In a surprising turn of events, U.S. manufacturing activities showcased an impressive rebound in March, serving as a testament to the robust underlying strength of the economy. The Institute of Supply Management (ISM) recently revealed that its U.S. manufacturing index stood at 50.3%, surpassing the consensus estimate of 48.6%. This marked a significant improvement from February’s figure of 47.8%. Noteworthy is the fact that any reading above 50% indicates an expansion in manufacturing activities.

The manufacturing sector, being the second-largest component of the U.S. economy, constitutes approximately 10-12% of the GDP. Throughout the pandemic period, unlike other sectors, manufacturing activities witnessed expansion for a remarkable 28 consecutive months.

However, as the economy gradually reopened and inflation soared due to the systemic breakdown in the global supply chain, manufacturing activities had dwindled for 16 continuous months. Nonetheless, the manufacturing Purchasing Managers’ Index (PMI) has finally rekindled hope by resuming its expansion trajectory in March 2024.

Overview of Sector Performance

In March, various indices exhibited positive signs for the manufacturing sector. The New Orders Index climbed back into expansion territory, reaching 51.4% compared to 49.2% in February. Similarly, the Production Index surged to 54.6% in March, up from the previous month’s 48.4%. Additionally, the Prices Index rose to 55.8% in March compared to 52.5% in February. However, the Backlog of Orders Index remained flat at 46.3%. The Employment Index also showed improvement, rising to 47.4%, a 1.5% increase from the previous month.

Potential Stock Picks in Manufacturing

Following a thorough analysis, we have identified five manufacturing stocks that exhibit strong potential for the year 2024. These companies have witnessed positive earnings estimate revisions within the last 60 days and are known for their consistent dividend payments. Furthermore, all five picks hold a Zacks Rank #2 (Buy).

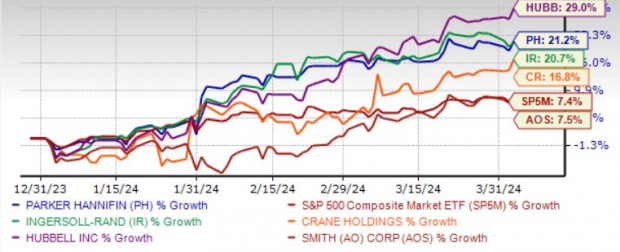

Below is a snapshot showcasing the year-to-date performance of our recommended stocks:

Image Source: Zacks Investment Research

Promising Stock Picks:

Let’s delve into the details of our top five manufacturing stock picks:

- Parker-Hannifin Corp. (PH): Benefiting from increased demand in various markets, PH is projected to experience revenue and earnings growth rates of 4.4% and 12.3% for the current year. The company’s dividend yield stands at 1.07%.

- Hubbell Inc. (HUBB): Known for its electrical and electronic products, HUBB is expected to achieve revenue and earnings growth rates of 9% and 7.1%. The company offers a current dividend yield of 1.17%.

- Ingersoll Rand Inc. (IR): IR is poised to benefit from a healthy demand environment, innovative product portfolio, and solid cash flows. Expected revenue and earnings growth rates for the year are 5.6% and 8.1%, with a current dividend yield of 0.1%.

- A. O. Smith Corp. (AOS): AOS, a prominent manufacturer of water heating equipment, is seeing growth in shipments and improving supply chains. The company’s revenue and earnings growth rates for the year are 3.9% and 6.8%, respectively, with a current dividend yield of 1.44%.

- Crane Co. (CR): Engaged in engineered industrial products, CR has expected revenue and earnings growth rates of 8% and 11.9% for the current year, with a current dividend yield of 0.61%.

Investors Takeaway: These manufacturing stocks paint a promising picture amid the sector’s resurgence, poised for potential growth in the coming months. With strong fundamentals and consistent dividend payments, these picks could offer attractive opportunities for investors seeking exposure to the manufacturing sector.

For further information on these stocks, please refer to the link provided.