Meta Platforms’ Future at Stake in High-Profile FTC Trial

On Monday, Meta Platforms, Inc. META CEO Mark Zuckerberg took the stand in a Washington, D.C., courtroom.

Trial Overview: Arguments from the Federal Trade Commission (FTC) and Meta were presented in a trial that could force the company to divest popular platforms like Instagram and WhatsApp, according to CBS News.

During the opening statements, Daniel Matheson, the FTC’s lead attorney, remarked, “There’s nothing wrong with Meta innovating. It’s what happened next that is a problem.”

Zuckerberg defended Facebook’s choice to acquire Instagram in 2012, explaining that it was essential for competing against mobile-first platforms dominant at that time.

See also: Netflix Unveils OpenAI-Enhanced Search Engine to Discover Movies and TV Based on Feelings

In response, Meta attorney Mark Hansen argued that Instagram and WhatsApp thrived under Meta’s management and highlighted that the services are offered for free—suggesting this evidence counters claims of monopolistic behavior.

Hansen posed a question to the court: “How can the FTC maintain this monopolization case when [Meta] has never charged users a cent?”

Zuckerberg’s testimony is set to continue on Tuesday morning.

Subscribe to the Benzinga Tech Trends newsletter for the latest tech developments directly in your inbox.

Significance of the Case: The trial is overseen by U.S. District Judge James Boasberg and is expected to unfold over several weeks. Notable former Meta executives, including Sheryl Sandberg, Mike Schroepfer, and Instagram co-founder Kevin Systrom, are likely to testify.

The FTC is also seeking an order that would require Meta to inform the government prior to any future acquisitions.

A spokesperson for Meta dismissed the FTC’s arguments, suggesting they are outdated and disconnected from current competitive dynamics. “The evidence at trial will show what every 17-year-old in the world knows: Instagram, Facebook, and WhatsApp compete with TikTok, YouTube, X, iMessage, and many others,” the spokesperson stated to CBS MoneyWatch.

YouTube is under the ownership of Alphabet Inc. GOOG GOOGL, while X, formerly Twitter, underwent a rebranding after being acquired by Elon Musk in October 2022 for $44 billion. Additionally, iMessage represents Apple Inc.’s AAPL secure messaging service.

In 2024, Meta reported over $164 billion in revenue, boasting a market capitalization of $1.37 trillion.

Market Response: Following the proceedings on Monday, Meta shares fell by 2.22%, closing at $531.48, as reported by Benzinga Pro.

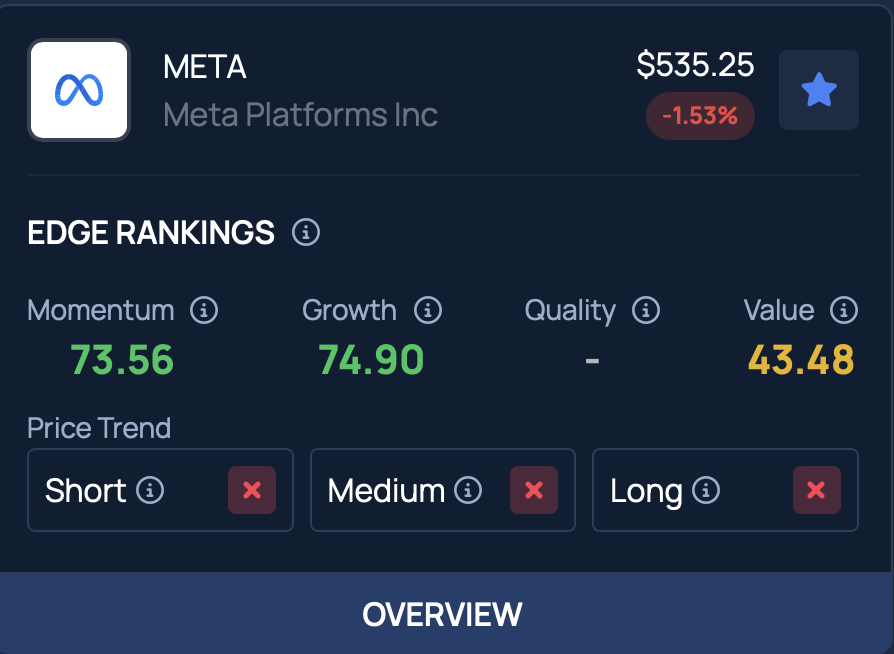

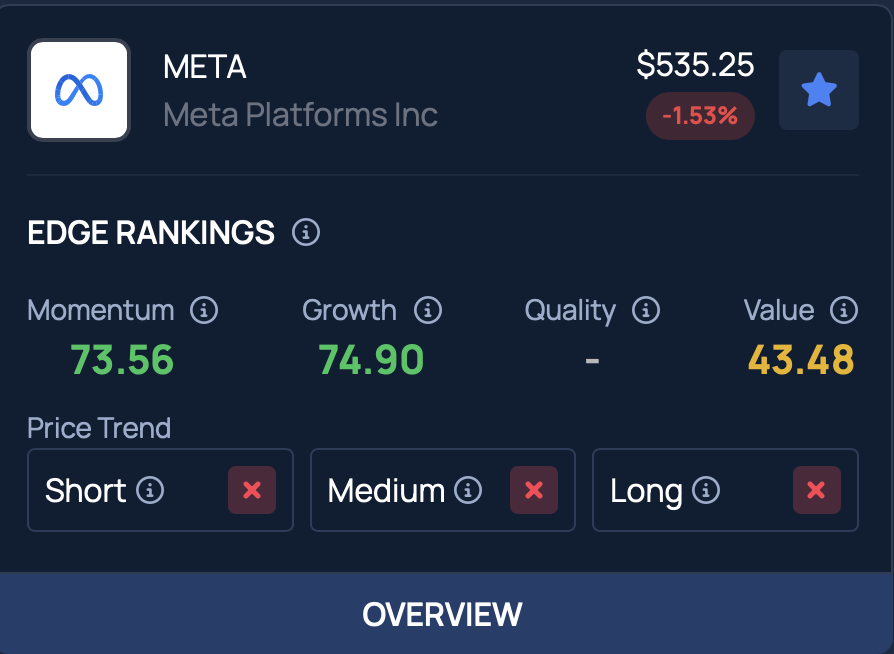

Meta currently holds a solid growth score of 74.90% according to Benzinga Edge Stock Rankings. Click here to compare it with Apple, Alphabet, and other major players.

Photo Courtesy: Frederic Legrand – COMEO on Shutterstock.com

Additional Information:

Disclaimer: This content was partially produced with the aid of AI tools and reviewed by Benzinga editors.