Mark Cuban is renowned for his candid opinions on various subjects, spanning from political landscapes to financial realms. The self-made billionaire is not one to shy away from dispensing advice on enhancing financial situations, even venturing into the realm of amassing wealth. This narrative draws inspiration from the playbook of billionaire Warren Buffett, the “Oracle of Omaha,” who staunchly advocates for strategic investments over broad diversification, arguing that expertise trumps broad strokes.

Despite occasionally endorsing unconventional investment pathways that defy popular sentiment, Cuban believes that a profound understanding of the investment landscape significantly mitigates risk. While not exclusively a passive investor, Cuban strategically selects investments that grow steadily in the background, buoying his business ventures with supplementary income streams. Below, we delve into Cuban’s favored investment avenues and explore passive income opportunities for aspiring investors.

Exploring Dividend-Paying Stocks

Cuban champions the intrinsic value of dividends, emphasizing their tangible benefit in enriching investors by proffering immediate passive income. In his eyes, non-dividend stocks merely embody abstract worth stemming from an array of market metrics.

Dividend-paying stocks epitomize Cuban’s closest association with passive income investments. Beyond the capital appreciation they yield, these stocks provide regular dividends, ensuring a steady income stream even in market downturns.

AI: A Futuristic Domain

While not an ardent supporter of individual stock ownership in general, Cuban shifts gears when discussing companies in the AI domain. Profoundly versed in the AI landscape, Cuban anticipates its ubiquitous importance in the corporate sphere, postulating that organizations will hinge on AI for survival and success. Hence, his stock selection criteria prioritize firms excelling in AI competency.

Although AI stocks aren’t synonymous with immediate passive income, their potential for exponential growth positions them as prospective income streams in due course. For now, investors can passively engage with these stocks in their portfolio, awaiting their favorable performance.

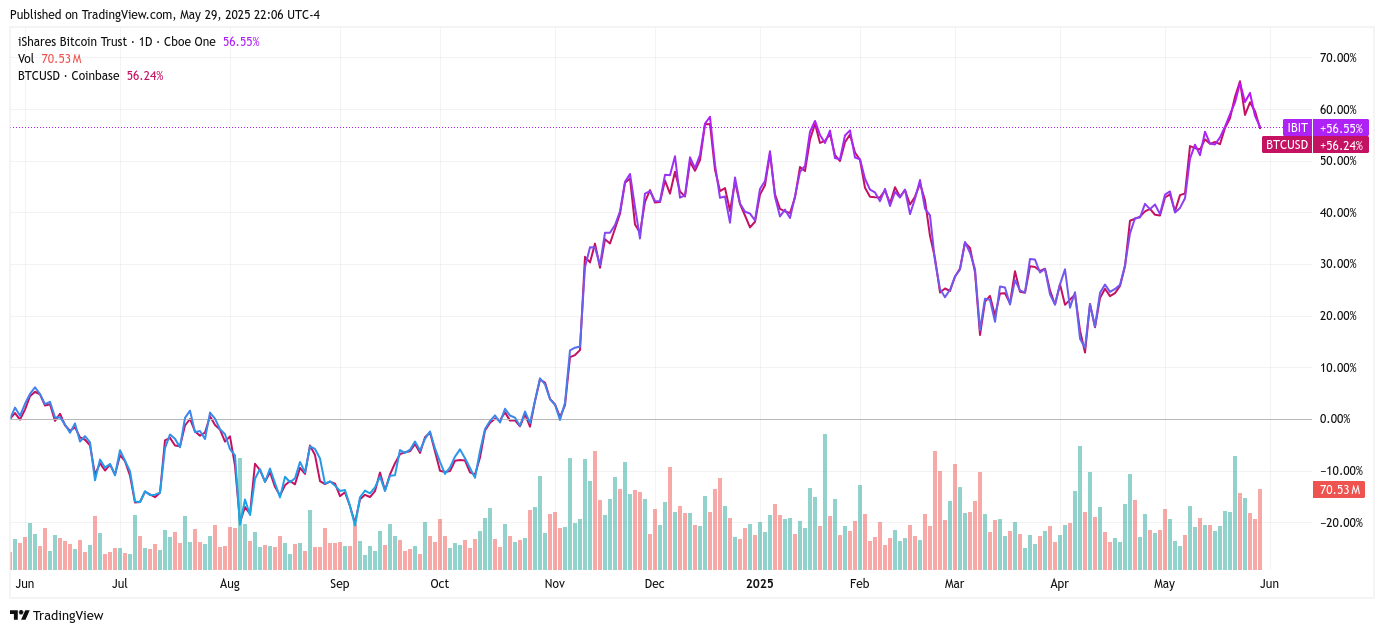

Navigating Cryptocurrency Realms

Cryptocurrency emerges not as a conventional source of passive income but as a high-risk, high-reward venture poised to either catapult or crash. Cuban extols the value proposition of cryptocurrency, rooted in the efficacy of smart contracts.

For the billionaire, cryptocurrency’s bedrock technology unfurls versatile applications with universal appeal, endowing cryptocurrencies tethered to functional smart contracts with formidable value. Unlike many speculators, Cuban doesn’t gamble blindly; his investments in cryptocurrencies are underpinned by a profound comprehension of the underlying technology and its enduring value.

However, Cuban proffers a cautionary note to potential investors, advising them to allocate only funds they are willing to lose in the volatile crypto sphere, advocating for prudent risk management strategies.

Mark Cuban’s Investment Insights: Navigating the Financial Landscape

In the world of investing, opinions often clash like opposing currents in a tumultuous sea. Mark Cuban and Warren Buffett are no strangers to this ideological battleground; while Buffett dismisses Bitcoin as “rat poison squared,” Cuban remains a steadfast believer in the potential of cryptocurrencies, urging investors to dive headfirst into the unknown waters “if you’re a true adventurer and you really want to throw the hail mary.”

Steady Waters of the S&P 500 Index

Despite their contrasting views on crypto, both Cuban and Buffett find common ground when it comes to the tried-and-true strategy of low-cost S&P 500 index funds. While the index may not promise overnight riches, its historical average annual return of around 10% provides a sturdy vessel for long-term wealth accumulation. Like a seasoned sailor charting a course through unpredictable markets, Cuban advises those less versed in financial tides to consider this index as the “single best way to invest your money,” emphasizing its consistent performance over time.

While the S&P 500 index may not churn out rivers of passive income, its current annual yield of approximately 1.39% offers a steady stream of returns for patient investors, akin to a reliable wellspring feeding into the reservoir of one’s financial portfolio.

Navigating the Turbulent Seas of Private Companies

Known for his role as a primary investor on “Shark Tank,” Cuban is no stranger to the high-risk, high-reward world of private company investments. Unlike the more tranquil waters of index funds, investing in private companies is akin to setting sail on a stormy sea, where the winds of success can propel one to great heights or leave them shipwrecked in financial distress.

For those tempted to venture into these uncharted waters, Cuban’s experience serves as a lighthouse guiding the way. While the allure of potentially lucrative returns may beckon like a siren’s call, navigating these treacherous waters demands not just capital but also sweat equity. Unlike the passive nature of index fund investments, backing a private company requires active participation, akin to rowing alongside the company’s founders toward the distant shores of profitability.

This article originally appeared on

GOBankingRates.com:

Mark Cuban’s 5 Best Passive Income Ideas

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.