s launch, Nvidia began to release the Blackwell series late last year. The upcoming Vera Rubin GPU architecture is set for release in 2026, with the Vera Rubin Ultra expected in the latter half of 2027. Both will integrate the new Vera processor.

However, consistently introducing a new AI GPU each year may undermine previous customers’ investments. They could witness their hardware’s value decline rapidly due to continual advancements.

Moreover, the enhancements seen in compute capacities, high-bandwidth memory, and energy efficiencies are likely to taper off year on year.

Nvidia Faces Challenges Amidst AI Hype and Investment Risks

The current landscape presents fewer incentives for Nvidia’s clients, particularly its largest customers, to invest heavily in the newest hardware. This shift suggests that demand may not keep pace with the company’s aspirations.

Historical Context of Market Trends

Moreover, historical patterns suggest that Wall Street could lower its price targets for Nvidia significantly.

For over 30 years, investors have been captivated by successive waves of transformative technology. While many of these trends have promised attractive markets, they’ve all faced bubbles that inevitably burst. From the internet boom in the 1990s onward, each major technology trend passed through a similar cycle.

Bubbles arise when investor enthusiasm leads to inflated expectations regarding a new technology’s initial adoption and effectiveness. Eventually, when these expectations are not fulfilled, the bubble collapses.

Nvidia has certainly seen robust demand for its AI hardware. Nevertheless, it’s crucial to recognize that many businesses investing in AI have not yet optimized their systems or realized a return on investment. The signs indicate that market participants may be overestimating the early-stage adoption and practical applications of AI.

The positive side is that historically, numerous groundbreaking trends have succeeded in the long run. Yet, the fact remains that new technologies, including AI, require substantial time to develop and mature. Currently, AI is far from reaching that maturity.

As Nvidia has reaped significant benefits from the AI surge, any potential bubble collapse would likely impact it more severely than other AI-centered companies.

Evaluating Investment in Nvidia

Before considering an investment of $1,000 in Nvidia, it’s wise to reflect on various perspectives:

The Motley Fool Stock Advisor team has identified what they see as the 10 best stocks for investors right now, with Nvidia not included in that selection. The chosen stocks may offer substantial growth opportunities in the years ahead.

For instance, when Netflix was featured on December 17, 2004, a $1,000 investment then would have grown to $524,747!* Similarly, if you had invested in Nvidia on April 15, 2005, your $1,000 would now be worth $622,041!*

Additionally, it’s noteworthy that Stock Advisor has a total average return of 792%—significantly outperforming the S&P 500 return of 153%.

view the full list of 10 stocks »

*Stock Advisor returns as of April 21, 2025

Bank of America is a promotional partner of Motley Fool Money. Sean Williams has holdings in Bank of America. The Motley Fool endorses and maintains positions in Bank of America and Nvidia, as detailed in their disclosure policy.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.