Author’s note: Since both companies discussed in this article only report EUR numbers, all numbers will refer to EUR.

Delving Into LVMH’s Operations

I’ve previously waxed lyrical about Hermès Paris (OTCPK:OTCPK:HESAY)(OTCPK:OTCPK:HESAF), it being the undisputed leader in the luxury goods sector and among the finest companies I’ve had the pleasure to know. In these discussions, I’ve made numerous references to its peers, including LVMH (OTCPK:LVMUY)(OTCPK:LVMHF).

This article will be dedicated to LVMH and its parent holding company Christian Dior SE (OTCPK:CHDRF)(OTCPK:CHDRY). The goals of this article are to:

- Provide a brief business overview of the conglomerates’ operations.

- Show the interconnection between Christian Dior SE, LVMH, and the Arnault family, and its implications.

- Discuss the reasons why LVMH is a high-quality business.

- Assess and compare the attractiveness of both companies.

The Multifaceted LVMH

This section will focus on LVMH, the “operating” company, while Christian Dior SE is merely the “holding” company. However, it’s important to note that LVMH also operates as a holding company, owning various subsidiaries for its different brands, with Bernard Arnault holding the reins as the controlling shareholder, possessing more than 50% of LVMH’s voting rights. The influence of Bernard Arnault and the Arnault family bears significant weight for LVMH.

LVMH operates across five main reporting segments:

- Wines & Spirits (Moët & Chandon, Dom Pérignon, Hennessy, Krug).

- Fashion and Leather (Louis Vuitton, Christian Dior, Fendi, Celine).

- Perfumes and Cosmetics (Christian Dior, Guerlain, Givenchy).

- Watches and Jewelry (Tiffany, Bulgari, Tag Heuer, Hublot).

- Selective Retailing (Mainly Sephora).

I’ve included some of the most renowned brands to illustrate LVMH’s diversification. LVMH refers to its segments and brands as “Maisons” (French for “Houses”), underscoring exclusivity, a cherished attribute for LVMH and its Chairman and CEO Bernard Arnault, especially in the luxury goods sector.

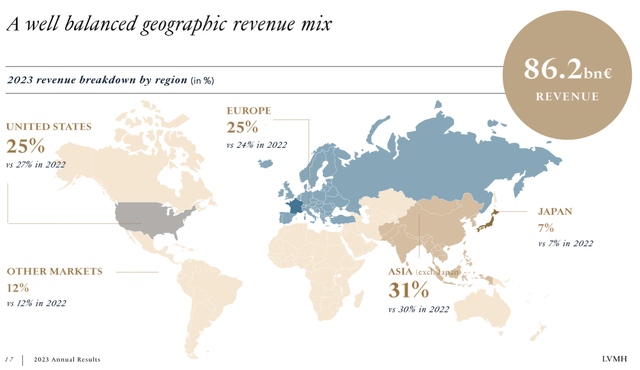

Before delving into the nitty-gritty of the holding structure, I’ll present a few easily digestible slides from the FY23 results presentation. The following slide depicts LVMH’s well-diversified revenue composition, with the main markets being Asia (38% of sales) and the U.S./Europe (25% each):

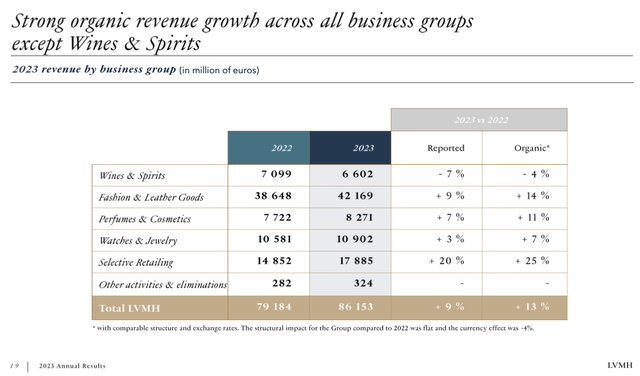

The Fashion & Leather Goods segment dominates (comprising nearly 50% of annual sales), followed by Selective Retailing (predominantly the retail chain Sephora) and Watches & Jewelry:

I’ll refrain from delving into the sales growth numbers at this point; I’ll shed light on this in a subsequent section of this article.

