Lyft Inc(LYFT) announced that it achieved a positive $14.9 million in free cash flow in Q4 2023 and is projecting positive FCF in 2024. This revelation has sparked optimism, with expectations of a 25% surge in LYFT stock, providing a boon for short-put investors.

The post-earnings stock closure at $17.91 significantly outperformed the pre-earnings price of $12.40, implying further room for growth based on the company’s guidance.

Now, calculating the potential 25% increase from today’s price will assist in establishing income strategies through short-put plays.

Positive Cash Flow Forecast

Lyft’s declaration of anticipated positive free cash flow for the entire year, with an estimated 50% conversion rate from adjusted EBITDA, offers valuable insight into its financial health and market potential. Utilizing the company’s adjusted EBITDA margins, we can estimate future cash flow and set a price target.

For example, with analysts predicting $5.08 billion in sales for 2024, we can estimate $91.44 million in adjusted EBITDA and $45.7 million in FCF for 2024. With a presumed improvement in EBITDA margin, this figure can rise to $63.5 million in FCF, indicating a positive trajectory for the upcoming year.

Setting a Price Target for LYFT Stock

This projection allows us to establish a price target. Considering a 0.80% FCF yield, the resulting market cap estimate of $8.9 billion suggests a 25% rise from its current market cap of $7.1 billion. This positions LYFT stock potentially worth as much as $22.39 per share in the next 12 months.

Existing shareholders can utilize this insight to determine price targets for short-put option plays, maximizing their earnings.

Shorting OTM Puts in LYFT Stock

Currently, LYFT stock features high put option premiums, indicating a bearish market sentiment. By selling short, out-of-the-money puts in nearby expiry periods, short sellers can capitalize on this to generate income.

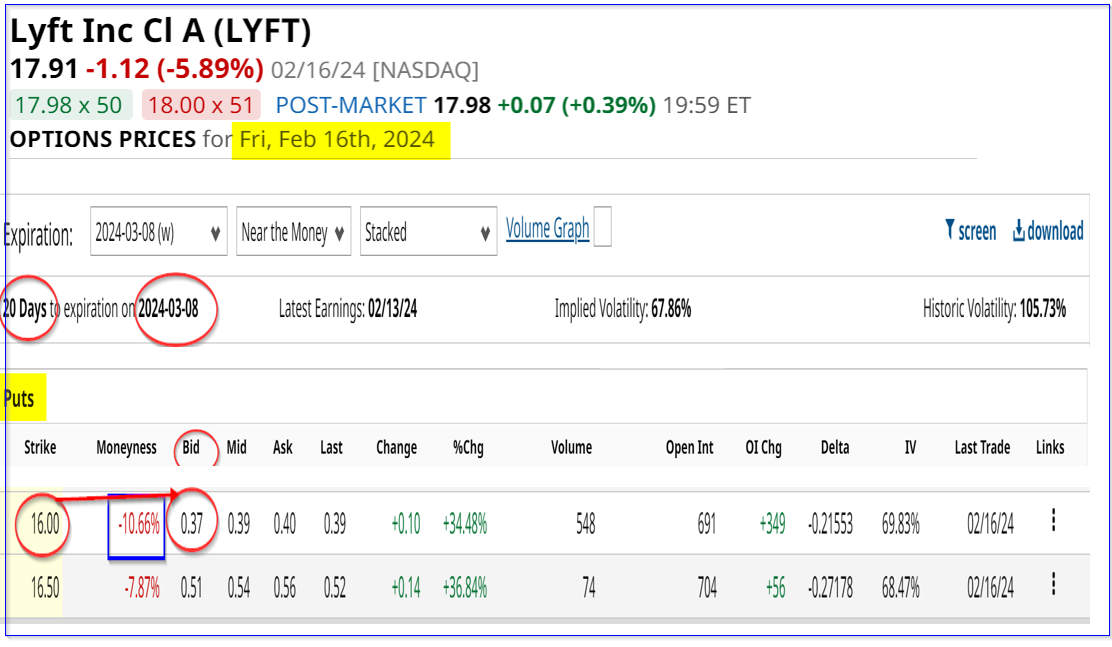

For instance, examining the options expiring on March 9 shows that the $16.00 strike price puts trade for 37 cents, signaling an immediate yield of 2.3125% for the short seller. This provides a unique income opportunity for investors willing to capitalize on short-put strategies.

Downside Protection

Furthermore, this approach offers notable downside protection, with LYFT stock needing to drop to $15.63 to incur an unrealized capital loss. This provides 12.73% in downside breakeven protection, assuring a favorable expected return for investors engaging in these trades.

Overall, the potential 25% increase in LYFT stock presents an attractive opportunity for investors, with shorting OTM puts emerging as a promising avenue to leverage this potential.

More Stock Market News from Barchart

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.