We’ve seen awe-inspiring results from three major players in the stock market: Microsoft MSFT, Meta Platforms META, and Amazon AMZN, solidifying their position as leaders in this domain. These companies, along with their counterparts in the ‘Magnificent 7’ group of stocks – Apple AAPL, Alphabet GOOGL, Tesla TSLA, and Nvidia NVDA – led the market to new heights last year, and this momentum has continued in the current year.

Despite a disappointing performance by Tesla, reflecting the fourth consecutive quarter of unsatisfactory results, all other members of the ‘Mag 7’ that have reported have posted impressive growth numbers. Although the market was not particularly impressed with the Alphabet and Apple reports, they still managed Q4 earnings growth of +51.8% and +13.1%, respectively.

On the contrary, Tesla’s earnings slumped by -45.8% in Q3, with a mere +3.5% increase in revenues, as the EV-maker continued to grapple with weakening margins in an increasingly competitive EV market.

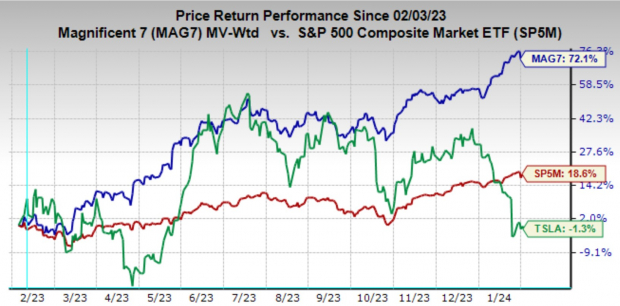

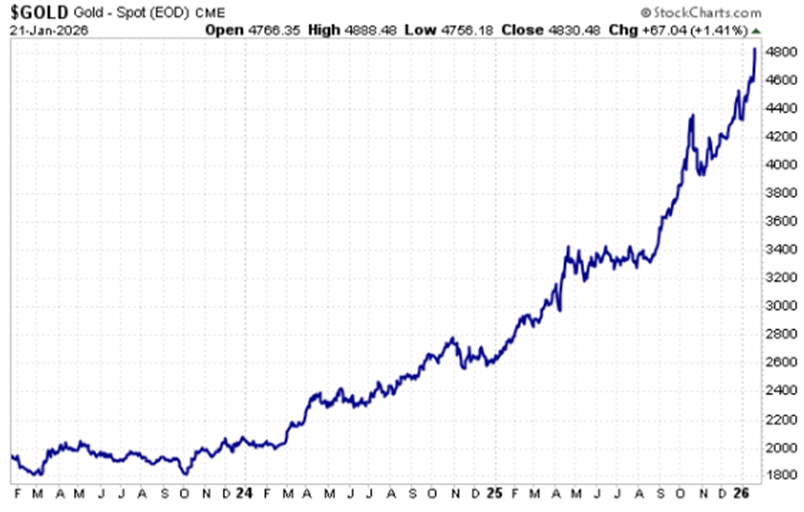

The one-year performance of the Magnificent 7 stocks relative to the S&P 500 index and Tesla is depicted in the chart below:

Image Source: Zacks Investment Research

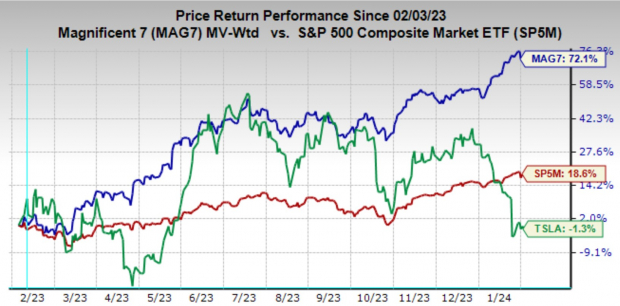

The chart below illustrates the January 2024 performance of this distinguished group:

Image Source: Zacks Investment Research

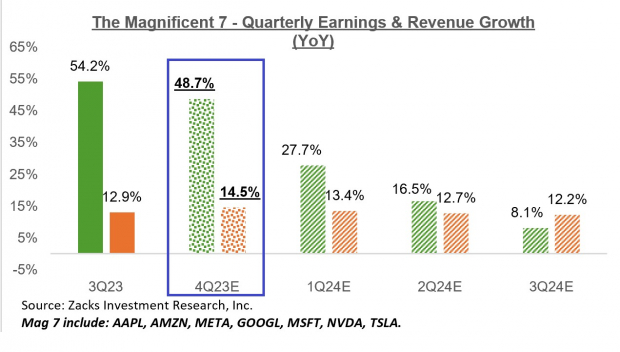

Utilizing estimates for Nvidia’s upcoming December-quarter results on February 21st, along with the actual results for the other six members, the total Q4 earnings for the group are expected to surge by +48.7% from the same period last year, on +14.5% higher revenues.

