“`html

Strong Job Growth Signals Economic Recovery: What Investors Need to Know

The U.S. economy shows no signs of recession; instead, it appears to be entering the initial phases of recovery.

Supporting this recovery, the Federal Reserve is likely to implement rate cuts in the coming months, potentially boosting stock performance as we approach the holiday season.

Tech analyst Luke Lango reported these insights in his Early Stage Investor Daily Notes, following last Friday’s impressive jobs report.

Luke provided several key highlights from the report. Here are some notable points:

The U.S. economy added 254,000 jobs in September, significantly surpassing expectations and marking the largest growth since March.

Revisions to job growth figures for July and August added a substantial 74,000 additional jobs.

Private payrolls increased by 223,000, which is much higher than anticipated and reflects a broad jobs recovery beyond government hiring.

The unemployment rate dropped from 4.2% to 4.1%, continuing a trend of monthly declines.

Average hourly earnings advanced by 4% year-over-year, outperforming expectations and improving from the previous month’s 3.9% increase. Current inflation estimates for September hover around 2.2%, indicating that wage growth has outstripped inflation for the 16th consecutive month.

With such positive data, it’s hard to disagree with Luke’s conclusion: the September jobs report was strong overall, signaling good news for our economy and stock market performance. It might be a good time to invest.

Recognizing this trend, Luke has issued new “buy” recommendations recently.

This move is noteworthy as Luke’s subscribers have reaped significant gains from his earlier recommendations over the past few months.

For instance, since August, Early Stage Investors subscribers have celebrated:

- 270% gains on AST SpaceMobile (ASTS)

- 50% gains on Life Time Holdings (LTH)

- 50% gains on ON Holding (ONON)

- 120% gains on Palantir (PLTR)

- 110% gains on Rocket Lab (RKLB)

Congratulations are in order for Luke’s subscribers, who continue to build on their successes.

This October, Luke has formulated six new recommendations, zeroing in on one primary focus. Let’s explore his latest trade alert:

[We’re identifying] exciting buying opportunities, particularly within the autonomous vehicle (AV) segment. With Tesla set to unveil its Robotaxi at an event this Thursday, we anticipate a significant shift in the AV landscape.

This unveiling could signal a critical turning point for the autonomous vehicle (AV) revolution, shifting from niche to mainstream acceptance. We recommend purchasing AV stocks before this key moment.

Implications of Tesla’s “We, Robot” Event on the AV/EV Sector

As we prepare for the “We, Robot” event this Thursday at Tesla, the company is expected to reveal its first dedicated robotaxi, likely called the “Cybercab.”

We believe this launch could transform the automotive industry and present numerous investment opportunities.

Some clear investment choices include Alphabet and Tesla. Luke remarked:

Alphabet owns Waymo, while Tesla is set to release the Robotaxi. Should these technologies scale and dominate an estimated $11 trillion ride-hailing market by 2030, GOOGL and TSLA could see substantial gains.

However, historical data suggests the best investment opportunities in a revolutionary technology often lie outside the spotlight. Typically, suppliers outperform the companies showcasing the innovation.

