Analyzing Potential Growth: Insights on iShares U.S. Equity Factor ETF and Key Holdings

In a recent analysis of ETFs, ETF Channel examined the holdings within its coverage and compared their trading prices to analysts’ target prices for the next 12 months. For the iShares U.S. Equity Factor ETF (Symbol: LRGF), the implied target price based on its underlying assets stands at $66.26 per unit.

Growth Prospects for iShares U.S. Equity Factor ETF

Currently, LRGF is trading at approximately $60.48 per unit, indicating a potential upside of 9.56% according to analyst projections for the underlying securities. Notably, three of the ETF’s significant holdings—monday.com Ltd (Symbol: MNDY), Etsy Inc (Symbol: ETSY), and PVH Corp (Symbol: PVH)—show considerable upward potential compared to their analyst target prices.

Key Holdings with Remarkable Upside Potential

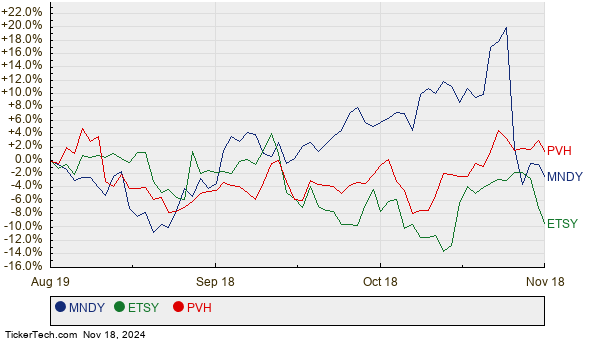

monday.com Ltd is trading at $262.85 per share, yet the average target price of $323.75 suggests an upside of 23.17%. Conversely, Etsy’s recent share price of $49.63 denotes a potential increase of 22.07%, with a target price of $60.58. Lastly, analysts predict PVH Corp will reach a target price of $124.36, which is 21.81% higher than its current price of $102.09. Below is a chart illustrating the recent performance trends of MNDY, ETSY, and PVH:

Current Analyst Target Prices Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Equity Factor ETF | LRGF | $60.48 | $66.26 | 9.56% |

| monday.com Ltd | MNDY | $262.85 | $323.75 | 23.17% |

| Etsy Inc | ETSY | $49.63 | $60.58 | 22.07% |

| PVH Corp | PVH | $102.09 | $124.36 | 21.81% |

These target prices raise an important question for investors: Are analysts being realistic in their expectations, or are they being overly optimistic about the future performance of these stocks? Determining whether their targets are justified requires deeper exploration into each company’s recent developments and market conditions. A higher target price compared to current trading levels can indicate a positive outlook but may also lead to potential downgrades if the targets are based on outdated information.

![]() Explore 10 ETFs with the Most Upside to Analyst Targets here.

Explore 10 ETFs with the Most Upside to Analyst Targets here.

Further Reading:

• High-Yield Canadian Energy Stocks

• GRPH Insider Buying

• Institutional Holders of GXGX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.