The chart below demonstrates the group’s Q4 earnings and revenue growth performance in the context of the previous quarter and the expected performance for the next three quarters:

Image Source: Zacks Investment Research

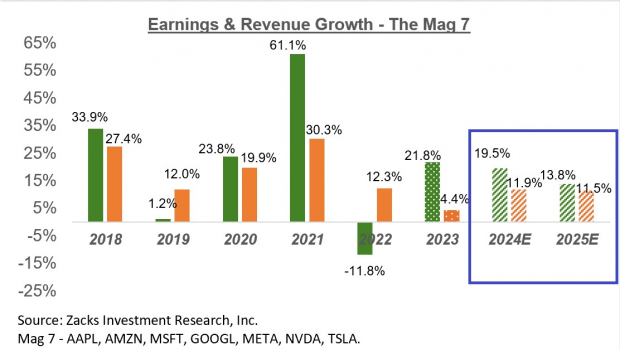

The group’s earnings and revenue growth picture on an annual basis is depicted in the chart below:

Image Source: Zacks Investment Research

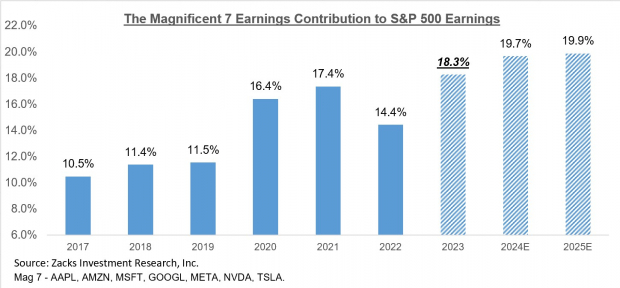

It’s important to note that the Mag 7 companies currently account for 28.6% of the S&P 500 index’s total market capitalization and are expected to contribute 19.5% to the index’s total earnings in 2024. For 2023 Q4, the Mag 7 group held a weightage of 23.1%, contributing to 23.1% of all S&P 500 earnings.

The chart below shows the group’s earnings contribution to the index over time, as well as the current expectations for the next two years:

Image Source: Zacks Investment Research

Given their significant earnings power and growth profiles, it’s hard to deny the market leadership exhibited by this group. Importantly, analysts had been revising their estimates for the group even before the December-quarter results, and these numbers are now contributing to the positive revision momentum.

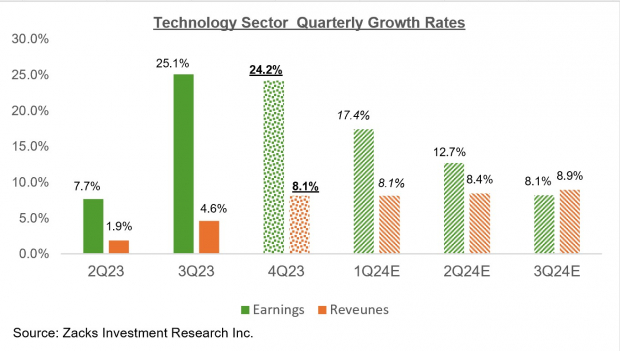

Looking beyond these mega-cap players, the total Q4 earnings for the Technology sector as a whole are anticipated to surge by +24.2% from the same period last year, on +8.1% higher revenues.

The chart below presents the sector’s Q4 earnings and revenue growth expectations in the context of recent quarters and the expected growth in the coming periods:

Image Source: Zacks Investment Research

The Earnings Big Picture

The chart below displays the achieved earnings and revenue growth rates over the preceding four quarters, along with the current earnings and revenue growth expectations for the S&P 500 index for 2023 Q4 and the following three quarters:

Image Source: Zacks Investment Research

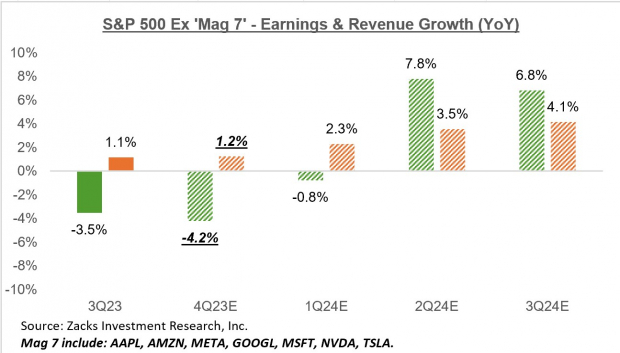

This week’s groundbreaking Tech results have bolstered the overall aggregate earnings growth of the S&P 500 index to +4.3%, an increase from last week’s +1.1% growth rate. Excluding the contribution from the Mag 7 stocks, Q4 earnings for the rest of the index would be down by -4.2%, as shown in the chart below:

