Enhanced Price Target Snapshot

Sit up and take notice as the price target for Mahindra & Mahindra (NSEI:M&M) experiences a thrilling hike, shooting up by a significant 5.68% to a commendable 1,903.06 / share. This uplift, dated January 16, 2024, marks a stark contrast from the prior estimate of 1,800.77.

Analysts have spoken, and this revised price target, derived from a spectrum of estimates, spans from a respectable low of 1,215.03 to an ambitious high of 2,336.25 / share. Even more intriguing is how this average price target actually represents a slight 1.41% decrease from the latest closing price of 1,930.20 / share.

A Steady Dividend Yield

Mahindra & Mahindra Maintains 0.84% Dividend Yield

At current evaluations, the company continues to boast a steadfast dividend yield of 0.84%.

Dive deeper into the data, and you’ll find the dividend payout ratio resting at a mere 0.16, shedding light on how much of the company’s income goes into dividend payouts. Understanding the payout ratio is crucial – a value exceeding 1 denotes the company delving into its savings to sustain dividends, which is hardly a rosy scenario. In contrast, businesses with limited growth potential often funnel most of their earnings into dividends, typically reflecting a payout ratio between 0.5 and 1.0. On the flip side, companies with promising growth prospects tend to reserve earnings to reinvest, showcasing a prudent payout ratio of zero to 0.5.

Encouragingly, the company’s 3-Year dividend growth rate stands at a respectable 5.91%, a testament to its praiseworthy upward trajectory in dividend offerings.

Diving into Fund Sentiment

What is the Fund Sentiment?

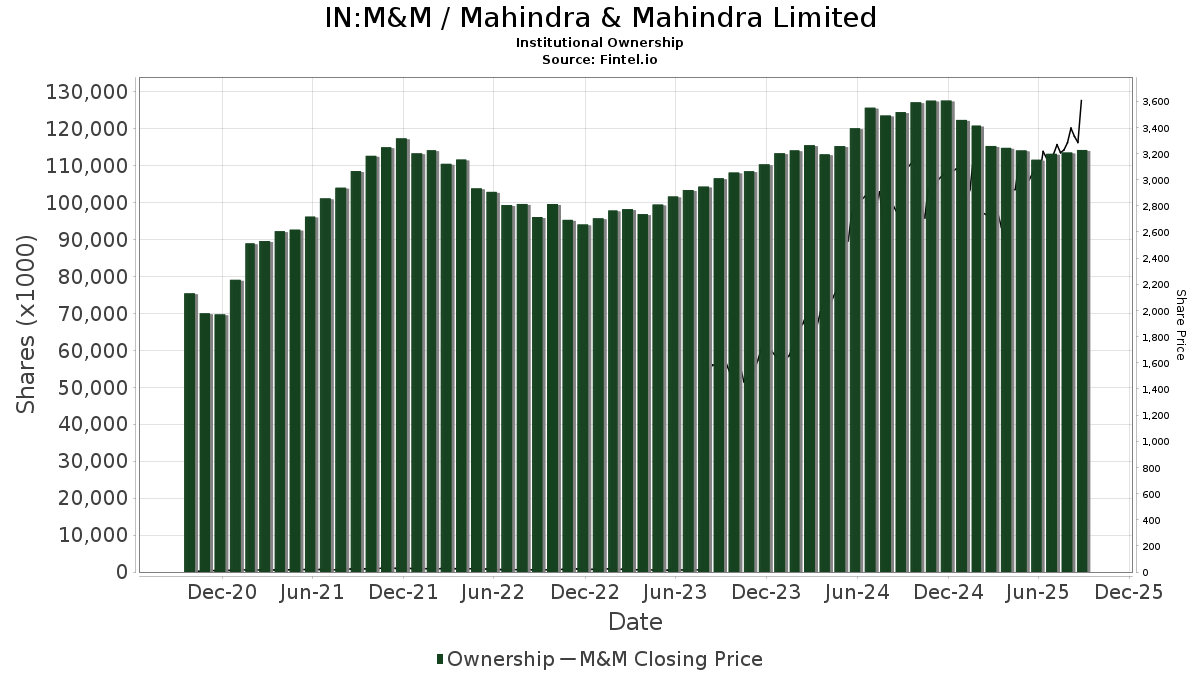

A thorough examination reveals that a whopping 231 funds or institutions have divulged their positions in Mahindra & Mahindra, showcasing an increase of 11 owner(s) or a solid 5.00% surge in the past quarter. Peruse the statistics further, and you’ll discover that the average portfolio weight across all funds dedicated to M&M now stands at a noteworthy 0.65%, escalating by an impressive 5.61%. Furthermore, total institutional shares owned surged by a commendable 7.84% over the past three months, now resting at 115,312K shares.

Insight into Other Shareholders

VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares proudly holds 12,826K shares, constituting a commendable 1.15% ownership of the company. Delve into the recent filing, and you’d observe that the firm disclosed an ownership of 12,865K shares previously, signaling a modest 0.31% decrease. Impressively, the firm augmented its portfolio allocation in M&M by an impressive 10.29% in the last quarter.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares secured 12,734K shares, reflecting a solid 1.14% ownership of the company. A closer look back reveals that the firm previously reported owning 12,543K shares, indicating a commendable 1.50% increase. Interestingly, the firm ramped up its portfolio allocation in M&M by a commendable 10.02% over the last quarter.

IEMG – iShares Core MSCI Emerging Markets ETF embraced 8,566K shares, equating to a promising 0.77% ownership of the company. In comparison to its prior filing, the firm had 8,551K shares in possession, translating to a modest 0.18% increase. Evidently, the firm augmented its portfolio allocation in M&M by a respectable 3.24% over the last quarter.

INDA – iShares MSCI India ETF clinched 5,577K shares, denoting a valuable 0.50% ownership of the company. If you mull over its prior filing, the firm reported a holding of 5,603K shares, showcasing a notable 0.47% decrease. However, the firm retrenched its portfolio allocation in M&M by an earnest 3.24% over the last quarter.

QCSTRX – Stock Account Class R1 netted 4,917K shares, resulting in a commendable 0.44% ownership of the company. Reflect on the prior filing, and you’d discern that the firm previously owned 4,009K shares, indicating an astonishing 18.45% increase. Astoundingly, the firm magnified its portfolio allocation in M&M by a staggering 36.11% over the last quarter.

Fintel invites you to delve into the depths of investing research in a comprehensive manner, catering to individual investors, traders, financial advisors, and small hedge funds alike.

Spanning the global landscape, our data portfolio encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading insights, options flow, unusual options trades, and a myriad of other offerings. Moreover, our exclusive stock picks are propelled by cutting-edge, backtested quantitative models to foster enhanced profitability.

Uncover more insights – Dive Into the World of Fintel!

This narrative was first featured on Fintel.

The perspectives conveyed in this article are that of the author alone and may not necessarily mirror those of Nasdaq, Inc.