“`html

S&P 500 Earnings Show Solid Growth Amid Estimate Revisions

Note: The following is an excerpt from this week’s earnings Trends report. For the full report containing detailed historical actuals and estimates for current and future periods, please click here.

Key Highlights:

- Total Q1 earnings for the 456 S&P 500 members that have reported results are up +12.1% from the same period last year, accompanied by +4.5% higher revenues. Approximately 73.9% surpassed EPS estimates, while 62.1% exceeded revenue estimates.

- This earnings season appears less focused on Q1 results and more on assessing the earnings impact of the evolving macroeconomic and public policy environment. Management commentary remains largely reassuring despite overall uncertainty.

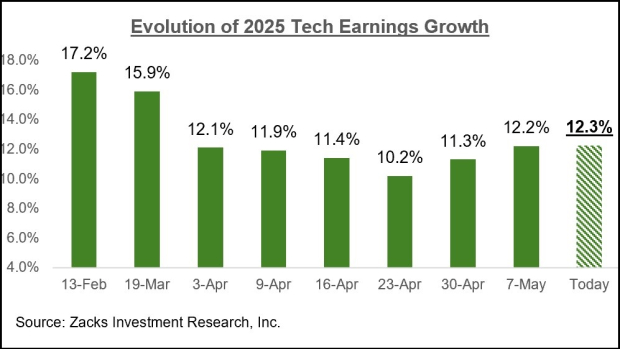

- Current estimates for Q2 2025 are facing pressure, with adjustments showing larger declines compared to recent post-COVID periods. However, estimates for the Tech sector have shown signs of stabilization recently.

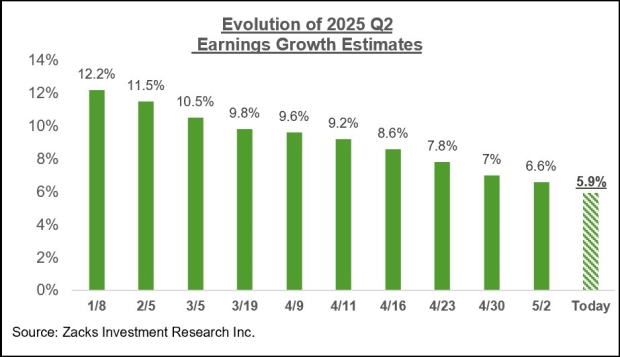

- For Q2 2025, total S&P 500 earnings are projected to rise +5.9% year-over-year, with revenues increasing by +3.8%. Despite this growth expectation, Q2 estimates have been revised downward significantly.

Trends in Q2 Earnings Estimates

The beginning of Q2 saw increased tariff uncertainty following the April 2nd tariff announcements. While the implementation of these levies was pushed back by three months, it has undoubtedly influenced estimates for upcoming quarters.

Currently, Q2 earnings for the S&P 500 index are expected to increase by +5.9% compared to last year, with revenues climbing by +3.8%. The evolution of Q2 earnings growth expectations since the start of the year is displayed in the chart below.

Image Source: Zacks Investment Research

It’s common for estimates to be adjusted lower; however, the extent of the Q2 estimate reductions exceeds what has been observed in comparable periods in recent quarters.

Since the quarter commenced, 13 of the 16 Zacks sectors have seen estimates decline, with the most significant drops occurring in the Transportation, Autos, Energy, Construction, and Basic Materials sectors.

Estimates for the two largest earnings contributors to the index—Tech and Finance—have also decreased since the quarter’s outset.

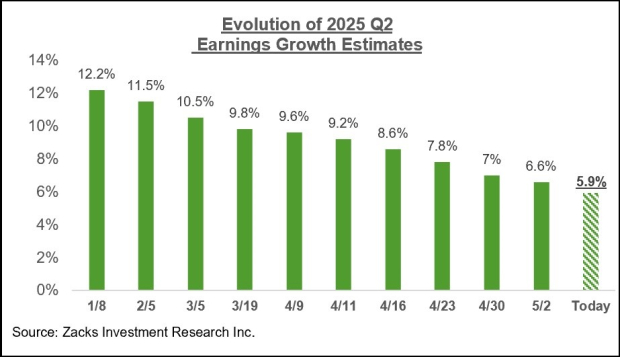

In particular, the Tech sector’s earnings are anticipated to rise by +12.4% in Q2 on +9.8% higher revenues. While these growth projections are lower than initial estimates in April, there has been a recent reversal in the revisions trend, which is notable.

Image Source: Zacks Investment Research

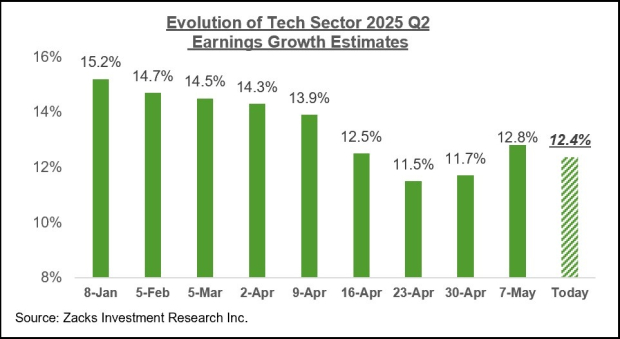

This positive shift in the Tech sector’s revision trend is also reflected in full-year 2025 expectations, as shown in the chart below.

Image Source: Zacks Investment Research

It’s too early to determine the durability of this reversal in the Tech sector’s estimates. However, the recent uptick in Q2 estimates suggests that this growth is not solely a result of strong Q1 earnings reports from major players.

For example, the current Q2 Zacks Consensus EPS estimate for Alphabet (GOOGL) is $2.12, down from $2.15 on April 4th but up from $2.08 on April 25th. Similarly, Meta (META) has a Q2 EPS estimate of $5.84, lower than $5.94 from April 4th but higher than $5.70 on May 2nd. Microsoft (MSFT) shows a similar pattern, with the current estimate slightly improved from early April.

We will continue to closely monitor the revisions in the Tech sector in the upcoming weeks.

The Broader Earnings Perspective

The following chart outlines expectations for 2025 Q1 alongside actuals from the previous four periods and current forecasts for the next three quarters.

Image Source: Zacks Investment Research

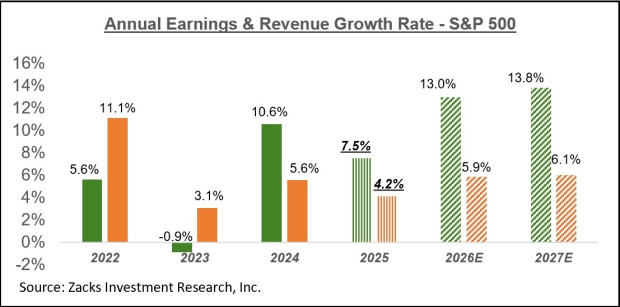

Another chart provides an annual overview of the earnings picture for the S&P 500 index.

Image Source: Zacks Investment Research

Although estimates for this year have begun to decline, the forecasts for the next two years remain largely unchanged at this stage.

With widespread concerns surrounding the growth momentum of the economy, it is reasonable to anticipate further reductions in estimates as the tariffs’ effects are reflected in the data.

The slight negative GDP reading for the first quarter represented the anticipatory impacts of the trade policies, notably as importers prepared for the new tariffs by stocking up supplies.

Market Insights

Zacks’ Research Chief has identified stocks with the highest potential for substantial gains in the near term.

This analysis focuses on stocks that are positioned for significant growth based on current market dynamics. The top selections provide a diverse range of opportunities that can capture investor interest.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`