Image Source: Zacks Investment Research

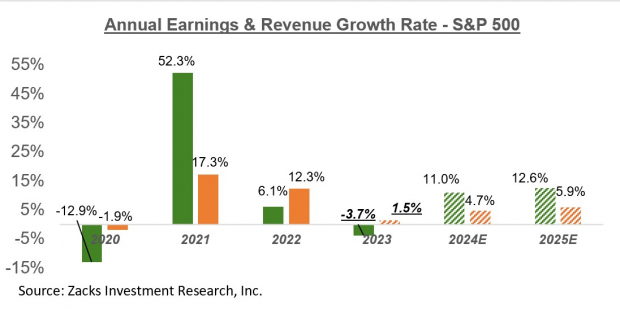

The chart below illustrates the earnings picture on an annual basis:

Image Source: Zacks Investment Research

Q4 Earnings Season Scorecard

With results from 230 S&P 500 members released through Friday, February 2nd, we have witnessed Q4 results from 46% of the index’s total membership.

This upcoming week boasts over 500 companies set to report their results, including 106 S&P 500 members. The lineup is impressive and includes big players such as Disney, Elli Lilly, MacDonalds, DuPont, Caterpillar, Ford, Pepsi, Chipotle, Uber, PayPal, and Expedia, among others.

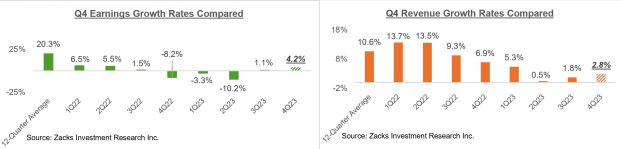

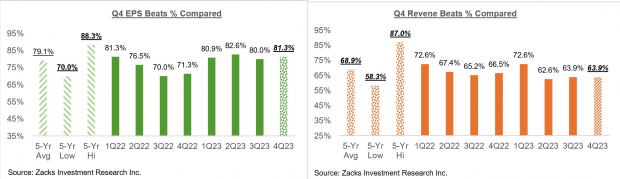

The 230 index members that have reported already have seen a +4.2% increase in total Q4 earnings from the same period last year, with +2.8% higher revenues. 81.3% of companies have surpassed EPS estimates, and 63.9% have exceeded revenue estimates.

The comparison charts below offer historical context for the Q4 earnings and revenue growth rates:

Image Source: Zacks Investment Research

Similarly, the following comparison chart provides historical context for the Q4 EPS and revenue beat percentages:

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>

The Magnificent 7: Tech Companies Lead in Q4 Earnings Report

Investors have reason to celebrate as tech companies have emerged as seemingly invincible powerhouses, as evident from the Q4 earnings report. Citing an impressive +974.1% gains, nearly tripling the S&P 500’s +340.1%, the Zacks Top 10 Stocks for 2024 confidently flaunts its success.

Top Stocks for 2024: A Glimpse into the Future

Cutting through the dizzying array of 4,400 companies covered by the Zacks Rank, Sheraz Mian seemed to have stumbled upon a prosperity potion, handpicking the 10 best stocks to buy and hold in 2024. The market has been stunned by their consistent success through the years. In the tumultuous financial landscape, these 10 top tickers offer a glimmer of hope, credible enough to serve as lifeboats for investors navigating stormy seas.

The formidable growth displayed by tech giants is more than just a momentary dazzle; it epitomizes a formidable legacy. History has witnessed the digital world mushrooming into a colossus of influence, with tech companies ruling the roost in financial markets, impervious and unshakeable. The Q4 earnings report signifies the blatant ascension of tech companies as the undisputed monarchs of the economic realm.

Unraveling the Success Stories

Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA), Tesla, Inc. (TSLA), Alphabet Inc. (GOOGL), and Meta Platforms, Inc. (META) have all emerged as market champions, solidifying their positions and demonstrating unwavering dominance. These success stories narrate the tale of cutting-edge innovation, foresight, and resilience, which has secured their positions as the titans of Wall Street.

Tech’s Unrivaled Dominance: An Everlasting Legacy

The magnificence of their performance is reminiscent of the fabled phoenix rising from its own ashes. Each earnings report not only cements their position but also amplifies their grandeur, underlining the enigma that is the tech industry. The exponential growth signifies the unyielding spirit that propels these companies to conquer new frontiers, seemingly impervious to any form of downturn; their trajectory seems to only point upwards.

The Q4 earnings report serves as a reminder of the everlasting legacy that these tech companies have etched in the annals of financial history. With an unwavering commitment to innovation and an insatiable hunger for growth, they continue to write their success stories in indelible ink, enticing investors to accompany them on this never-ending rollercoaster ride.