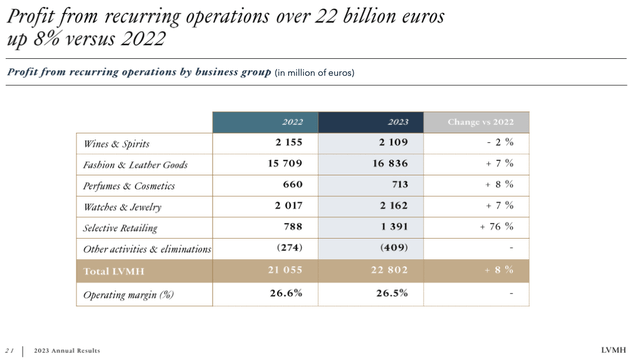

Lastly, the following chart illustrates the operating profit for the different segments:

The chart unequivocally portrays the sheer profitability of the Fashion & Leather Goods segment, contributing nearly 75% to the operating profits, while Selective Retailing, as expected for pure retail operations, is a low-margin pursuit.

LVMH’s Ethos

It’s essential to delve into a topic that often gets overlooked in financial analysis: a company’s culture. I’ve noticed that many high-quality companies, albeit not all, tend to share their success with all stakeholders. This is a subject that Bernard Arnault frequently underscores during the Year-End earnings calls he attends. Here are a few noteworthy excerpts from his recent FY earnings calls:

So this family that welcomes the main members of the group when one enters LVMH, one enters a family. Considered like a family. We do things. We approved the Board today an employee share ownership plan that was submitted to me, and we’re going to launch that during the course of the year once it’s been tabled at the AGM.

Source: Bernard Arnault – FY23 Earnings Call.

LVMH will approve an employee share ownership plan at the upcoming shareholder meeting. This initiative will tether the employees to LVMH’s success, allowing them to partake in the group’s triumphs. Aligning the employees with himself (as a major shareholder) and the shareholders is commendable and deserving of accolades.

I would like to demonstrate here that this magnificent group that has spectacular results is also a group that has a great economic and social footprint for France. In 2022, we recruited worldwide close to 40,000 young people in France. In France alone, we recruited over 15,000 people, making the group the leading recruiter in France in 2022. LVMH invested over 200 million for the training of its employees. In France, a job created by LVMH generates four in — with our partners or suppliers.

So, we carry some 160,000 people in France who work directly or indirectly for LVMH.

Source: Bernard Arnault – FY22 Earnings Call.

LVMH generates considerable employment opportunities worldwide, particularly in France, where most of the manufacturing activities are concentrated.

The group has worked on its building new workshops and it stores over 5 million — in over 500 stores and 100 craftsmanship manufacturing sites are in France. LVMH opens every year many manufacturing facilities, notably for Louis Vuitton in France and we need, the group — because we generate profits, we pay a lot of tax. We pay €5 billion in

French Luxury Conglomerate LVMH Shaping the Future of Fashion

Bernard Arnault, the chairman and CEO of LVMH, proudly announced a staggering corporate tax footprint of over €4.5 billion a year for the luxury conglomerate. This includes taxes, social benefits of LVMH, and substantial investments in France. Arnault’s statement, made during the FY22 Earnings Call, offers a compelling financial insight into the corporation’s solid commitment to its home country.

LVMH’s Patriotism and Tax Footprint

With over €1 billion invested annually in France, LVMH’s financial contribution within the country is commendable. Arnault emphasized that over half of the corporation’s corporate tax is paid in France, while approximately 80-90% of its products are sold abroad. This statement underlines LVMH’s significant international presence while maintaining a strong link to its national roots.

Strategic Insights into Christian Dior SE

Delving into Christian Dior SE, the holding company of LVMH, provides crucial clarity on the interconnected operations with LVMH. Articulating the distinction between the Christian Dior brand under LVMH’s ownership and Christian Dior SE, which holds a substantial stake in LVMH, unravels the intricate dynamics of the company’s structure.

Christian Dior SE’s involvement as the majority shareholder of LVMH, highlighting a 41.42% stake, emphasizes its pivotal role in steering the conglomerate’s strategic decisions.

Shareholder Structure and Financial Implications

The intricate web of LVMH’s ownership structure, including the role of Agache SCA and Agache Commandite, presents a captivating saga of Bernard Arnault’s family interests and strategic positioning within the conglomerate. This immense economic interest and strategic maneuvering showcase a unique perspective of corporate governance within LVMH.

Crucially, Christian Dior SE’s financial statements prove intricate and significantly distorted due to the consolidation of LVMH’s profits. This financial complexity serves as a critical factor for investors, necessitating a comprehensive understanding of LVMH’s financial position for informed decision-making.

