LyondellBasell Showcases Advanced Polymers at Plastico Brasil 2025

LyondellBasell Industries N.V. (LYB) is set to unveil its innovative polymer products at Plastico Brasil 2025, the foremost trade show for South America’s plastics sector, taking place from March 24-28 at the Sao Paulo Expo in Brazil. This event will highlight LYB’s commitment to enhancing efficiency, sustainability, and performance in plastic manufacturing.

Event Overview and Industry Relevance

Plastico Brasil serves as a hub for professionals across the entire plastics supply chain to explore the latest advancements in technology, materials, and processes. LyondellBasell will feature its Advanced Polymer Solutions (APS) portfolio, offering attendees exclusive insights into how these materials are expected to influence the industry’s future.

With the growing demand for plastic solutions in South America stemming from economic growth, infrastructure initiatives, and sustainability efforts, LyondellBasell remains dedicated to providing high-performance materials tailored to these evolving needs. The expo represents a crucial opportunity for the company to collaborate with industry experts and showcase technologies that align with the region’s focus on efficiency, durability, and environmental stewardship.

Current Market Performance

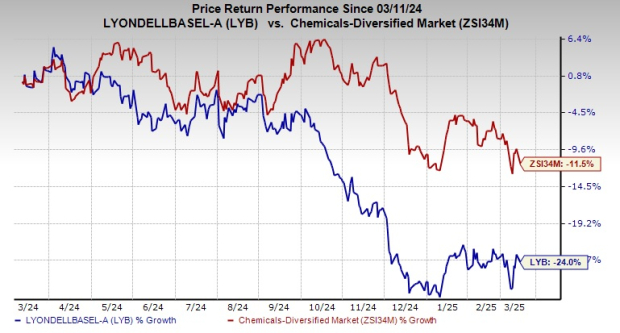

Despite the rising industry demand, LYB stock has decreased by 24% over the past year, in contrast to the 11.5% decline observed within the industry.

Image Source: Zacks Investment Research

Outlook for LyondellBasell

During its fourth-quarter earnings call, LYB indicated readiness to leverage macroeconomic drivers that will eventually boost supply chain replenishment, elevate demand for durable goods, and facilitate a broader economic recovery. Notably, North American domestic demand for polyolefins rebounded in 2024 after two consecutive years of decline. The company expects seasonal demand increases across most product categories during the first quarter.

Factors such as anticipated interest rate reductions, moderating inflation, and pent-up consumer demand are likely to enhance consumption of durable goods, positively impacting LYB’s polypropylene and Intermediates and Derivatives segments. Seasonal spikes in driving and gasoline requirements during summer are projected to lift oxyfuels margins typically.

LyondellBasell Stock Analysis

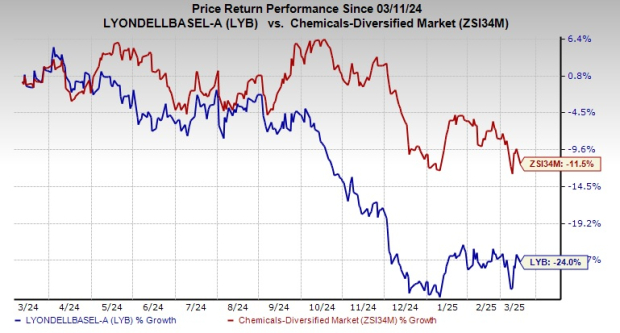

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Investment Insights

Currently, LYB holds a Zacks Rank #5 (Strong Sell). However, other stocks in the basic materials sector present more favorable conditions.

Prominent companies include Carpenter Technology Corporation (CRS), ArcelorMittal (MT), and Axalta Coating Systems Ltd. (AXTA). Carpenter Technology features a Zacks Rank #2 (Buy) and has consistently exceeded the Zacks Consensus Estimate over the last four quarters, with an average earnings surprise of 15.7%. Its stock has appreciated by 218.2% in the last year.

ArcelorMittal’s current year earnings estimate stands at $3.72 per share, maintaining a Zacks Rank #2. The company has surpassed the Zacks Consensus Estimate in three of the previous four quarters, yielding an average earnings surprise of 4.11%.

Axalta Coating Systems, rated Zacks Rank #1, has beaten consensus estimates across the past four quarters with an average earnings surprise of approximately 16.3%. Its stock has grown by 10.7% year to date.

Stock Prospects for Significant Growth

Experts have recently identified five stocks with a strong potential for significant gain. Among these, Zacks’ Director of Research, Sheraz Mian, emphasizes one stock positioned for outstanding growth, leveraging its innovative approach and expanding customer base of over 50 million.

This leading candidate boasts promising solutions and could potentially outperform previous top picks, such as Nano-X Imaging, which surged by 129.6% in less than nine months.

For more insights and stock recommendations, visit the Zacks Investment Research platform. Click here for the latest analysis on top stocks.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.