Marathon Petroleum Options Insight: New Contracts for June Expiration

Investors in Marathon Petroleum Corp. (Symbol: MPC) observed new options trading today, specifically for expiration on June 13. Our analysis has pinpointed one put and one call contract from the June 13 options chain that are particularly noteworthy.

Put Contract Highlights

The put contract at the $135.00 strike price currently has a bid of $4.80. Selling-to-open this put contract commits an investor to purchase the stock at $135.00. By doing so, they also collect the premium, leading to a cost basis of $130.20 per share, not including broker commissions. This could be an appealing option for investors interested in acquiring shares of MPC, especially compared to today’s trading price of $139.65 per share.

This $135.00 strike price represents an approximate 3% discount from the current trading price, indicating it is out-of-the-money. Present analysis suggests a 65% likelihood that this put contract will expire worthless. We will track these odds over time, providing ongoing updates on our contract detail page. Should the put expire worthless, the premium would yield a return of 3.56% on the cash commitment, which annualizes to about 30.18%, a figure we term the YieldBoost.

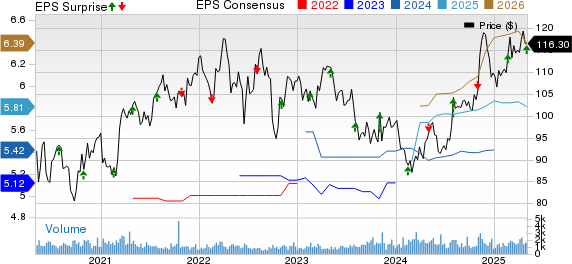

Trading History Chart

Below is a chart showcasing the trailing twelve-month trading history for Marathon Petroleum Corp., with the position of the $135.00 strike highlighted:

Call Contract Highlights

Turning to the call side, the contract at the $143.00 strike price has a current bid of $5.80. By purchasing shares of MPC at the present price level of $139.65 and simultaneously selling-to-open this call as a “covered call,” an investor commits to sell the stock at $143.00. Including the premium, this strategy could result in a total return of 6.55% if the stock is called away at the June 13 expiration, excluding any dividends and broker commissions.

While the return appears solid, potential price increases beyond $143.00 may lead to missed opportunities for additional gains. Thus, analyzing the trailing twelve-month trading history and business fundamentals of Marathon Petroleum is essential. The chart below illustrates MPC’s trading history, with the $143.00 strike clearly marked:

The $143.00 strike represents approximately a 2% premium to the current trading price, implying it is also out-of-the-money. There’s a 51% chance that this covered call could expire worthless, allowing the investor to retain both shares and collected premium. If the contract does expire worthless, the premium would equate to a 4.15% additional return for the investor, or an annualized rate of 35.25%, which we also identify as a YieldBoost.

Volatility and Market Context

The implied volatility for the put contract is currently at 42%, while the call contract’s implied volatility stands at 39%. In contrast, the actual trailing twelve-month volatility—derived from the last 250 trading days combined with today’s price of $139.65—is calculated to be 36%. For further options contract ideas to consider, additional insights can be found on our site.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.