Valuation and Market Dynamics

Unveiling the intrinsic value of Christian Dior SE, based on its shareholding in LVMH, offers a thought-provoking perspective on market dynamics. The compelling analysis suggests that Christian Dior SE shares are potentially undervalued, warranting a deeper assessment of their true market worth.

Arnault’s insightful exposition reflects LVMH’s steadfast commitment to France, while the intricate shareholder and financial dynamics offer a captivating narrative of corporate intricacies. The compelling financial insights and market dynamics surrounding LVMH and Christian Dior SE warrant prudent consideration for astute investors navigating the luxury conglomerate’s landscape.

A Deep Dive into LVMH and its Operating Business

Exploring the LVMH Financials

Turning our attention to LVMH’s financial performance in recent years, it’s crucial to begin with a scrutiny of the balance sheet. A comprehensive examination of Goodwill, Net Debt, Book Value, and Capital Employed will shed light on the company’s financial standing.

Goodwill and Acquisitions

Delving into LVMH’s Goodwill over the years reveals a marked increase, particularly following significant acquisitions such as the high-profile purchase of Tiffany & Co. Goodwill surged by close to €10 billion from 2020 to 2021, eliciting concerns about the sustainability of serial acquisitions. However, given LVMH’s robust organic growth and track record, the influx of acquisitions appears to be well-managed.

Net Debt and Balance Sheet Health

Perhaps a cause for slight trepidation, the net debt witnessed a substantial increase post the Tiffany deal, peaking close to €10 billion in 2021. Nonetheless, contrasted with LVMH’s formidable earnings power, this figure of net debt equates to a mere half year of EBIT, thereby cementing the company’s robust balance sheet.

Book Value and Capital Employed

Charting the development of Book Value and Capital Employed presents a reassuring picture, as both metrics underscore a steadfast pattern of consistent growth. The 10-year Compound Annual Growth Rate (CAGR) for both parameters nears 12%, promising considerable returns for shareholders in the long run.

Evaluating Earnings Metrics

Shifting focus to the earnings metrics, a thorough analysis of LVMH’s revenue, EBIT, and net income over the past decade propounds a tale of resilient performance. Notwithstanding the hurdles presented by the pandemic year of 2020, revenue exhibited consistent growth, while profit margins surged substantially post-2020, chiefly attributable to the highly profitable Fashion & Leather segment.

Unraveling Free Cash Flow

Diving into Free Cash Flow (FCF), the myriad nuances of EU-based accounting practices come to the fore. The intricacies of lease liability repayment, interpreted within the rubric of IFRS, warrant a careful dissection. The real picture of LVMH’s FCF unveils a steady pre-pandemic growth, a notable spike in 2021, and a subsequent downturn. Balancing these dynamic figures against the vagaries of accounting methods is paramount to gaining a clear perspective on LVMH’s actual cash generation.

The Unyielding Fortunes of LVMH Group: A Financial Odyssey

Operating cash flows stood strong at approximately €18 billion over the past three years, reflecting a sustained vigor in LVMH Group’s financial underpinnings. The decline in cash flows, a cause for concern to some, is inextricably linked to the marked increase in CAPEX. From €2,664 million in 2021, CAPEX skyrocketed to €7,478 million in 2023, signaling a compelling eagerness on LVMH’s part to explore reinvestment prospects. Such resolve, as evidenced by the burgeoning profit margins, is poised to yield resounding returns.

Returns on Capital Employed (ROCE) is a yardstick I hold in high regard. It encapsulates EBIT’s quotient by Capital Employed. Evidently, LVMH’s capital has steadily burgeoned, indicative of pivotal reinvestment avenues. The rise in capital, tandem with escalating returns, is inherently designed to stir shareholder wealth and irrevocably ignite unparalleled returns. The accompanying chart graphically narrates LVMH’s ROCE trajectory over the bygone decade.

The superior triumph of LVMH and Christian Dior SE, significantly towering over the S&P 500, is a testament to the consummate financial prowess of these establishments. Yet, even within this ardent success, Christian Dior SE clinches a minuscule yet notable edge over LVMH. The querulous motivations underpinning this impetus warrant an unequivocal dissection, which we shall undertake imminently.

Luminaries in Financial Segments

I shall, in all brevity, elucidate on two salient facets that arrested my attention during my perusal of the varied segments.

