Magna International Reports Mixed Results, Stock Gains 11.7%

Shares of Magna International (MGA) have increased by 11.7% following the release of its third-quarter 2024 financial results. The company reported adjusted earnings of $1.28 per share, down from $1.46 in the same quarter last year, and falling short of the Zacks Consensus Estimate of $1.48.

Net sales decreased by 3.8% year over year to $10.3 billion, also missing the Zacks Consensus Estimate of $10.6 billion.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

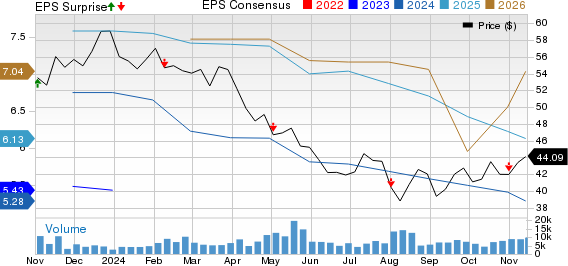

Magna International Inc. Price, Consensus, and EPS Surprise

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

Segment Performance Overview

The Body Exteriors & Structures segment saw revenues drop to $4.04 billion, a 4% decline from the previous year. This downturn resulted from the conclusion of certain production programs, lower outputs on some projects, divestitures, and customer price concessions. Revenues also fell below the Zacks Consensus Estimate of $4.32 billion. Adjusted EBIT for this segment was $273 million, down from $358 million a year ago, missing the Zacks Estimate of $345 million due to heightened production costs and lower sales.

The Power & Vision segment, in contrast, experienced a 2% revenue increase to $3.84 billion, driven by new program launches, price hikes, favorable currency translations, and benefits from acquisitions. This figure exceeded the Zacks Consensus Estimate of $3.83 billion. Adjusted EBIT rose from $221 million to $279 million, also surpassing the Zacks Estimate of $228 million.

Meanwhile, Seating Systems revenues fell by 10% year over year to $1.38 billion, missing the Zacks Consensus Estimate of $1.46 billion due to lower production levels. The adjusted EBIT slipped from $70 million to $51 million, falling short of the $54 million estimate.

Finally, revenues in the Complete Vehicles segment decreased by 2% year over year to $1.16 billion, attributed to lower assembly volumes. However, this figure surpassed the Zacks Consensus Estimate of $1.13 billion. The segment’s adjusted EBIT improved to $27 million, compared to a loss of $5 million the previous year, and exceeded the Zacks Estimate of $8.98 million.

Financial Snapshot

As of September 30, 2024, Magna reported $1.06 billion in cash and cash equivalents, down from $1.2 billion on December 31, 2023. Long-term debt increased to $4.91 billion from $4.18 billion during the same period.

For the reported quarter, cash generated from operating activities totaled $727 million, which is lower than the previous year’s $797 million.

Magna declared a third-quarter dividend of 47.5 cents per common share, set to be paid on November 29, 2024, to shareholders registered by November 15, 2024.

Revised Outlook for 2024

Magna has updated its financial projections for the year. It now anticipates revenues between $42.2 billion and $43.2 billion, down from the earlier range of $42.5 billion to $44.1 billion. The adjusted EBIT margin is expected to be between 5.4% and 5.5%, revised from 5.4% to 5.8%. Additionally, adjusted net income is predicted to be between $1.45 billion and $1.55 billion, a reduction from the earlier estimate of $1.5 billion to $1.7 billion. Capital expenditures are now projected to range from $2.2 billion to $2.3 billion, down from the previous estimate of $2.3 to $2.4 billion.

Zacks Rank & Noteworthy Picks

Currently, WPRT holds a Zacks Rank #5 (Strong Sell).

In contrast, other auto stocks like Dorman Products, Inc. (DORM), Tesla, Inc. (TSLA), and BYD Company Limited (BYDDY) are all rated Zacks Rank #1 (Strong Buy). For a complete list of Zacks’ top-ranked stocks, view the rankings here.

The Zacks Consensus Estimate suggests DORM will see year-over-year sales and earnings growth of 3.66% and 51.98%, respectively. EPS estimates for 2024 and 2025 have increased by 75 cents and 88 cents in the last month.

For TSLA, the 2024 sales estimate indicates a year-over-year growth of 2.85%, with EPS estimates improving by 22 cents and 18 cents for 2024 and 2025, respectively.

BYDDY is projected to experience sales and earnings growth of 25.07% and 31.51%, respectively, with EPS estimates rising by 35 cents and 39 cents for 2024 and 2025.

Emerging Opportunities in Solar Stocks

The solar sector is on the verge of a resurgence as companies adapt to a future focused on clean energy and away from fossil fuels. Financial investments into clean energy are expected to soar, with solar anticipated to make up a significant portion of this growth.

Investors who choose wisely could benefit significantly in the coming years.

Discover Zacks’ latest solar stock recommendations for potential gains in this booming market.

Want the latest insights from Zacks Investment Research? Today, you can download “5 Stocks Set to Double” for free.

Magna International Inc. (MGA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

Byd Co., Ltd. (BYDDY): Free Stock Analysis Report

For more information, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.