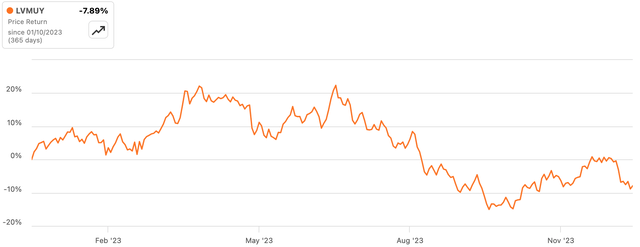

It’s been surprising to see the luxury goods juggernaut LVMH Moët Hennessy Louis Vuitton (OTCPK:LVMUY)(OTCPK:LVMHF) experience uncharacteristic softness in its shares, delivering a roughly negative 6% total return over the last 12 months. This trend is occurring amidst concerns about a broader slowdown in the global luxury market.

While those fears may hold some truth, it’s important to recognize LVMH as a top-tier operator. It’s likely to withstand the storm better than most. With shares currently standing at 21.5 times trailing twelve months earnings per share (TTM EPS), the anticipated long-term growth should justify the current investment, hence meriting a Buy rating for the stock.

The LVMH Landscape

LVMH boasts an empire of luxury brands, including the esteemed Louis Vuitton, Moët, Hennessy, Christian Dior, Bulgari, TAG Heuer, and Guerlain. The Fashion & Leather Goods segment accounts for over 70% of the group’s operating profit, followed by Wines & Spirits, Watches & Jewelry, Selective Retailing, and Perfumes & Cosmetics.

LVMH doesn’t officially break down sales by specific brand, but information hints that Louis Vuitton is a €20 billion business, contributing approximately 25% to the group’s sales. The Fashion & Leather Goods segment already touts the strongest margins among the group, with Louis Vuitton likely to surpass these margins. Consequently, Louis Vuitton is likely to play an even more prominent role in the group’s earnings.

Notably, LVMH manages the entirety of both production and distribution for the Louis Vuitton brand, choosing not to utilize wholesale channels. Although this approach has its pros and cons, the company’s focus on controlling sales through its stores underlines the importance of maintaining exclusivity and perceived scarcity. Additionally, the alcohol segment, despite its cyclical nature, serves as a stabilizing force for the fashion arm of the business, providing a unique strength relative to its peers.

Moderate Sales Growth Amidst Concerns

Though concerns loom over a potential slowdown in the global luxury market, it’s crucial to note that LVMH continues to deliver respectable performance. In the latest available quarter (Q3 2023), the company reported a 9% year-on-year organic revenue growth at constant exchange rates. This figure, while not exceptional, still places LVMH above some peers, albeit below others. Despite a considerable slowdown from the 17% growth reported in previous quarters, the numbers are far from discouraging.

Delving deeper, the performance in the United States reflects some softness, with organic sales up just 3% year-on-year. However, given the extraordinary growth experienced in the wake of the COVID-19 fiscal stimulus, this moderation in growth is understandable. On the brighter side, the Chinese customer base remains a promising segment, with Asia ex-Japan sales showing encouraging signs, even as some sales have shifted back to Europe due to a resumption of travel post-COVID.

LVMH: A Toast to Long-Term Returns

The luxury market has been a rollercoaster, but LVMH Moët Hennessy Louis Vuitton (LVMUY) is showing resilience. Despite global uncertainties like travel restrictions and economic fluctuations, the company continues to deliver robust long-term growth prospects.

LVMUY Stock Can Deliver Good Long-Term Returns

Despite a 7% decline in ‘LVMUY’ ADSs over the past year, the stock’s valuation has de-rated, making it an attractive investment opportunity. With an EPS still on an upward trajectory, the stock now trades at a P/E of 21.4, down from around 29x TTM EPS just 12 months ago.

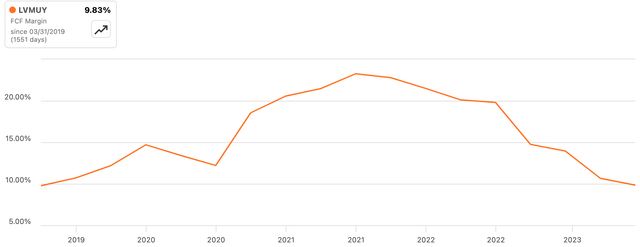

The luxury market is expected to grow at a circa 5% CAGR through 2030. Despite the slightly reduced growth rate, LVMH’s solid performance signifies a potential to outpace the market, especially in its Fashion & Leather Goods segment. With brands like Louis Vuitton leading the charge, a high single-digit annualized sales growth is anticipated, while the rest of the business groups should align with the 5% global luxury market growth. Additionally, LVMH’s consistent ability to generate substantial free cash flow further solidifies its position as a sound investment.

Although there was a slight dip in free cash flow in H1 2023 due to heavy investments in its alcohol and jewelry businesses, the company’s healthy balance sheet, coupled with a strong cash conversion, bodes well for long-term stability. With a dividend yield of 1.8% and a payout ratio of around 40%, LVMH has substantial surplus FCF for future EPS growth. Its net financial debt of less than 0.5x annual EBITDA supports strategic initiatives like M&A and potential buybacks, enhancing shareholder value.

LVMH has a history of strategic acquisitions, and it’s likely to continue this trend alongside exploring buyback avenues. These initiatives, combined with the 1.8% dividend yield, could pave the way for a 9-10% annualized growth in EPS, further reinforcing the company’s attractiveness as an investment option. Given these aspects, factoring in around 1-2% from long-term P/E multiple contraction, LVMH proves to be an enticing prospect, offering approximately 10% annualized returns. With its ownership of prestigious consumer brands, a Buy rating for the stock is well deserved.

Risks

However, there are potential risks in the macro and brand landscape that could impact LVMH’s trajectory. The company’s reliance on Chinese consumers for long-term growth is significant, and any slowdown in the region’s economic development could challenge growth forecasts. Moreover, core brands like Louis Vuitton falling out of favor could dampen long-term volume growth and pricing power. Additionally, the luxury sector’s inherent cyclical nature introduces the potential for short-term volatility, which investors should bear in mind.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.