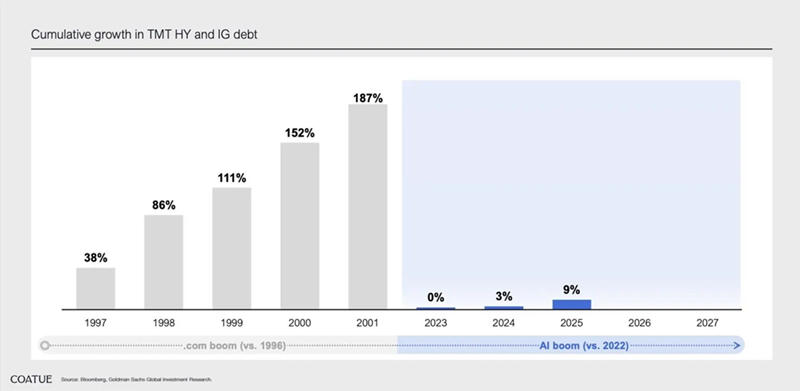

Concerns regarding a potential AI bubble are being dismissed by key industry figures and hedge funds alike. Major CEOs, including those from Microsoft, Meta, Alphabet, and Oracle, continue to invest heavily in AI technology. Data from Coatue Management indicates that total debt issues in tech, media, and telecom sectors have seen minimal growth from 2023 to 2025, with only 0%, 3%, and 9% increases, suggesting the market is not overly exposed to AI.

Hedge fund Coatue Management, which has grown from $45 million to $70 billion since its inception, recently backed the notion that AI bubble fears are overstated. The corporate-bond market appears to be a safer investment right now; with low exposure to AI, it stands to benefit from any volatility related to AI concerns. The BlackRock Corporate High Yield Fund (HYT) offers a 10.6% yield and has seen a significant discount in net asset value, presenting a buying opportunity amidst fluctuating market conditions.

With AI bubble fears declining since November, there’s potential for cash to flow from stocks into corporate bonds if volatility arises, making it an ideal time for investors to consider bond investments. The stability of corporate bonds, alongside hedge fund insights, suggests a low-risk environment for cautious investors aiming to hedge against potential downturns in the AI sector.