Foremost is the prodigious upswing in the operating margin within the Fashion & Leather segment. In the following graphical depiction, the EBIT margin’s evolution within this segment unfurls:

The discernible ascendancy of the margin since 2015 acutely peaks in 2021. This peculiarity, however, yields to marginal erosion in 2022 and 2023. Notably, my previous discourse on Hermès in 2022, hazarded the notion of a transient pandemic-induced trigger. Nevertheless, events have proven otherwise, a sentiment concurred in the recent Q4 2023 earnings call by LVMH’s CFO, Jean-Jacques Guiony.

“In 2021, margins were up significantly, up 8 percentage points. And we said at the time that we propose to remain there, and we were able to do that. We’re 26.7% now with 26.5% today. So we were able to keep margins at that level. We certainly intend to do this.”

Intriguingly, it’s noteworthy that the CFO espoused on net margins as opposed to EBIT margins. Ergo, LVMH’s steadfast resolve to defend the meteoric margin escalation attests to its remarkable fortitude.

Subsequently, the resurgence of the Selective Retailing segment, chiefly anchored by the beauty retail chain Sephora, presages a compelling narrative. Staggering from a €10 billion slump in sales in 2020 (2019: €14.7 billion) due to the pandemic, sales have now burgeoned to €17.8 billion in 2023, bearing close to an 80% augmentation. This echoes a narrative akin to its less opulent counterpart Ulta Beauty (NASDAQ:ULTA). Ulta Beauty’s sales plummeted to $6.15 billion during the pandemic year, inching back to $10.9 billion for the trailing twelve months (TTM). Nevertheless, Selective Retailing margins, though convalescent, still trail the precursory pre-pandemic levels of approximately 9-10% in 2018 and 2019. This juxtaposition vis-à-vis Ulta Beauty’s EBIT margin, hovering around 15% in 2022, does seem to elicit potential margin traction albeit cautiously optimistic.

Prospects of Ascension and Allure

This chapter is emblematic of quintessential value attribution to LVMH (and by corollary, Christian Dior SE).

My predilection impels me to commence by expounding on the facet I deem paramount to Bernard Arnault: Desirability. Permit me to requisition some of his past utterances during earnings calls to bolster my postulation:

“Our overriding objective is to make these brands increasingly desirable. And the desirability of the brands when we compare it to that of our peers is improving steadily. And therein lies the success. The results that will be presented in the moment and I’m sure you’ll have questions is a consequence of all that. It’s not at all an objective. That’s not where I spend most of my time, because the desirability, its improvement leads, of course, with the quality of the products, the creativity in stores, leads to a certain consequence, which is increased sales and better profitability. But it’s a consequence.”

These words adumbrate Arnault’s cardinal contention. The pith is not to foment sales or profits but to augment the brands’ desirability and product quality. The exponential surge in sales and profits is, ergo, an organic corollary.

Further attestation is gleaned from the latest Q4 2023 earnings call:

“On your first question, the old couture growth is in the average of what was reported. But as I said earlier, growth is not — must not be a goal. The goal is desirability. People must desire the brand, whether it’s for dual or other brands in the Fashion

The Slow and Steady Path of LVMH: A Deeper Look into the Luxury Conglomerate’s Growth and Valuation

It’s fascinating how LVMH, the renowned luxury conglomerate, has reached a stage where the pursuit of breakneck growth is no longer the prima ballerina in their grand ballet. During the Q4 2023 Earnings Call, Bernard Arnault, the Chairman and CEO of LVMH, expressed a notable shift in focus. “It’s great what we did with Pietro these past few years with Dior. But we’ve reached a stage such that we no longer need to have such high growth. And between 8% and 10% is perfect,” he mused. This strategic pivot, akin to reining in an overzealous stallion, is a breath of fresh air in a business landscape often dominated by endless expansion.

Redefining Desirability

Arnault’s emphasis on desirability, rather than relentlessly chasing a burgeoning top line, underscores the alluring essence of luxury. Indeed, desirability is the lifeblood of a conglomerate like LVMH, infusing its brands with an aura of exclusivity that beckons the discerning elite. The reverberations of this philosophy are starkly evident when held up against the trials of Kering SA, the parent company of Gucci, which has weathered a palpable struggle in recent years, as evidenced by its drooping stock performance.

