Major Corporations Announce Significant Layoffs

On January 12, a wave of layoffs struck numerous successful enterprises. Discord, a popular instant messaging and communications platform, declared a 17% reduction in workforce as reported by Fast Company. In the same vein, Audible, a subsidiary of Amazon, disclosed intentions to lay off 5% of its employees. Alphabet, the parent company of Google, announced layoffs in the hundreds, with a substantial impact on the teams associated with the Google Assistant product and the knowledge and information product, as documented by Semafor. Additionally, Meta Platforms-owned Instagram made a move to eliminate about 60 technical program manager positions at its image-sharing app, noted by Business Insider. Twitch, an Amazon-owned live-streaming site, disclosed plans to reduce its staff by 35%, and Amazon, in a broader initiative, aims to terminate “several hundred” employees across its Prime Video and MGM Studios divisions. Unity Software, a prominent video game software developer, also intends to discharge one-quarter of its workforce. Beyond the tech sector, financial giants BlackRock and Citigroup also revealed plans for job cuts. These announcements coincide with the restructuring efforts led by Citigroup’s new CEO. While recent financial results showed higher earnings but lower revenue, the reorganization efforts demonstrate noteworthy progress in realigning the company’s operations.

Intrinsic Shifts in Job Dynamics

The current wave of layoffs underscores a larger macroeconomic undercurrent reshaping the job landscape. Paradoxically, the companies involved in this spate of layoffs represent successful entities, with the exception of Citigroup, which is undergoing significant restructuring. These events signify a broader evolution in the economy, as corroborated by The Wall Street Journal’s report on January 5. According to the publication, IT employment experienced tepid growth, adding only 700 jobs in 2023 – a stark contrast to the substantial increase of 267,000 positions in 2022.

Complex Forces Driving Reduction in Tech Demand

The decline in demand for technology and other white-collar managerial roles is powered by multifaceted dynamics. Notably, artificial intelligence (AI) capabilities, specifically Large Language Models (LLM), have revolutionized software development. LLMs have the capacity to generate software autonomously, rendering the traditional code-writing process outdated. Moreover, the advent of no-code cloud-based services, bolstered by LLM technology, has augmented office productivity and streamlined enterprise functions. RPA (Robotic Process Automation) and collaboration platforms like Slack, Team, Anaplan, Smartsheet, DocuSign, and Zoom have further transformed organizational operations. The pandemic-induced remote work environment has also catalyzed the flattening of organizational structures, diminishing the need for middle management roles. Consequently, AI-driven solutions have extended to various sectors, including call center services, accounting, and contract automation, drastically reshaping job requirements for workers in these domains.

Economic Ramifications of the Shifting Job Landscape

Contrary to inducing panic, the current restructuring in the job market reflects the inherent dynamism of a healthy economy. As expounded by the economist Joseph Schumpeter in his seminal work “Capitalism, Socialism, and Democracy,” the concept of “creative destruction” underpins the organic evolution of market economies. This paradigm suggests that outdated processes and technologies are supplanted by superior alternatives, fostering innovation and entrepreneurial endeavors. Consequently, the downsizing of workforces presents an opportunity for employees to channel their expertise into new ventures or contribute to agile, efficient enterprises. However, an excessive influx of layoffs in a condensed timeframe may temper overall job growth temporarily. Nonetheless, this does not denote an economic downturn but rather signifies a strategic shift towards leaner, more responsive, and ultimately more profitable business models.

