Meta Platforms: Pioneering AI Innovation Amidst Stiff Competition

Meta Platforms (NASDAQ: META) is leading the way in artificial intelligence (AI) advancements. CEO Mark Zuckerberg has made substantial investments in this arena, predicting that 2025 could welcome several groundbreaking developments.

However, the company faces competition from entities like DeepSeek, a Chinese firm that trained its generative AI platform at just $5.6 million—considerably less than Meta’s significant expenditure of over $60 billion earmarked for infrastructure by 2025. This leads to questions about the rationale behind such high spending.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Despite the doubts about spending, Meta’s vision for AI suggests that these investments could yield impressive outcomes, potentially rendering DeepSeek’s model obsolete.

Zuckerberg Eyes a Transformational AI Engineering Agent

Meta Platforms, previously known as Facebook, oversees popular social media platforms like Threads, Instagram, WhatsApp, and Messenger. The company generates most of its revenue through advertising on these platforms.

These profitable ventures allow Meta to invest heavily in AI without facing bankruptcy concerns, which explains its decision not to focus solely on creating an efficient model like DeepSeek’s. Nevertheless, Zuckerberg has suggested that some of DeepSeek’s innovations will likely be integrated into Meta’s AI development.

Currently, Meta prioritizes the potency of its AI model over its efficiency. Zuckerberg is particularly excited about one possible innovation in 2025:

I also expect that 2025 will be the year when it becomes possible to build an AI engineering agent that has coding and problem-solving abilities of around a good mid-level engineer. This is going to be a profound milestone and potentially one of the most important innovations in history, as well as over time, potentially a very large market. Whichever company builds this first, I think is going to have a meaningful advantage in deploying it to advance their AI research and shape the field.

If Meta can indeed create an AI agent with capabilities akin to a mid-level engineer, it could choose between two paths: eliminating a substantial portion of its workforce to save costs or keeping its engineers and deploying multiple AI agents to enhance productivity. Such a choice could drastically speed up innovation and grant an edge to the company that leads in this AI race.

Opting for the second pathway could also propel Meta’s advancements in augmented reality (AR) glasses, a sector where it has already invested billions.

This insight reassures my confidence in Meta’s hefty AI expenditures: the company seems poised to create a world-changing AI model.

The Stock Price Reflects Promising Growth Potential

While AI is not contributing to Meta’s revenue just yet, the firm is thriving primarily through its advertising business. In the fourth quarter, the company posted a revenue surge of 21% year-over-year to $48.4 billion.

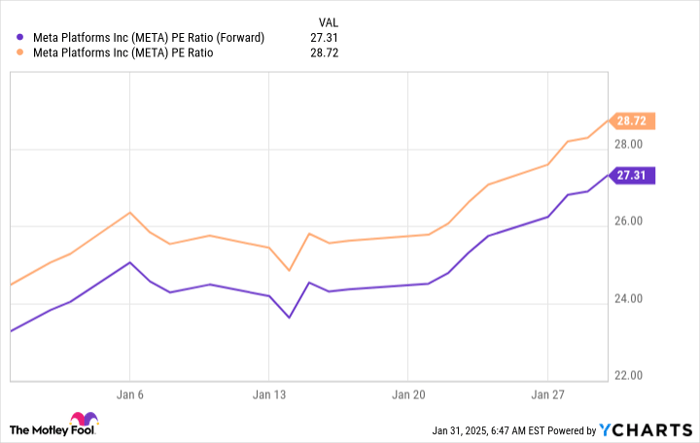

Cost management also proves effective, as expenses grew only 5% year-over-year, which drove the operating margin up from 41% to 48%. Consequently, earnings per share (EPS) experienced remarkable growth, increasing by 50% year-over-year in the fourth quarter to $8.02. For 2024, EPS surged 60% year-over-year to reach $23.86, placing the stock at 29 times trailing earnings.

This strong growth rate justifies the stock’s current valuation. However, it trades at 27 times forward earnings, suggesting that Wall Street analysts are skeptical about substantial earnings growth for Meta in the upcoming year due to heightened spending on infrastructure.

Yet, I believe these estimates may be conservative since the company continues to grow robustly. Management expects revenue to rise by 8% to 15% in the first quarter.

Meta Platforms might be on the verge of a significant AI breakthrough. Currently, the stock price reflects only the advertising business, presenting an attractive buying opportunity. If the company successfully develops the first AI engineering agent, the upside potential could be substantial.

Is It Time to Invest $1,000 in Meta Platforms?

Before committing to purchasing Meta Platforms stock, consider the following:

The Motley Fool Stock Advisor analyst team has identified what they consider the 10 best stocks for investment currently, and Meta Platforms is not among them. The stocks that did make the list hold promise for major returns over the coming years.

Reflect on when Nvidia appeared on this list on April 15, 2005… if you invested $1,000 at that time, you’d have $735,852!*

Stock Advisor offers investors clear guidance for success, including strategies for building a portfolio, updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.