TSMC Expands Horizons: A Bright Future for Semiconductor Manufacturing

It’s TSMC’s world; the rest of us are just living in it. 2024 is shaping up to be a strong year for Taiwan Semiconductor Manufacturing (NYSE: TSM), the global leader in advanced semiconductor manufacturing.

A Strategic Expansion Amid Global Challenges

The company is investing billions in factories in Arizona to address geopolitical tensions with China. Just last week, TSMC made significant progress with its factories in the United States.

Understanding Chip Yields and Their Significance

TSMC’s Arizona plant is on track for commercial production in 2025. As the facility prepares to operate, the focus is on the yield of semiconductor wafers produced. These wafers are essential in creating advanced computer chips for major players like Apple and Nvidia, particularly as these chips drive the artificial intelligence (AI) revolution. Higher yields indicate that more wafers are functioning correctly, which is crucial for production efficiency.

Recently, TSMC revealed a 4% increase in yields at its Arizona facility compared to its Taiwanese factories. This is significant news for investors and analysts who were skeptical about TSMC’s ability to replicate its success outside of Taiwan, a long-standing hub of semiconductor manufacturing with deep expertise.

The improved yields suggest that TSMC can produce more semiconductors without increasing costs, which could enhance profits. Previously, there were concerns that lower yields in Arizona could have reduced profit margins as new factories were established. These concerns appear to be easing.

AI Demand Continues to Surge

The new facilities in Arizona, as well as those in Japan and Europe, are positioned to play a vital role in the burgeoning AI market over the next five to ten years. TSMC is uniquely capable of producing top-tier semiconductors for companies like Nvidia, which is essential for powering data centers amid the escalating AI spending.

As AI investments flourish, TSMC’s revenue is expected to rise accordingly. In the last quarter, the company’s high-performance compute (HPC) segment saw an 11% increase, now representing 51% of total sales—a significant jump from 39% just two years ago. This segment focuses on advanced semiconductors for data centers, primarily driven by AI needs.

Investors should closely monitor the HPC segment, as it is now the majority of TSMC’s revenue and is growing rapidly. If demand in the data center sector persists, TSMC’s revenues should maintain strong growth. With wafer yields approaching those of Taiwan, profit margins remain robust, with the latest operating margin reported at an impressive 47.5%.

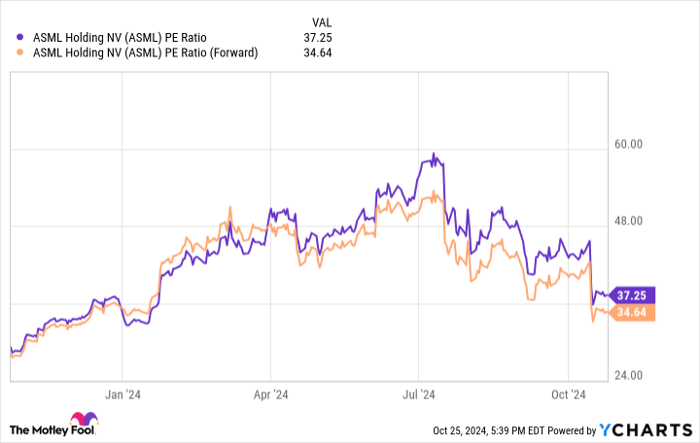

ASML PE Ratio data by YCharts

High Earnings Ratio Reflects Market Optimism

With rising sales and profits, TSMC’s stock has surged. Over the past year, shares have increased by more than 100%, even briefly surpassing a market cap of $1 trillion.

As a result, the stock’s price-to-earnings ratio (P/E) has reached 31, which is higher than the average for the S&P 500 index. Some investors may shy away from TSMC because of its premium valuation. However, this perspective may overlook TSMC’s history of solid earnings growth and the positive momentum from AI spending. Over the last decade, the company’s earnings per share (EPS) have increased nearly 300%.

Despite the lofty valuation, TSMC stock could be a worthy investment for those who believe in the future of AI. The company’s ongoing expansion solidifies its status as a leader in the semiconductor market, demonstrating an ability to replicate success in different regions.

Is it Time to Invest $1,000 in TSMC?

Before investing in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe to be the 10 best stocks to buy now, and TSMC was not among them. The selected stocks have the potential for significant future returns.

Consider that if you had invested $1,000 in Nvidia when it was listed on April 15, 2005, you would have seen your investment grow to $829,746!*

Stock Advisor offers investors a straightforward strategy for achieving success, including portfolio-building guidance and regular updates from analysts, with two new stock recommendations each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than four times.

View the 10 stocks »

*Stock Advisor returns as of October 28, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.