Esteemed readers and followers,

Maersk reported its full-year results today. As an investor, my journey with Maersk has been nothing short of a rollercoaster ride – from the tumultuous dip in November 2023 to the current revival, which has seen a formidable 19% surge as of the time of writing this article.

Valuation for the company has fared unfavorably over the past 10 months, as was the case for many companies in 2023. For an investor like myself, conditioned to the ebb and flow of the market, such fluctuations are par for the course.

In this article, we’ll revisit Maersk, analyze its 4Q performance, and most importantly, forecast its trajectory from here.

Maersk – Revisiting Upside

Despite the myriad challenges faced by shipping companies, I firmly maintain my belief in significant upside for Maersk and reaffirm my “BUY” rating. Over the past decade, Maersk has undergone a remarkable transformation, transitioning to a more streamlined, ocean-focused business model, which bodes well for sustainable long-term growth. The burgeoning logistics segment, in particular, provides favorable exposure to a less asset-intensive sector while leveraging synergies with existing customers.

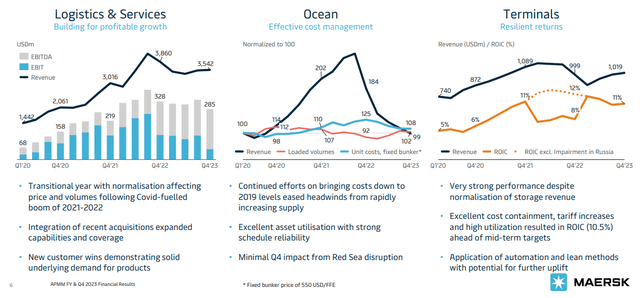

The ocean remains the core revenue driver, constituting over 60% of Maersk’s top-line revenue. Although the prevailing challenges in freight rates present an enduring obstacle, I am optimistic about the company’s overall prospects. Like its counterparts, Maersk is consolidating its assets through alliances with other carriers, enhancing operational efficiency and rationality.

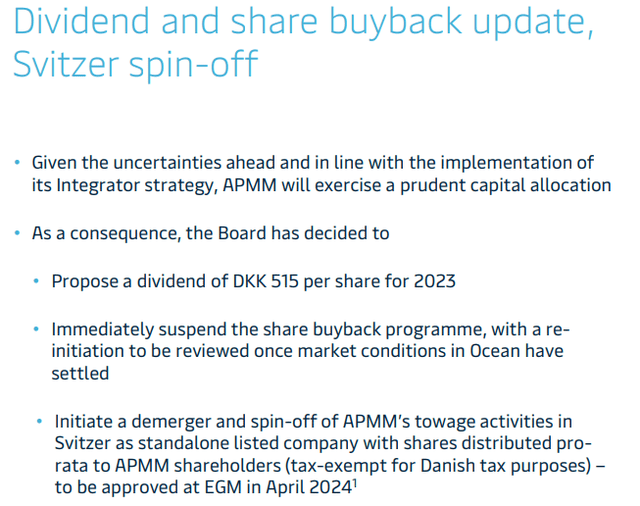

Amid the financial turbulence of 2023, Maersk achieved its guidance, yielding revenues of over $51 billion with an underlying EBITDA close to $10 billion, and a commendable underlying EBIT margin of almost 8%. The company’s decisive cost management in the face of deteriorating market conditions underscores its resilience. Furthermore, 2023 witnessed the company’s largest share buyback and dividend in its history, indicative of astute capital allocation in adverse conditions.

The Red Sea/Gulf of Aden conflict, while marginally impacting 4Q, is anticipated to reverberate into 2024, a factor already factored into the company’s updated 2024E guidance.

However, Maersk’s dividend proposal of 515 DKK/share marks a significant departure from its previous levels, causing the yield to dip below 5%. This substantial dividend cut has likely precipitated the market’s reaction, yet it’s essential to place it in the context of the company’s ongoing strategic transformation.

The company’s mutable approach and the surprises unveiled in the annual report signify that Maersk is entrenched in a sweeping transformation. While the terminal segment boasts stable return rates, the ocean segment remains enigmatic, characterized by fluctuating freight rates and revenues.

Compounding the challenge is the fact that the highly profitable and predictably accurate segments account for less than 25% of the company’s sales.

Predictably, the current trends in the Red Sea are likely to exacerbate in 1Q, further complicating Maersk’s outlook.