The Nuances of Growth Prospects

Luxury retail, a realm where the magnetism of a brand hinges on its scarcity, presents a distinctive paradigm for growth. Unlike conventional retailers, where volumetric expansion reigns supreme, the crux of growth for LVMH and its ilk lies in wielding the power of pricing. The corollary is clear – the rarer and more coveted a brand, the more potent its pricing authority. This sheds light on the divergence in valuation between LVMH and Hermès, with the latter commanding a premium multiple owing to its unparalleled cachet in the realm of opulence. Unveiling this unique tenet is akin to holding a prism to discern the kaleidoscopic hues of the luxury market.

Unwrapping Valuation

A quantitative dissection of LVMH’s valuation illuminates several facets of its investment quotient. With a current P/E ratio of 26.4, it straddles the line between pricey and reasonable, offering a nod to its robust but not exorbitant earnings. Yet, a closer inspection, mirroring the volatility of free cash flow (FCF), uncloaks a less lustrous perspective, painting the current FCF yield at a meager 2%. This sets the stage for a nuanced evaluation, with a normalized cash-conversion rate providing a glimpse into a prospective FCF yield of 3.25% – a figure that still reverberates with opulence in valuation terms.

The delicate art of forecasting returns necessitates an orchestration of FCF growth and yield. Amidst this symphony, the assumption of a 6% annual price escalation, juxtaposed against a conservative 2% volume growth, offers a sonorous revelation – a probable 10% uptick in earnings, a harmonious chord aligning with LVMH’s tempered growth ethos. This echoes the historical cadence of LVMH’s ascent, predating the pandemic-induced spurts, and heralds a pragmatic melody of restrained expansion.

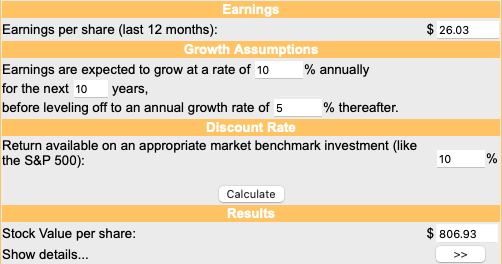

Delving further into the market’s projection, an additional discounted cash flow (DCF) estimation paints a canvas of promising returns, unveiling the allure of low double-digit aspirations, unfurling a tapestry of wealth anchored in grounded growth.

LVMH and Christian Dior SE: Probing Valuation and Risks for Investors

LVMH, the luxury goods conglomerate, appears to be priced for 10% earnings growth over the next decade, followed by 5% in perpetuity. Given the historical earnings growth and the stable nature of the luxury sector, this valuation seems reasonable.

Christian Dior SE’s role comes into play, where every share equals 1.154 LVMH shares, with a negligible cash component. With this calculation, the underlying free cash flow per share for Christian Dior SE amounts to €30.04, reflecting a 3.9% yield, 20% higher than LVMH shares. These figures indicate that LVMH is reasonably valued and may deliver modest returns, while Christian Dior SE appears even more attractive for investment.

Key Risks to Consider

Two significant risks need attention. One pertains to the desirability of LVMH’s brands, affecting both LVMH and Christian Dior SE, and the other solely concerns Christian Dior SE.

The risk associated with the desirability of LVMH’s brands is paramount. A decline in the appeal of these brands can trigger a downward spiral of stagnating sales and diminishing margins, significantly impacting the valuation. This scenario underscores the importance of LVMH’s brand strength, with a historical example being Kering SA’s challenges with the Gucci brand. While trust in Bernard Arnault’s acumen provides some reassurance, the risk remains a key consideration.

The second risk specific to Christian Dior SE relates to the potential for an unfavorable squeeze-out due to Bernard Arnault’s high ownership through Agache SCA. While rumors about squeeze-out plans have circulated, the company’s trading at a discount to its intrinsic value underscores some unease in the market regarding this possibility.

An unfavorable squeeze-out poses lesser concern compared to declining brand desirability. Legal provisions allow minority interest holders to claim fair or intrinsic value, which should provide some protection in the event of a squeeze-out, with LVMH’s publicly listed shares simplifying the intrinsic value calculation. Bernard Arnault’s recent actions also suggest a lower likelihood of an unfavorable squeeze-out taking place.

In Closing

Covering various aspects pertaining to these companies, it’s clear that LVMH, with its strong financial track record and insider ownership, remains an appealing prospect. Christian Dior SE, trading at a discount to its intrinsic value, presents an even more compelling opportunity for investors. In light of these factors, a “buy” rating for Christian Dior SE shares and a “hold” for LVMH shares is warranted. Full disclosure: I have established a small position in Christian Dior SE over recent months, with a cost basis of around €640 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.