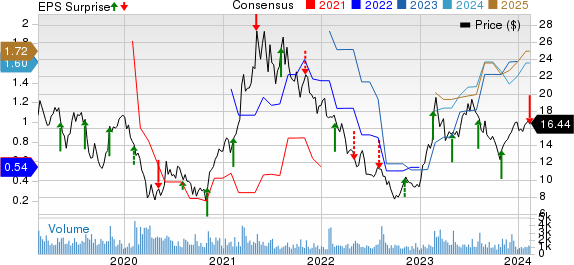

The Manitowoc Company, Inc. MTW reported adjusted earnings per share (EPS) of 9 cents in fourth-quarter 2023, a significant drop from 74 cents in the fourth quarter of 2022. The dramatic 87.8% decrease was primarily due to lower sales, missing the Zacks Consensus Estimate of 19 cents.

This marks a considerable downturn for the company, whose earnings were previously on a more positive trajectory.

Revenue and Backlog Decline

Manitowoc’s revenues were down 4% year over year to $596 million in the quarter under review, although they did beat the Zacks Consensus Estimate.

Orders in the reported quarter decreased 32.8% year over year to $475.7 million, leading to an even more significant decline in backlog at the end of the fourth quarter.

In the past year, Manitowoc’s shares have gained 14.5% compared with the industry’s 25% growth, indicating potential investor dissatisfaction with the company’s performance.

These tough numbers demonstrate a sharp decline, potentially impacting investor confidence in the company’s future prospects.

Operational Performance

The cost of sales declined 1.7% year over year to $497 million in the reported quarter. The gross profit was down 15% year over year to $99 million, with the gross margin also declining to 16.6%.

Manitowoc reported cash and cash equivalents of $34 million at the end of 2023, a notable decrease from the previous year. This decline in cash reserves may raise concerns about the company’s financial stability.

Outlook for 2024

The company’s guidance for 2024 reveals a cautious yet optimistic outlook, with expectations of strong global demand for mobile cranes. However, the European tower crane market is expected to remain challenging, posing potential headwinds for the company’s performance.

These projections suggest that the road to recovery for Manitowoc may be a long and uncertain one.

Stock Rankings and Expert Recommendations

While Manitowoc currently sports a Zacks Rank #1 (Strong Buy), investors should approach this ranking with a more critical outlook given the company’s recent struggles. It is important to consider multiple factors beyond just stock rankings when making investment decisions.

Additionally, as experienced investor experts can attest, it is crucial to conduct thorough research and analysis of a company’s financial health and performance before making investment decisions.

The glowing recommendations for other companies highlight the contrast with Manitowoc’s current performance. Investors may find the success stories of these companies particularly enlightening when exploring investment options.

These contrasts make it crucial for investors to carefully consider all aspects of a company’s performance before making investment decisions.

The disappointing Q4 earnings of Manitowoc Company, Inc. serve as a stark reminder of the challenges facing the company. Investors will undoubtedly be watching closely to see how the company navigates these turbulent times.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.