A Surprising Turnaround

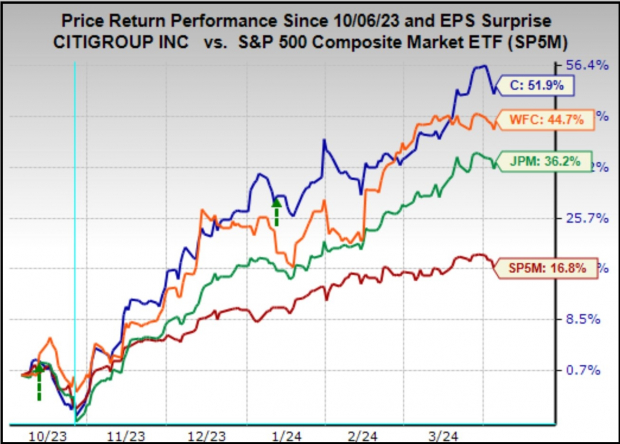

Citigroup’s recent stock performance has been nothing short of impressive, leaving industry giants like JPMorgan and Wells Fargo trailing in its wake. The bank has outperformed the S&P 500 index by a significant margin, showcasing a remarkable +19.8% gain compared to the index’s +6.3% this year.

Hope Amidst Hardship

The road for Citigroup shareholders has been tumultuous, with the bank losing -6.8% over the past five years while its counterparts enjoyed significant gains. However, a newfound optimism surrounds Citigroup, attributing its resurgence to a strategic restructuring plan implemented by the new management team.

Charting a New Path

As Citigroup prepares to announce its Q1 results, investors eagerly anticipate insights into the company’s restructuring progress. Analysts predict a year-over-year decline in earnings but emphasize the potential for a turnaround, particularly in terms of expense management and long-term restructuring benefits.

Riding the Wave

JPMorgan, set to announce earnings alongside Citigroup, is expected to showcase positive year-over-year growth, buoyed by favorable industry trends and increased activity in the capital markets. The banking sector, although facing challenges, hints at promising developments like M&A activity and IPO growth.

Industry Trends and Valuations

The Zacks Major Banks industry, including Citigroup, JPMorgan, and Wells Fargo, is projected to experience a decline in earnings in Q1 2024. Despite this, the sector contributes significantly to the overall Finance sector’s earnings, depicting a mixed outlook for the banking industry.

Valuation metrics indicate that big bank stocks remain attractively priced even after recent outperformance. The forward 12-month P/E ratios reveal a historically discounted industry compared to the broader market, pointing towards potential investment opportunities.

Future Prospects and Earnings Insights

The upcoming earnings reports from key players in the banking sector set the stage for investors to assess industry performance and future prospects. As market conditions evolve, the spotlight shifts to potential opportunities within the financially sensitive banking space.

Early Q1 earnings reports show promising growth for S&P 500 members, indicating positive trends in both earnings and revenues. While early to draw definitive conclusions, these reports provide valuable insights into market dynamics and potential growth trajectories for the sector.

The Tech Sector Renaissance: A Bright Light in the Earnings Picture

The Earnings Overview

In the realm of financial markets, where projections and estimates reign supreme, the first quarter of 2024 has unfolded with a mix of optimism and caution. Total S&P 500 earnings for Q1 are anticipated to rise by a modest +2.3% compared to the same period the prior year, propelled by a +3.4% uptick in revenues. These figures, albeit positive, mark a slight slowdown from the preceding quarter’s +6.7% earnings growth and +3.9% revenue expansion. As the figures play out, investors are keeping a keen eye on the performance of the leading sectors, notably the Technology sector.

Industry Insights

As the curtains rise on the Q1 earnings season, patterns emerge that foretell a nuanced tale of sectoral performances. Noteworthy shifts in estimates have been witnessed across various industries, with Energy, Autos, Basic Materials, and Transportation facing downward revisions while Retail, Consumer Discretionary, and Tech enjoy upward adjustments, painting a dynamic tapestry of the current economic landscape. Amidst these fluctuations, the Technology sector stands out as a beacon of growth and innovation, poised to play a pivotal role in shaping the aggregate earnings scenario.

The Tech Sector Resurgence

After navigating through a phase of post-COVID adjustments in 2022 and the first half of 2023, the Technology sector is now staging a robust comeback. Expected to post a remarkable +19.3% earnings growth in Q1 2024, accompanied by a +8.4% rise in revenues, the sector signifies a renewed vigor that reverberates throughout the market. This resurgence underscores the sector’s intrinsic significance as the primary earnings contributor to the S&P 500 index, with its performance dictating a substantial portion of the market’s overall trajectory.

Visual representations of the sector’s growth trajectory reveal a compelling narrative, with the latest quarterly earnings setting a new benchmark. The Technology sector’s quarterly earnings tally of $158.5 billion in 2023 Q4 not only signals a record high but also underscores the sector’s unyielding potential as a driving force behind the market’s upward momentum.

Implications for Investors

Against the backdrop of these developments, investors are advised to pay heed to the tech sector’s resurgence as a compelling indicator of market dynamics. Excluding its substantial contributions, the overall earnings landscape would have painted a less rosy picture for Q1, marking the sector’s pivotal role in propping up the market’s performance.

Looking ahead, the Technology sector’s growth trajectory holds the key to shaping the market’s future landscape, underlining the sector’s enduring impact on the market’s overall health and vitality. As investors navigate through the complex terrain of earnings projections and market fluctuations, the Tech sector’s renaissance serves as a guiding light, illuminating pathways to potential returns and investment opportunities.

Disclaimer: The views and opinions expressed in this article belong solely to the author and not Nasdaq, Inc.