Lucid Motors: A Mixed Bag for Investors Amidst Rapid EV Growth

The electric vehicle (EV) market is experiencing rapid growth worldwide, especially in China, where EV sales now account for over 50% of new vehicle purchases. Lucid (NASDAQ: LCID) has gained traction recently, seemingly at Rivian’s expense. The crucial question is: should long-term investors consider it a viable option?

Recent Performance: A Double-Edged Sword

Lucid has a history of disappointing its shareholders with production setbacks and disappointing delivery figures. However, the company has turned a corner, achieving three consecutive quarters of record deliveries.

So far in 2024, Lucid has delivered over 7,100 vehicles, exceeding last year’s total of 6,001. This upward trend continues with the recent launch of the Gravity SUV.

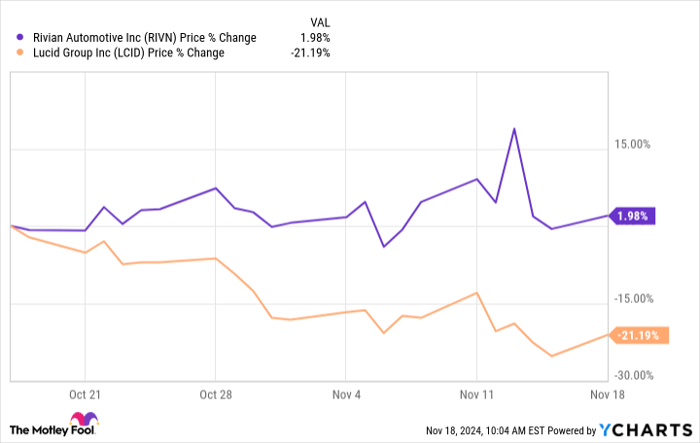

Despite this delivery momentum, Lucid’s stock price remains stagnant, especially when compared to rival Rivian, which also faced production issues resulting in a weaker third-quarter performance.

RIVN data by YCharts.

Challenges Ahead: Share Dilution Concerns

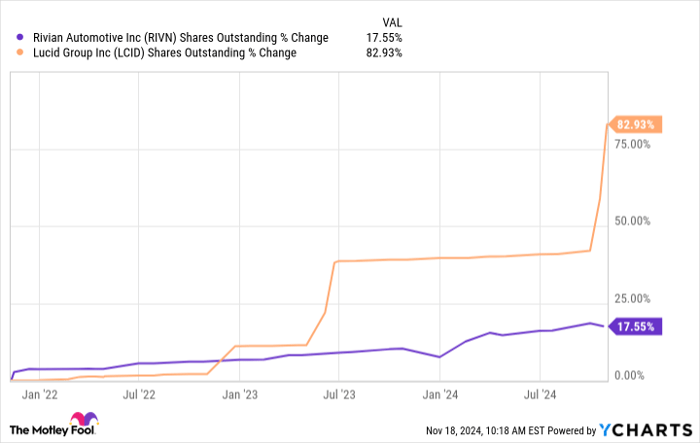

Lucid’s recent success was overshadowed by mixed third-quarter results and a plan to sell more than 262 million shares. This offering includes nearly 375 million shares for its main shareholder, Saudi Arabia’s Public Investment Fund (PIF), reinforcing Lucid’s connections to Saudi Arabia.

While it is expected for emerging EV companies to seek capital as they grow, the dilution of shares is a concern for investors, especially when compared to Rivian.

RIVN Shares Outstanding data by YCharts.

Is Now the Time to Invest in Lucid?

On a positive note, Lucid’s delivery growth is likely to continue with the launch of the Gravity EV SUV. A successful rollout and increase in production will be crucial for achieving a strong performance by year-end and into 2025. Additionally, Lucid has plans to introduce a midsize crossover priced below $50,000 in about two years.

As the global EV sector expands, early investors should understand the speculative nature of these stocks. The bankruptcy of Fisker serves as a warning.

While Lucid’s progress is noteworthy, it may not yet be a solid buy. However, it merits a spot on your watch list as the company works through challenges, expands its offerings, and aims for a stronger position in the competitive EV landscape. Currently, Lucid’s stock price is near all-time lows, presenting a potential entry point for risk-tolerant investors.

Explore New Investment Possibilities

Do you feel like you’ve missed out on buying successful stocks in the past? Here’s some good news.

Our team of analysts sometimes issues a “Double Down” stock recommendation for companies on the verge of significant growth. If you believe you have missed your chance, now might be the optimal time to buy before the opportunity slips away. Consider these past successes:

- Nvidia: An investment of $1,000 when we doubled down in 2009 would now be worth $368,053!*

- Apple: A $1,000 investment when we doubled down in 2008 would be valued at $43,533!*

- Netflix: If you invested $1,000 in 2004, it would have grown to $484,170!*

Currently, we’re highlighting “Double Down” alerts for three exceptional companies, and you won’t want to miss out.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Daniel Miller does not have positions in any of the stocks mentioned. The Motley Fool has no positions in any of the stocks mentioned. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.