Lucid Group Faces Market Challenges Despite Strong Sales Projections

Lucid Group (NASDAQ: LCID) is poised for notable sales growth this year. Analysts predict that the company’s revenue could nearly double by 2025, mainly due to the launch of Lucid’s new Gravity SUV platform, which began shipping to customers earlier this year.

However, shares have dropped approximately 20% since the start of 2025. This decline reflects broader market corrections. Many electric vehicle stocks, including Lucid, have experienced significant challenges, leading to valuations not seen in years.

Insight into Lucid’s Trading History

Before considering an investment in Lucid, it’s important to examine the company’s trading history. In early 2024, analysts dramatically raised their sales growth forecasts, anticipating over 100% annual sales growth. This optimism stemmed from a smaller sales base and a one-time transaction with the Saudi government that exceeded $50 million.

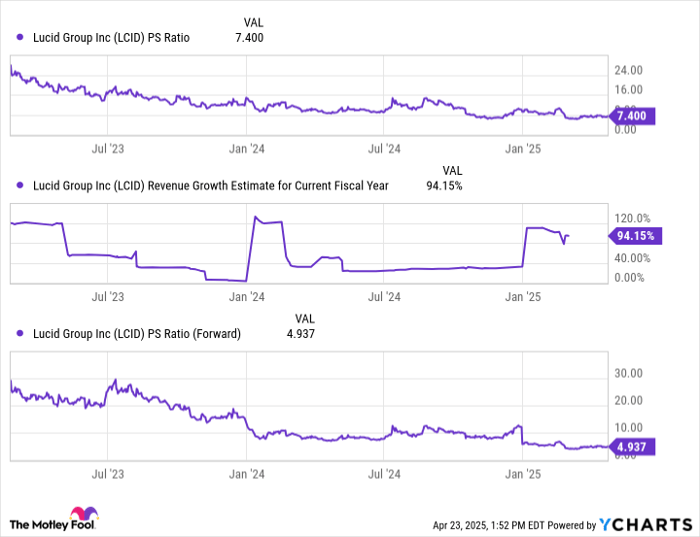

Interestingly, Lucid’s stock price and valuation multiples did not show considerable movement during this surge in expectations. Ultimately, forecasts were sharply revised downward later that year due to unexpected sales weaknesses, demonstrating the volatility of such projections.

LCID PS Ratio data by YCharts. PS = price-to-sales.

Currently, some may argue that Lucid’s valuation is unfairly depressed, particularly after a market correction coincided with renewed sales growth estimates. Yet, Lucid’s prior performance indicates that shares often do not react positively to increased growth forecasts. There are key reasons for this skepticism.

Firstly, Lucid is considerably smaller than well-funded competitors like Tesla. While sales may be increasing, doubts remain about the company’s long-term viability. Secondly, Lucid’s growth trajectory has faced unexpected hurdles, leading the market to withhold assigning a higher valuation based solely on analyst projections.

While Lucid Group stock may appear undervalued, significant share price increases are unlikely until actual growth matches these forecasts.

Should You Invest in Lucid Group Now?

Before deciding to purchase stock in Lucid Group, consider this: the Motley Fool analyst team has identified their top ten stocks currently, and Lucid Group is not featured among them. The companies that made the list are expected to deliver strong returns in the coming years.

For context, when Netflix was recommended on December 17, 2004, an initial investment of $1,000 would be worth around $594,046 today.* Similarly, an investment of $1,000 in Nvidia following a recommendation on April 15, 2005, would have grown to about $680,390.*

Overall, the Stock Advisor program has delivered an average return of 872%, greatly outperforming the 160% return of the S&P 500.

Ryan Vanzo holds no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.