Similar to many long-term investments, Maersk necessitates a horizon of at least 3-5 years. The company’s ongoing strategic transformation demands patience and fortitude, both virtues essential for weathering the market’s inherent volatility.

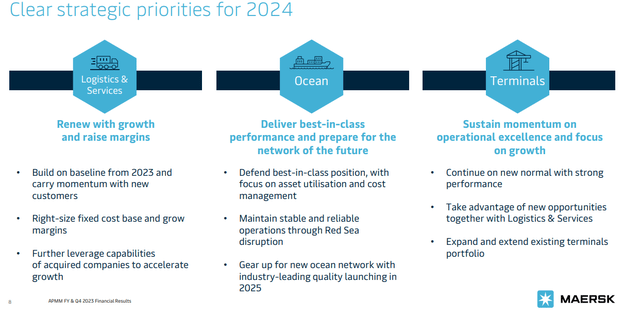

The company has laid out unequivocal priorities for this year.

Maersk: Navigating Stormy Waters in 2024E

As we navigate the stormy waters of 2024E, uncertainty looms large for the global shipping giant, Maersk. The company is bracing for what seems to be a tumultuous period, prompting investors and analysts to scrutinize its position in the market with keen interest. Shifts in consumer demand, industry headwinds, and the company’s strategic adaptations are all key factors in this high-stakes drama.

2024E Projections: Facing the Trough

According to current projections, 2024E is anticipated to be a trough year for Maersk. Expectations are rife that free cash flow (FCF) and underlying earnings before interest and taxes (EBIT) could potentially dip into negative territory, adding to the already chaotic landscape the company is poised to traverse.

Maersk – Risks & Upside

In assessing the risks and potential upsides for Maersk, the company’s exposure to short-term volatilities stands out prominently. While some analysts anticipate a temporary downturn in consumer demand, there remains a consensus that this trend is transitory and likely to dissipate. However, the specter of a recession-induced demand slump leading to plummeting freight rates casts a shadow of uncertainty over the company’s earnings outlook.

Furthermore, Maersk’s foray into new segments such as terminals and logistics introduces additional risk factors, given the dependence on throughput volume.

Contrariwise, the company’s strategic restructuring has yielded operational efficiencies and a leaner operational approach, positioning Maersk for long-term gains. Despite the challenging landscape, the company’s scale and enduring quality remain pivotal attributes, offering glimmers of positivity in the event of a market reversal.

Maersk Valuation – Weathering the Storm

Addressing the company’s valuation, analysts underline the robust moat safeguarding Maersk, owing to its prominence in the oceanic and APM terminals, where it holds the first and second positions respectively on the global stage. While these businesses contend with periodic overcapacity-induced competition, a normalization trend over time underscores the company’s enduring market strength. Despite the prevailing headwinds, Maersk offers one of the most promising investments in the sector, particularly amidst the recent stock price decline.

The prevailing forecasts portend a notably adverse trajectory for Maersk, which is endemic to the volatility characterizing the industry. However, for astute investors with a long-term view, this period of turmoil could present an opportune entry point.

Thesis: Anchoring Resilience

- This company is one of the world’s most pivotal shipping entities, entwined with the broader macroeconomic landscape, meriting a strong “BUY” recommendation.

- The company’s current valuation portrays it as fairly or slightly undervalued amidst an unparalleled logistical crisis, representing a compelling investment proposition.

- At my target price of 13,500 DKK/share, updated for late November 2023, Maersk’s resilience and long-term potential beckons astute investors to reconsider their positions in the company.

- Adhering to an investment philosophy of buying undervalued companies, locking in gains at appropriate junctures, and reinvesting to capitalize on market dynamics, Maersk aligns with my investment approach.

Remember, I’m all about:

- Purchasing undervalued companies to capitalize on normalized valuations over time, while accruing dividends and capital gains.

- Strategically harnessing overvaluation to reap gains and reallocate investments into undervalued stocks, ensuring a dynamic portfolio mix.

- Continuously reinvesting dividends and other income sources to perpetuate a compounding effect, thereby enhancing the long-term investment horizon.

- Validating my criteria for investment, ensuring qualitative strength, prudent financial management, sustainable dividend payments, and a compelling growth perspective.

In light of the multifaceted landscape, Maersk seemingly aligns with a majority of investment criteria and beckons contemplation, albeit against the backdrop of a shifting valuation paradigm.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.