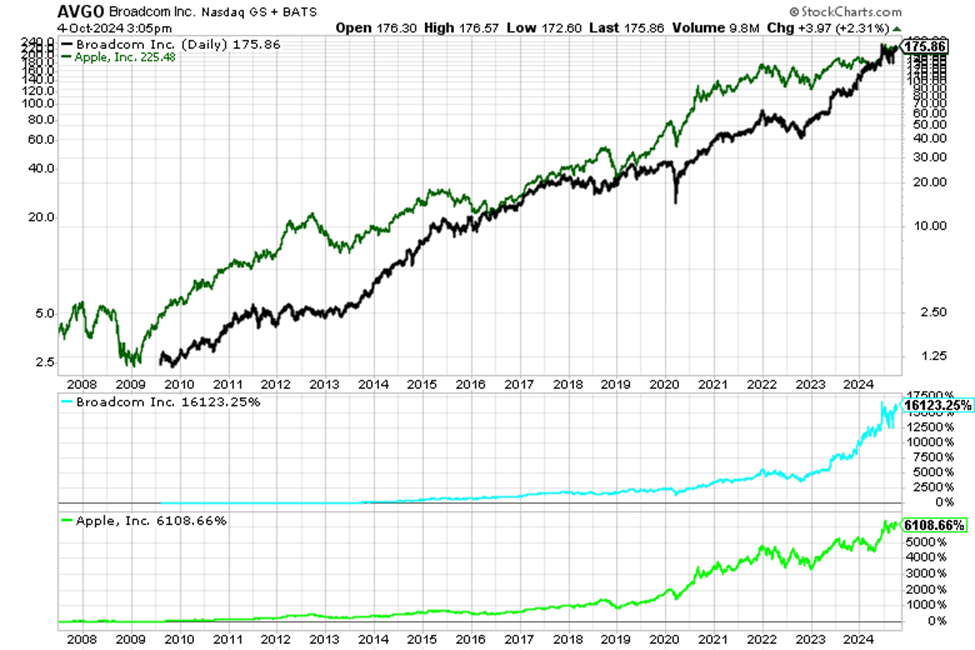

Luke illustrated this trend with Apple’s rise since launching the iPhone in 2007, which saw a growth of over 6,000%. In contrast, supplier Broadcom’s stock skyrocketed over 16,000% during the same period.

Source: StockCharts.com

Investors witnessed similar patterns with Nvidia’s chips for Tesla and Intel’s supplies to IBM, where supplier stocks greatly outperformed the innovating firms.

Luke anticipates this pattern will emerge again, which is why he held a time-sensitive event yesterday to discuss suppliers with potential for significant returns as AV/EV technologies evolve. You can access a free replay of this event here.

Summing it up, Luke stated:

Our research indicates that self-driving cars are rapidly gaining momentum and will soon become commonplace, potentially replacing human-driven vehicles entirely.

This transition to the Age of Autonomous Vehicles brings substantial opportunities within AV stocks.

The global transportation services market is estimated to exceed $7 trillion, and autonomous vehicles will likely alter every aspect of that industry.

To address this market shift, I presented a playbook in yesterday’s event detailing what I believe are essential tech supplier stocks to consider right now.

I may have a vested interest, but I believe this is a crucial October event that could unveil the next wave of standout tech stocks.

As mentioned before, you can view Luke’s briefing for free and explore his playbook by clicking here.

Reviewing the Recent Labor Report and Its Impact on Bitcoin

Returning to last Friday’s labor report, Luke suggests that the strong data could also positively impact Bitcoin and the broader crypto market. Importantly, the economic strength is unlikely to change the Fed’s plan for interest rate cuts, addressing concerns shared by some investors on Wall Street.

Here’s…

“`

Bitcoin’s Recent Strength Signals Possible Recovery Ahead

Understanding the Fed’s Stance on Economic Recovery

The Federal Reserve recognizes that economic recoveries can be delicate. Their priority is to support ongoing recovery efforts, especially while inflation remains low—currently at 2% to 2.5% for September and October.

The U.S. economy isn’t close to recession; rather, it’s just starting its recovery journey. With inflation under control, the Fed can continue to back this recovery with potential rate cuts, encouraging further strength in the crypto market.

Bitcoin’s Recent Price Movements

Focusing on Bitcoin’s recent activity, the last few days have shown significant resilience.

Just two weeks ago, Bitcoin surged past $66,000, breaking through its multi-month downward trendline. While this was promising, we anticipated that Bitcoin would need to test these gains at key technical levels.

We specifically monitored the $64,000 level, correlating it to Bitcoin’s bearish trendline. Ideally, we wanted to see Bitcoin dip to $64,000 and maintain that point, converting it from resistance to support for further upward movement.

However, it fell short of expectations. Last week, Bitcoin dropped from $66,000 and broke below $64,000, hitting approximately $60,500. Fortunately, it found support at its 100-day moving average (MA), which is a reassuring indicator of strength.

The 100-day MA had previously acted as resistance in August, but it successfully served as support this time. Although we would have preferred it happening at $64,000, the current scenario is still a positive sign.

Source: StockCharts.com

Analyzing Bitcoin’s Momentum with MACD Indicators

Luke then turned attention to Bitcoin’s Moving Average Convergence Divergence (MACD) indicator, which offers valuable insights into asset momentum. This helps identify optimal times for entry or exit. Luke noted:

Bitcoin has shown a strong performance within the $50,000 to $70,000 range over the past several months, getting close to triggering a bullish weekly MACD crossover above the zero line.

This crossover is uncommon; it has only occurred twice in the last five years.

The first time was in August 2021 and again in October 2023. Each instance was followed by a notable rally in Bitcoin’s price over the following weeks and months.

If Bitcoin can continue to climb and fully activate this bullish MACD crossover, it could signal a promising rise for cryptocurrencies as we approach the end of the year.

We firmly believe that Bitcoin and select leading altcoins are essential for a balanced portfolio aimed at preserving wealth. Whether or not this marks the breakout we’ve been anticipating since spring, our outlook on crypto remains optimistic.

We will keep you updated, including insights from Tesla’s upcoming “We, Robot” event.

Wishing you a good evening,

Jeff Remsburg