Stock Market Analysis: Reading the Tea Leaves

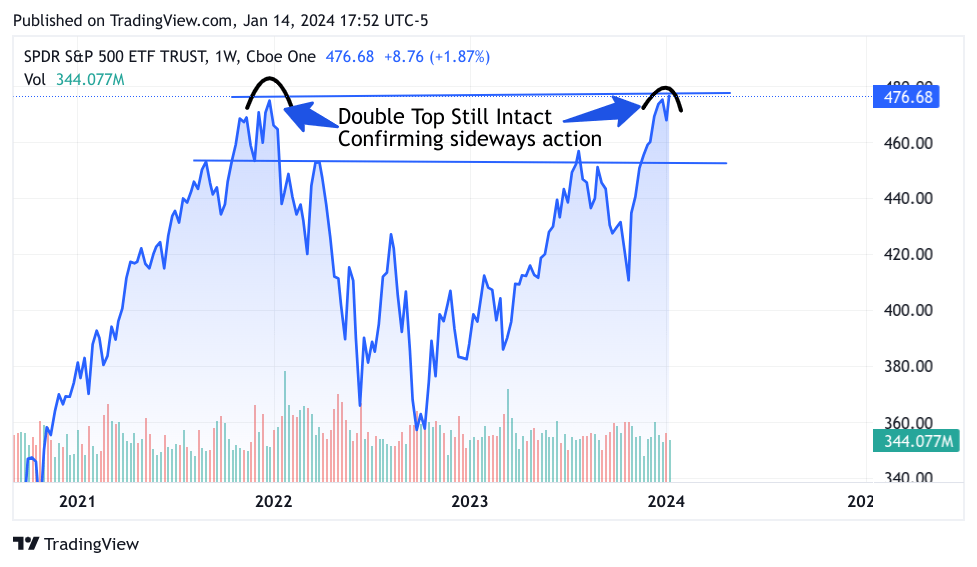

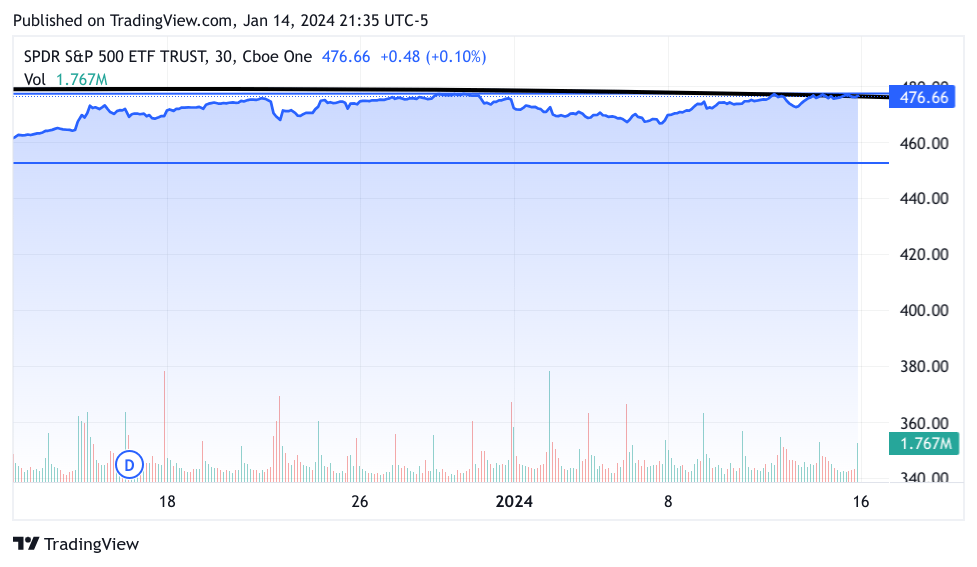

Looking back at the events of this week, it appears that the market is coasting along without any dramatic shifts. The one-month overview doesn’t offer much insight apart from confirming our sideways trajectory.

Although several attempts were made to surpass prior intraday highs on Wednesday, Thursday, and Friday, the index recoiled, resulting in a closing figure of 4783 for the week. It’s worth noting that this double top might not endure if earnings unfold as expected. Nonetheless, I anticipate that the upcoming week will follow a similar pattern. A sideways market presents favorable conditions for discerning stock pickers like ourselves.

Recent Trades

In response to the Boeing (BA) news and after monitoring price movements, I initiated a trade position. I entered at the 220 strike, with the stock closing at 217. I will maintain my position in this stock and potentially adjust downward if necessary. My options extend to April, and I am open to rolling over into May and beyond. The decision to do so is based purely on intuition, rather than chart patterns or a meticulous analysis of the facts, although I am closely attuned to the latter. I strongly believe that David Calhoun, the CEO of BA, may resign or retire to prioritize family commitments. I anticipate that once this news breaks, the stock will surge by 20 points, and the new CEO will unveil an agreement with the FAA to revamp their approval process. Furthermore, the incoming CEO will affirm the growth in 737 MAX production. Following the change in the C-suite, I expect a continued enhancement in the BA stock price. Anyone who watched Calhoun’s interview on CNBC would have observed his deeply emotional response to the mishap. When the FAA strongly advises his departure, I foresee minimal resistance from him.

I also have a long position in Apellis (APLS) Calls at the 65 strike. APLS is a firm conviction buy within our Microcap Biotech 30 list, and I am personally invested in this company.

Wishing you good fortune this Tuesday!